Updated January 3rd, 2026

Augusta Precious Metals Review 2026

Best Gold IRA Company for High Income Earners, Best Pricing, & Lifetime Customer Support

Minimums, Fees, Storage Options, BBB Ratings, Pros and Cons

Our Pick For The Top Gold IRA Company

preciousmetalsinvestmentportfolio.com

Disclaimer: Precious Metals Investment Portfolio may receive compensation from many or all of the companies listed, including Birch Gold. This is how we maintain our free service for consumers.

Quick Summary

Augusta Precious Metals is a highly rated gold IRA company founded in 2012 by Isaac Nuriani. The firm specializes in helping investors protect retirement savings with gold and silver IRAs, offering transparency, personalized education, and strong customer support.

-Legitimacy: Backed by top BBB/Trustpilot ratings and awards like Best Overall Gold IRA Company (Money Magazine, 2022).

-Minimum Investment: $50,000-best for serious or high-net-worth investors.

-Fees: About $250 the first year; ~$200 annually after.

-Metals Offered: Gold and silver (no platinum or palladium).

-Price Protections: Locked-in pricing, a 7-day price protection program, and a price-match guarantee.

-Storage: IRS-approved depositories across 10 U.S. states, with insurance and high-level security.

-Pros: Transparent pricing, educational resources, buyback program, no high-pressure sales.

-Cons: High investment minimum, limited to gold/silver, no online checkout.

-Best For: Investors with larger portfolios who want to hedge against inflation and market volatility with physical metals.

Table of Contents

-

- Introduction – How Does Augusta Precious Metals Work?

- Is Augusta Precious Metals Right For You?

- Pricing Protections & Guarantees

- IRA Rollover Process

- Fees & Investment Minimums

- Pros & Cons of Augusta Precious Metals

- Gold IRA & Inflation Calculators

- IRA-Elligible Coins

- Storage & Security Options

- Gold IRA Comparisons

- Final Verdict

- FAQ Section

Introduction – How Does Augusta Precious Metals Work?

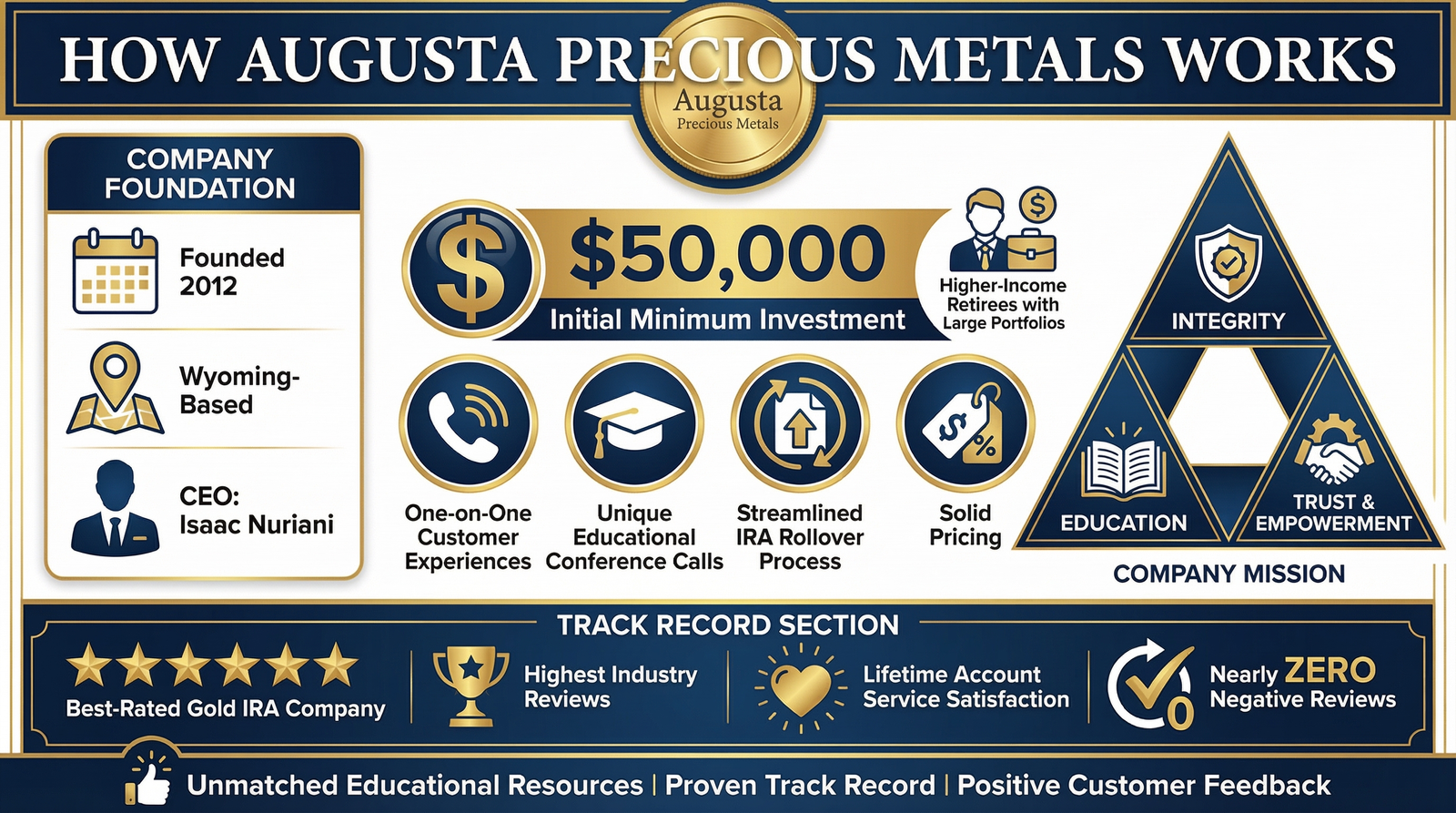

Augusta Precious Metals has a proven commitment to exceptional one-on-one customer experiences with its unique educational conference calls. With an initial minimum investment of $50,000, Augusta’s main investors are typically higher-income retirees with larger portfolios. However, many of Augusta’s clients agree that the level of established trust, empowerment, and excellent lifetime account service is worth the price of entry.

Augusta Precious Metals provides unmatched educational resources, a streamlined IRA rollover process, solid pricing, and a proven track record of positive customer feedback and industry ratings.

Founded by CEO Isaac Nuriani in 2012, Wyoming-based Augusta Precious Metals has remained one of the best-rated gold IRA companies with the highest reviews across the industry, namely for lifetime account service satisfaction.

The company centers its focus on a mission of integrity, education, and investor trust and empowerment, resulting in a nearly ZERO negative customer review record.

Is Augusta Precious Metals Right for You?

Exceptional ratings from Trustpilot, BBB, TrustLink, Facebook Business, and Google demonstrate Augusta Precious Metals’ consistent track record and established trust.

Augusta was just recently chosen as Money magazine’s “Best Overall” Gold IRA Company and Investopedia’s “Most Transparent” Gold IRA Company multiple years in a row.

CEO Isaac Nuriani is a member of Ethics.net and founded the company with a vision of empowering people in retirement, professionals, and serious investors to take control and diversify their savings through IRA investing in gold and silver.

Augusta Precious Metals wants to help put you back in the driver’s seat and in control of your retirement savings. Protecting it from the constant erosion of inflation and erratic markets. Augusta often warns against other companies’ use of scare tactics, sales gimmicks, and free silver giveaways to lure customers.

Augusta Precious Metals stands by an integrity-first model and upfront transparency to build long-term customer trust.

The team at Augusta Precious Metals understands there can be a great deal of confusion with starting a Gold IRA or the process of an IRA rollover.

Augusta takes the time to provide as much information and resources to help new clients make the best decisions possible for their specific self-directed gold IRA.

Unique to Augusta is the company’s one-to-one video conference calls with the firm’s on-staff Harvard-educated economic analyst and Director of Education Devlyn Steele.

In these calls, Devlyn discusses the importance of precious metals, the dangers of inflation, the state of the economy, as well as IRA investing and IRA rollovers. This call is also followed by a Q&A session.

Augusta Precious Metals realizes that a satisfied customer is an educated customer.

Augusta Precious Metals Pricing Protections & Guarantees

IRA Rollover Process

If you have an existing IRA and 401(k) plan, you can roll it into a Gold IRA or start a brand new IRA. Augusta Precious Metals aims to make the rollover process as simple as possible and guides you seamlessly through this straightforward process.

Augusta does 95% of the paperwork with you. Just specify how much money you want to invest and which precious metals you want to invest in. Augusta will do the rest of the heavy lifting.

The company is committed to supporting its customers for the lifetime of their accounts. This is reflected by the company’s record of near-zero negative customer reviews. Very few of the company’s competitors can make that boast.

Augusta Precious Metals IRAs are a type of self-directed Individual Retirement Account that contains IRA-eligible gold and precious metals.

This self-directed path gives you greater control and flexibility over your investments and assets. You are no longer restricted to the most common of assets, such as stocks, bonds, CDs, and mutual funds.

Augusta Precious Metal IRAs provide diversification and protection to your retirement accounts with tangible, physical assets as opposed to standard stocks and bonds. Augusta sells IRA-compatible coins and bars as well as non-IRA collectible bullion.

How Do I Contact Augusta Precious Metals?

Getting in touch with Augusta Precious Metals is as simple as navigating to their online platform. To get started, attend their free gold and silver web conference here.

Access Augusta’s free gold investment guide by clicking the banner below.

Augusta Precious Metals Fees & Minimums

Service Fees

Gold IRA Account Setup – $50

Storage – $100

Custodian Fee – $100

Total IRA Fees – $250 for first year, $200 after that

Shipping Fees – None

Investment Minimum

$50,000

Pros and Cons of Gold Investing with Augusta Precious Metals

Pros

✓Best prices and price transparency

✓Unmatched educational resources

✓They have simplified the process of rolling over an IRA to help their clients.

✓Offers a buy-back program to its clients if their circumstances change.

✓Free one-on-one web conference with Harvard-trained economist Devlyn Steele

✓They offer numerous storage locations across the country.

✓No high-pressure tactics

✓Potential to have fees waived for 10 years

Cons

✓No online orders.

Gold IRA and Inflation-Retirement Calculators

Find out whether Augusta Precious Metals Gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement Calculators. Perform real-time calculations as you read our reviews. See the buttons below to access these calculators and start protecting your wealth today.

Augusta Precious Metals’ selection of IRA-eligible coins includes but is not limited to:

Gold Investments

-Gold American Buffalo Coins

-Gold American Eagle Coins

-Gold American Eagle Proofs

-Gold Canadian Eagle Coins

-Gold Canadian Maple Leaf Coins

Silver Investments

-Silver American Eagle Coins

-Silver Canadian Soaring Eagle Coins

Storage and Security

Augusta Precious Metals serves as your personal guide through the process of storing your precious metals. Various IRS-approved vaults are offered for storage, providing exceptional security and full insurance for the value of your account.

Augusta offers 12 country-wide storage depositories spread over 10 states. Locations include Bridgewater, Massachusetts, Salt Lake City, Utah, South Fargo, North Dakota, Wilmington, Delaware, New York, New York, and Los Angeles, California.

Each location is equipped with a secure vault protected and managed by a highly vetted and experienced staff of custodians and a robust and stress-tested computer network.

Gold IRA Company Comparisons

Augusta Precious Metals vs. Other Gold IRA Companies

- Annual Fee: Fees vary

- Minimum Investment: $10,000

- Promotion: 1st year fees waived (over $50k accounts)

- Annual Fee: $180

- Minimum Investment: $10,000

- Promotion: Free Storage and custodian fees for the first year

- Annual Fee: $225 – 250

- Minimum Investment: $10,000 for direct transfers, $20,000 for IRA/401k rollovers

- Promotion: 1st-year fees waived for qualifying IRAs

Final Verdict

Augusta Precious Metals’ proven track record for sustained long-term relationships with its customers through the life of its precious metal portfolios makes up the bedrock of the company’s trusted reputation.

By arming their clients with unmatched educational guidance, superb customer service resulting in near-perfect positive customer reviews, solid prices, sound buy-back guarantees, and an ethic-centered and transparent approach, it is no wonder why an Augusta customer remains a satisfied lifetime customer.

Weathering a bear market or cycles of inflation and recession is about preparation and managing risk. Augusta Precious Metals has proven to be a safe and trusted choice for your retirement planning and wealth-building needs.

If you have 100k of savings to protect and want to take advantage of the best gold prices and lifetime customer support, click the banner below to join a free gold and silver web conference hosted by Augusta Precious Metals. Secure your place today:

Frequently Asked Questions

Q: Who owns Augusta Precious Metals and what is their mission?

A: Augusta Precious Metals was founded in 2012 by CEO Isaac Nuriani. The company is focused on ethics, investor education, transparency, and helping customers protect their retirement savings through precious metals.

Q: Is Augusta Precious Metals a legitimate company?

A: Yes. The review highlights that the company has strong industry ratings (BBB, Trustpilot, TrustLink, etc.), has won awards like “Best Overall Gold IRA Company” (Money Magazine 2022) and “Most Transparent Gold IRA Company” (Investopedia 2022), and generally enjoys very few negative reviews.

Q: What is the minimum investment required to open a Gold IRA with Augusta Precious Metals?

A: The minimum investment is $50,000.

Q: What are the fees for having a Gold IRA with Augusta Precious Metals?

A: Some of the fees noted in the review include:

-$50 setup fee

-$100 storage fee

-$100 custodian fee

-Total IRA fees estimated at $250 for the first year, and about $200/year thereafter

Note: There is mention of “annual fees of $180/year” in one quick-summary section-it’s possible that this is a promotional rate or applies under certain conditions.

Q: Does Augusta Precious Metals offer any price guarantees?

A: Yes. Some of the pricing features include:

-Locking in the price once your purchase order is confirmed.

-A 7-Day Price Protection Program: if the spot price of your metals drops within seven days after ordering, the company may reprice the order lower.

-A price-match guarantee to ensure you are getting the best possible purchase price.

Q: What metals does Augusta Precious Metals offer? Are there limitations?

A: They offer IRA-eligible gold and silver metals and coins. Some examples include:

-Gold: American Buffalo, American Eagle, Canadian Maple Leaf, etc.

-Silver: American Eagle, Canadian Maple Leaf, etc.

-Platinum and palladium are offered as well.

Q: What storage options does Augusta Precious Metals provide?

A: They use IRS-approved vaults across multiple states. They have around 12 depositories in 10 states (such as Massachusetts, Utah, North Dakota, California, etc.). These vaults are insured and have robust security and custodial oversight.

Q: How does the IRA rollover process work with this company?

A: The process is described as pretty streamlined. If you have an existing IRA or 401(k), you can roll it into a Gold IRA with Augusta. They will help you with the paperwork (they do ~95% of it), guide you through deciding which metals to buy, etc.

Q: What are the pros and cons of doing a Gold IRA with Augusta Precious Metals?

A: Some of the pros are:

-Tight pricing and transparency

-Strong educational resources

-Simplified rollover process

-Buy-back guarantee if needed

-Free one-on-one educational calls with their economist

-Multiple secure storage locations

-No high-pressure sales tactics

-Possible fee waivers under certain conditions.

Some cons are:

-No online ordering of metals (you likely need to go through their reps or calls)

Q: Who is Augusta Precious Metals best suited for?

A: They tend to work well for high-net-worth individuals, retirees, or people with larger retirement portfolios who want to diversify, protect against inflation, and have more control over part of their savings.

Because of the high minimum investment, their offering may not be ideal for those with smaller retirement accounts.

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com.