Gold Price Forecast Next 5 Years | Gold Price Expectations.

Gold price expectations. A gold price forecast. Gold prices have already pierced $3,400 in 2025 and as we look at the near-term expectations, the future of gold prices is a topic of significant interest for investors and analysts alike. Gold price predictions range from 4,500 to up and above $7,000 per ounce by 2030.

Gold has long been considered a safe-haven asset, protecting investors against economic uncertainty, inflation, and currency fluctuations. With global economies evolving, many wonder how gold prices will fare over the next five years. This article examines key factors influencing gold prices and expert predictions for its future.

Why is Gold Rising? Current State of Gold Prices

The wise Yogi Berra once said: "It's tough to make predictions, especially about the future".

As of April 2025, gold prices have shown resilience despite economic fluctuations. Gold has already pierced $3,400 per ounce, reflecting a more than 27% increase this year alone. This recent price surge reflects a mix of inflationary pressures, central bank policies, and investor sentiment. Analysts are closely monitoring trends to determine whether gold will continue its bullish trajectory or stabilize at a lower range.

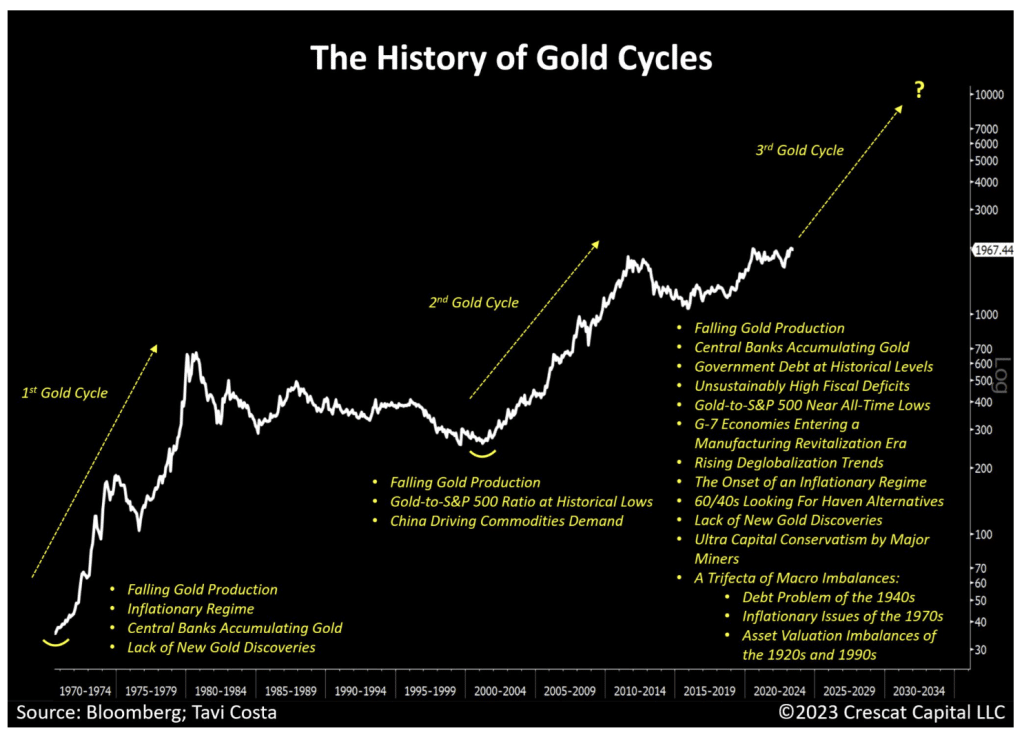

Gold Prices Historical Overview

Let's dive into the historical journey of gold prices and gold’s historical returns, tracing its fluctuations and trends over the centuries. Gold's economic significance dates back to around 550 B.C., where it was used as money. The price of gold was determined by government authorities, from the reign of Emperor Augustus in ancient Rome to Great Britain in 1257.

The real turning point for gold, however, came in the 1800s with the advent of the gold standard, where paper currencies were backed by their value in gold. This system changed in 1971 when the U.S. stopped aligning the dollar's value with gold. This marked gold's transition from a currency value to a store of value, leading to a significant increase in its price.

From being worth $40 an ounce in 1971, gold had a meteoric rise to $2,249 in 1980. This upward trend has continued, albeit with some volatility, reflecting gold's status as a hedge against economic uncertainty.

After the historic unpegging of the US dollar from its golden chaperone, the price of gold, understandably, started to truly experience it’s meteoric rise. Analyzing these trends, it's clear that gold's price movements have been largely influenced by shifts in monetary policy and economic climate. While the past doesn't guarantee future performance, it does provide a valuable context for forecasting.

Looking forward, you can expect gold's price to continue to be influenced by factors like global economic health, inflation, and market sentiment. Armed with this historical understanding, you'll be better equipped to navigate the complex world of gold investing over the next five years.

Factors That Are Affecting On Gold Price

Several factors contribute to the movement of gold prices, and understanding them can provide insights into future trends.

1. Inflation and Economic Policies

Gold is traditionally viewed as a hedge against inflation. When inflation rises, the value of paper currency declines, making gold more attractive. With ongoing monetary policies aimed at stabilizing economies post-pandemic, inflationary pressures remain a key driver of gold prices.

Historically, during periods of high inflation, gold has outperformed other investment assets, proving its role as a wealth-preserving instrument. If inflation remains persistent or increases, we could see more investors turning to gold as a reliable store of value.

2. Interest Rates and Central Bank Decisions

Interest rates directly impact gold’s appeal. Higher interest rates typically lead to lower gold prices since bonds and savings accounts offer better returns. However, if central banks maintain low-interest policies, gold may retain its strength as an investment option.

Central banks worldwide, including the U.S. Federal Reserve and the European Central Bank, hold significant gold reserves. Any major shift in their monetary policies or increase in gold purchases by central banks can further impact gold’s trajectory.

In addition, emerging nations within the Eastern BRICS nations have been increasing their stockpile gold reserves in record amounts in the last 5 years. This high demand and limited will also place upward pressure on the gold price.

3. Geopolitical Uncertainty

Political instability, wars, and trade disputes often lead to increased demand for gold. Investors seek the metal as a reliable store of value during turbulent times. With global tensions rising in various regions, this factor will play a significant role in shaping gold prices.

Gold prices spiked during past geopolitical crises, such as the 2008 financial crash, Brexit, and the COVID-19 pandemic. Future conflicts, economic slowdowns, or changes in international trade policies could once again drive up demand for gold.

Looking for ways to diversify in uncertain times? Consider a tax-deferred gold IRA. Tap the banner below to visit Augusta’s official site to get started today.

4. Demand and Supply Dynamics

Gold’s supply is relatively fixed compared to its demand, which can fluctuate based on consumer and industrial use. Jewelry demand, central bank reserves, and investment funds all contribute to pricing trends. If demand outpaces supply, prices will continue to rise.

In addition, gold mining activities and technological advancements in metal extraction can influence supply. If mining costs rise due to labor shortages or increased environmental regulations, gold prices

Best Gold IRA for Low Minimum Investment

Gold Price Predictions from Experts

While predicting exact gold prices is challenging, analysts have made educated forecasts based on economic trends and historical data.

2025-2026: Modest Growth with Inflation in Focus

Investment firms such as Goldman Sachs and UBS project that gold prices will maintain an upward trend, potentially reaching $2,800 by late 2025. Inflation concerns and geopolitical risks may keep demand strong.

A gradual economic recovery combined with ongoing global challenges is expected to maintain gold’s appeal, though moderate fluctuations are anticipated.

2027-2028: Stronger Gains Expected

With potential economic slowdowns, increasing debt levels worldwide, and suborn inflation concerns some experts predict gold may even cross $3,500 by 2028.

Major investment funds are likely to increase their gold allocations, especially if fiat currencies weaken or stock markets become volatile. The expanding middle class in emerging markets such as China and India may also drive higher jewelry and investment demand.

As previously mentioned, the mass purchases by Chinese and allied BRICS nations are providing a continued price floor that serves towards gold a stability.

2029-2030: A Potential Boom

Long-term forecasts suggest that by 2030, gold could surpass $4,000 per ounce, especially if central banks continue to accumulate reserves and economic uncertainty persists. Some optimistic projections even hint at a $5,000 target if inflationary policies remain unchecked.

The role of digital gold investments and blockchain-based gold trading platforms is also expected to expand. These innovations may attract younger investors, further increasing market participation and demand.

Analysts and financial institutions have provided various forecasts for gold prices by 2030:

- InvestingHaven: Projects that gold prices could reach between $4,500 and $5,000 by 2030, citing long-term bullish trends (investinghaven.com).

- CoinCodex: Estimates that gold could gain approximately 91.70% from current prices, reaching between $4,591.62 and $5,612.13 by 2030 (coincodex.com).

- IBIS InGold: Economist Charlie Morris predicts that a troy ounce of gold could surpass $7,000 by 2030, influenced by factors such as inflation and real interest rates (ibisingold.com).

- Coin Price Forecast: Anticipates that gold will rise to $4,000 within 2028 and reach $5,000 by 2031 (coinpriceforecast.com).

Should You Invest in Gold?

Investing in gold can be a smart move for portfolio diversification and risk management. However, it's crucial to consider:

- Market Timing: Buying during dips and holding during market instability can maximize returns. Working with a reputable gold investment company can assist in finding logical entry points

- Storage and Security: Physical gold requires safe storage, while ETFs and mining stocks offer alternatives.

- Diversification: Relying solely on gold isn’t advisable—balance your investments with stocks, real estate, and other assets.

- Understanding Market Trends: Keeping an eye on macroeconomic indicators and central bank policies can help in making informed investment decisions.

For those considering an investment, there are multiple ways to get exposure to gold:

- Physical Gold: Coins, bars, and bullion. Make sure to purchase from reputable dealers and ensure secure storage options. Gold IRAs are a great way of owning physical gold while enjoying added tax benefits as well as ensuring safe storage of your precious metals. We will discuss this investment strategy further.

- Gold ETFs, Exchange-Traded Funds: Easier and more liquid than physical gold – Ideal for those looking for convenience. Again, these investments involve higher risk.

- Gold Mining Stocks: Investing in companies that produce gold – Offers indirect exposure to gold price movements. However, gold mining stocks are known for higher volatility and greater risk.

- Futures and Options: For experienced investors comfortable with higher risks – Suitable for those familiar with derivatives trading.

- Gold Leases: Fixed-income products such as gold leases provide the investor the opportunity to earn interest on gold as well as physical ownership. See the link in the video description to take advantage of Monetary Metals gold and silver lease options. Earn interest in gold, paid in gold.

Looking for a place to start? Working with a trusted gold investment company that understands the various market forces, inflation, and global economic dynamics can make the gold investing landscape smoother and less stressful.

Gold IRA companies, more specifically, provide a tax-advantaged way of buying and owning gold without the stress of dealing with local or online vendors or the need for security and storage in your own home. These companies can provide access to competitive prices, price transparency, a reasonable buyback policy, reliable customer service, and security of your precious metals.

Finding the right gold IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a gold IRA, Birch Gold Group or American Hartford Gold would be two choices to consider.

However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive gold prices and lifetime customer support, then Augusta Precious Metals would be a good fit.

For a highly personalized experience, National Gold Group is a family-owned gold IRA company that offers a low minimum investment, a no-fee buyback policy, and great educational resources for its clients.

Furthermore, Noble Gold Investments provides gold and silver IRAs as well as private investment options for home storage. See the links at the end of this article to find the right gold IRA company that best serves your needs.

To start now, tap the banner below to visit Augusta Precious Metals' official site to receive a free gold IRA company checklist.

Conclusion

You've navigated the golden landscape, understanding why prices rise, the historical context, and affecting factors.

Now, armed with expert predictions for 2023 and 2024, you're better prepared to make informed decisions.

Remember, gold's allure lies in its stability amidst economic turbulence, making it a worthy consideration for portfolio diversification.

Keep an eye on the global stage and market sentiment to anticipate fluctuations.

Ultimately, the future of gold seems promising, and its timeless appeal endures.

Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com