Gold Historical Returns

You're about to dive into the fascinating history of gold's returns from 1971 to the present, May 2025.

Gold has performed well against other commodities in terms of historic returns even in the face of rate hikes and other economic headwinds. To get a better sense of the complexities surrounding gold and its historic price action, it is necessary to discuss:

- Economic History Resources - What was the price of gold then?

- The factors that influence prices and gold returns

- Historical Returns of Gold

- Why Look at Historical Gold Prices?

- What has Driven Changes in the Gold Price?

U.S. rate hikes, global gold holdings, and tax implications further complicate the picture. Still, as part of a diversified portfolio, gold remains a robust option.

We'll also explore gold holdings globally and delve into the complexities of its indexed cost.

By the end, you'll have a clearer picture of gold as an investment and its role in a diversified portfolio.

Let's start this golden journey!

Economic History Resources - What was the Price of Gold Then?

If you're looking to delve into the economic history of gold, it's crucial to first understand how the price of gold has fluctuated over the years. Gold prices have been shaped by many factors such as supply and demand dynamics, geopolitical events, and changes in the currency markets. To get a comprehensive view, it's essential to consider both the long-term trends and shorter periods of volatility.

Historical gold prices can be traced back hundreds of years, providing a rich dataset for your analysis. For example, the British Official Price data spans from 1257 to 1945, while the U.S. Official Price data covers 1786 to 2001. In these records, you'll notice periods of relative stability along with episodes of rapid price changes. This volatility is a key characteristic of gold, reflecting its sensitivity to global economic and political shifts.

To dive deeper, you can analyze the Gold/Silver Price Ratio, which offers insights into the relative value of these two precious metals over time. This ratio can be a useful indicator of broader market trends and investor sentiment.

Moreover, looking at the New York and London Market Prices allows you to compare gold prices in different financial hubs. Notably, gold is typically denominated in U.S. Dollars, so changes in the dollar's value can significantly affect gold's price in other currencies.

In your analysis, it's important to consider different timeframes. Whether you're planning to swing trade or invest long-term, understanding these historical trends can guide your strategy, as gold's price patterns often repeat over time.

The Factors that Influence Prices and Gold Returns

When examining gold's historical returns, it's critical to understand the factors that influence gold prices.

These include:

- Demand dynamics

- The inverse relationship between gold and fiat currencies

- Gold's role as a safe haven asset

- The supply of available gold

Each plays a significant role in shaping the investment landscape of this precious metal.

Gold Demand

Often, you'll find that the demand for gold and its subsequent returns are significantly influenced by various factors, including geopolitical events, economic stability, and market sentiment.

For instance, during periods of political unrest or economic instability, investors often turn to gold as a safe haven asset, driving up demand and prices. Conversely, in times of economic prosperity, demand for gold may fall as investors shift towards riskier assets.

Furthermore, market sentiment plays a crucial role in gold demand. If investors are bullish about the future, they might reduce their gold holdings, pushing prices down. Conversely, bearish sentiments lead to increased gold purchases, driving prices up.

Therefore, understanding these factors can help you predict gold's future demand and potential returns.

Gold and Fiat Currencies: An Inverse Relation

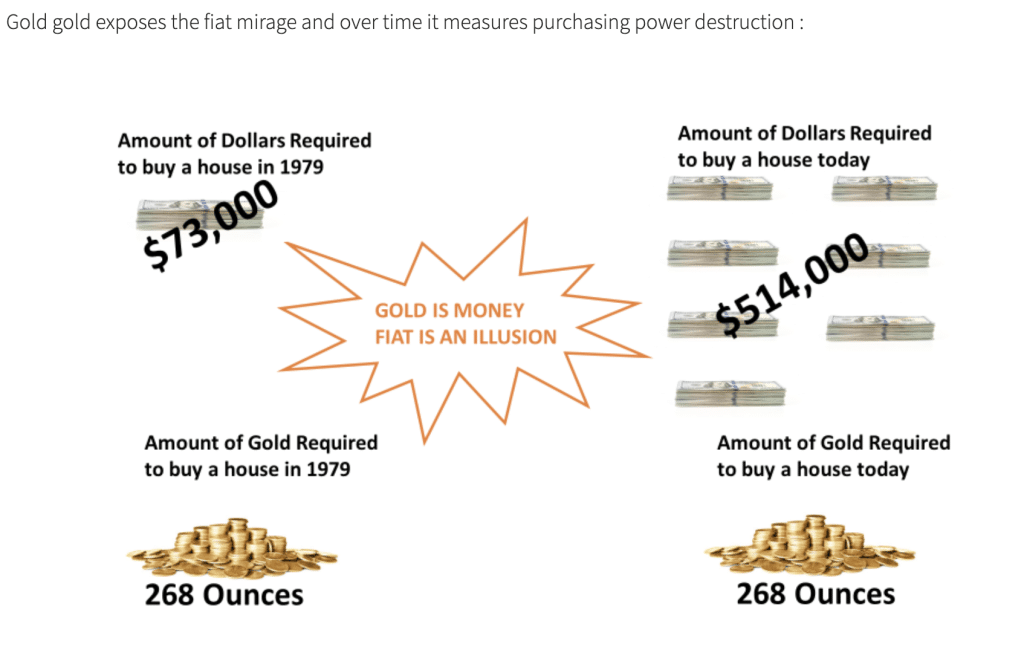

As you delve deeper into the world of gold investments, it's essential to understand the inverse relationship between gold and fiat currencies, which heavily influences gold prices and returns.

Today, most nations use fiat currencies, unpegged from gold, causing their value to fluctuate based on economic factors and government trust. This fluctuation creates a seesaw effect with gold prices; as fiat currency value drops, gold value rises and vice versa.

Particularly, the US dollar has a significant impact on gold prices. If the dollar strengthens against other currencies, gold prices usually fall, as its relative cost increases for non-US investors, reducing demand. However, recent trends show gold and the dollar rising together due to macroeconomic factors like global debt levels and the China-US trade war.

Gold as a Safe Haven Asset

Understanding how gold acts as a safe haven asset and the factors that influence its prices and returns can help you make more informed investment decisions.

Gold's value remains steady amidst economic volatility, providing a hedge against rising costs of living. Central banks often hold gold reserves as a safeguard during financial instability. In fact, during 2020, gold prices hit an all-time high due to investor concerns about the COVID-19 pandemic.

On the other hand, news about a coronavirus vaccine saw a dip in gold prices, indicating how global events can impact its value. These fluctuations show how investing in gold can minimize portfolio risks during periods of uncertainty.

It's crucial to consider these factors to maximize your gold returns.

Supply of Available Gold

You might be wondering, how does the supply of available gold influence its prices and returns? It's a matter of supply and demand.

Each year, we add around 2.5 to 3 million kilograms of gold from mining to the overall stock. However, this supply typically falls short of global demands.

- Miners finding less gold than anticipated can unexpectedly reduce supply, driving prices up.

- Only an estimated 20% of gold remains to be mined, which could impact future availability and prices.

- Technological advancements in mining could increase extraction at previously uneconomical sites, potentially influencing gold returns.

Historical Returns of Gold

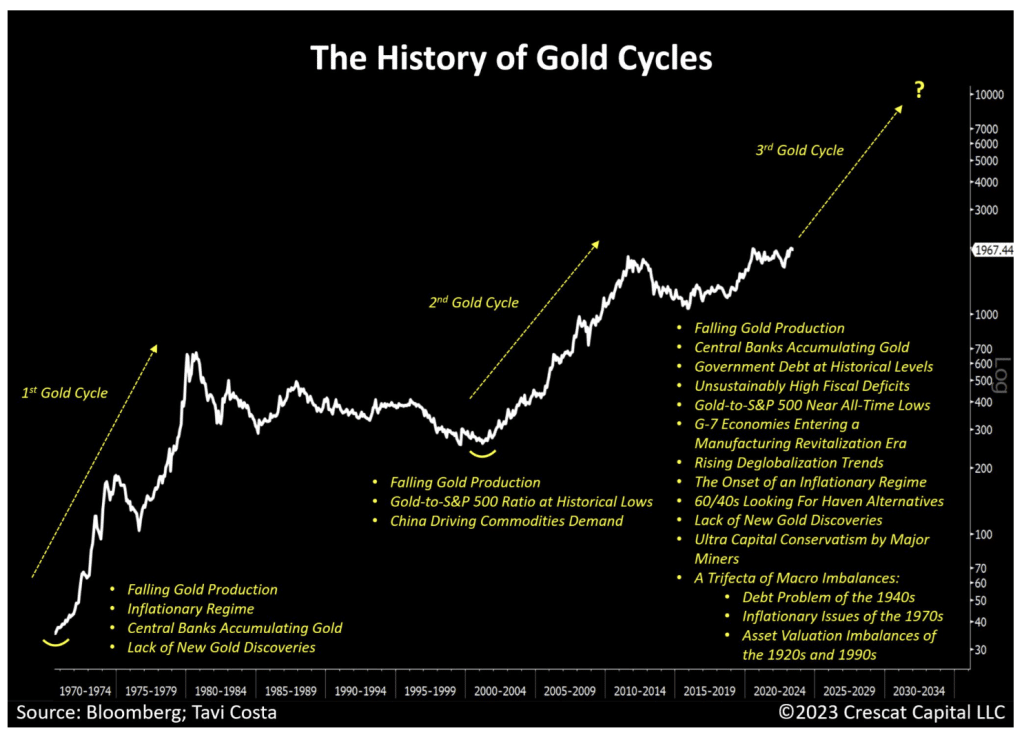

As we shift focus to the historical returns of gold, consider that from 1972 to 2022, gold's long-term nominal annualized return was 7.78%.

This period is significant as it follows the end of the gold standard, a time when gold prices in U.S. dollars were no longer arbitrary.

Your understanding of this data is crucial to appreciating gold's performance over time.

However, it's important to note that this can vary significantly over shorter periods.

Gold's 7.78% return is a long-term average, meaning returns can diverge drastically over shorter spans. For example, during certain years, gold's annual returns plummeted to -23.27% or soared as high as 58.44%.

Analyzing these figures can help you understand gold's volatility and potential for both high returns and significant losses. It's crucial to consider this when planning your investment strategy.

Presently, gold appears to be at the start of another bull run with all of the aforementioned 'tailwind' and it's potential for growth through 2030.Finding a trusted gold investment company that actively monitors economic trends and policies that can directly affect the gold price is critical. Professional gold investment companies can help determine and guide buying entry points as well. In addition to investment timing, a gold IRA company, more specifically, can provide a means owning gold, yielding additional benefits.

Choosing the right gold IRA company will depend on one's unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist:

Why Look at Historical Gold Prices?

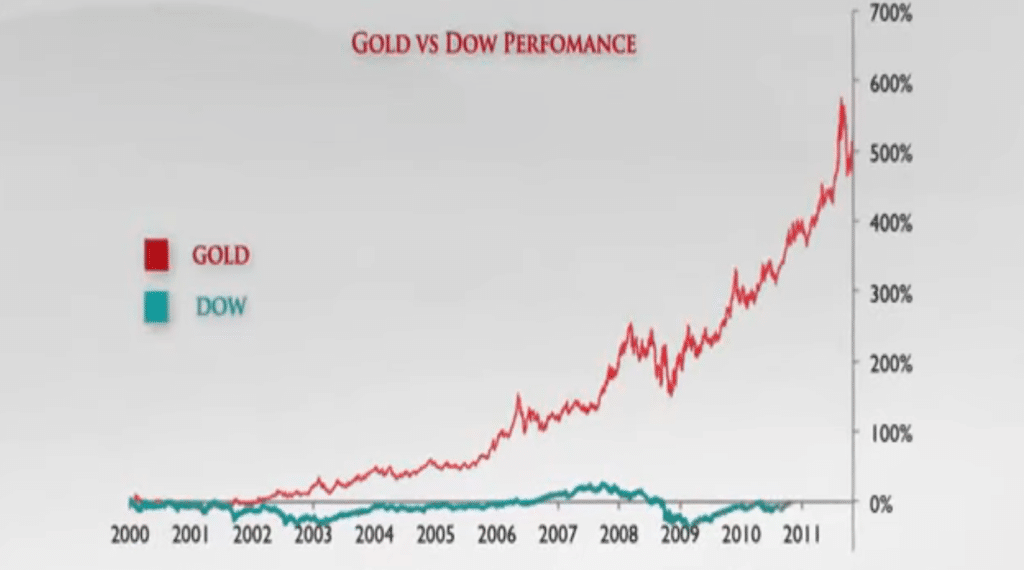

By examining historical gold prices, you're potentially able to identify trends and price support levels, which might assist in making informed buying or selling decisions. For instance, gold trended higher for many years before hitting all-time highs in 2011 of nearly $2000 per ounce

Analyzing historical gold prices can be useful in identifying potential areas of price support. For example, if gold has pulled back to $1200 per ounce multiple times, but each time is met with strong buying interest, then the $1200 area may be considered a level of support, potentially a good area to buy.

Furthermore, viewing historical gold prices in various currencies such as British Pounds, Euros, or Swiss Francs can offer different perspectives. An inflation-adjusted gold price chart using the 1980 CPI formula can further enhance your analysis.

This analytical approach isn't just about studying past prices. It's about understanding the larger trends and making data-driven decisions. For easy reference, consider using a table that shows gold's price change and percentage change over different timeframes, like a single day, 30 days, six months, one year, five years, or 16 years.

In essence, historical gold prices present valuable insights that can guide your future gold investment decisions.

What has Driven Changes in the Gold Price?

percentstock-to-flowametal'sNow, let's delve into the factors that have driven changes in gold prices over the years. The price of gold has been influenced by a variety of elements, each playing a significant role in its valuation.

Firstly, one of the biggest drivers of gold is currency values. The dollar, in particular, can greatly impact the price of gold. As gold is denominated in dollars, a weaker dollar makes gold relatively less expensive for foreign buyers, potentially lifting prices. Conversely, a stronger dollar makes gold more expensive for foreign buyers, possibly depressing prices.

Central bank buying, inflation, geopolitics, monetary policy, and equity markets have also been key determinants in the fluctuation of gold prices.

Gold's reputation as a reliable store of wealth and value also contributes to its pricing.

Studying past price data can help spot trends or patterns, providing potential buying or selling opportunities.

However, it's essential to remember that past performance doesn't necessarily indicate future results. Fiat currencies, like paper dollars, tend to lose value over time. If this continues, gold could potentially continue in an uptrend as investors look to it for its perceived safety and its potential as a hedge against declining currency values.

Lastly, one of the main drivers for the price appreciation and the security of gold as an investment is the metal's high stock to flow ratio. Meaning that the flow of new gold into the system when weighed against the existing stock is very low. The yearly average is in the range of 1.5 percent.

Conclusion

So, you've journeyed through gold's historical returns, understanding its price influences and performance amidst economic shifts. It's clear that gold has held its own against other commodities, but it's not immune to market fluctuations.

U.S. rate hikes, global gold holdings, and tax implications further complicate the picture. Still, as part of a diversified portfolio, gold remains a robust option. To learn more about gold investing for the protection of your wealth and preserving your purchasing power, see the links below to the free gold investment guides and get started with a gold IRA.

Remember, understanding the past is key to navigating future investments. Keep digging into the data.

If you have 100K in retirement savings to protect and looking to take advantage of the best gold and silver prices, attend a free gold investment educational webinar hosted by Augusta Precious Metals via the button below.

Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com