Updated January 3rd, 2026

Noble Gold Investments Review 2026

Best Precious Metals IRA Company for Storage and Product Diversity for Independent-Minded Investors

Costs, Fees, Storage Options, BBB Ratings, Pros and Cons

Disclaimer: Precious Metals Investment Portfolio may receive compensation from many or all of the companies listed, including Birch Gold. This is how we maintain our free service for consumers.

Quick Summary

Noble Gold was founded in 2016 by Charles Thorngren and Colin Plume. It’s a newer entrant in the precious metals/Gold IRA space but built by people with over 20 years of combined experience.

Ideal company for beginning and independent-minded investors who want more control, product variety, and strong storage/security options.

Noble Gold has an A+ rating with the BBB, and also good feedback via Consumer Affairs, TrustLink, and Business-Consumer Alliance.

To open an account: ~$2,000; direct transfers: ~$10,000; IRA/401(k) rollovers: ~$20,000. Annual/ongoing fees are ~$225-250; setup fees are much lower (around $80). Some first-year fees may be waived under qualifying conditions.

What they offer:

• Gold & Silver IRAs (Traditional & Roth) with options also including platinum & palladium.

• “Royal Survival Packs” that let you hold precious metals physically (for emergency or independent control).

• Secure storage via IRS-approved depositories (Texas, Delaware) with strong physical security and ease of management.

Table of Contents

- How to Open a Gold IRA with Noble Gold Investments

- Who Owns Noble Gold Investments?

- Noble Gold Investments Minimum Investment

- How Does Noble Gold Investments Work?

1. Noble Gold Investments Services

3.2. Gold & Silver IRAs (Traditional & Roth)

3.3. Easy Website Navigation & Account Setup

3.4. Noble Gold Survival Packs

3.5. Storage and Security Options (Texas & Delaware) - What is a Noble Gold IRA?

1. IRA Rollovers

4.2. Why Invest in a Noble Gold IRA?

4.3. Noble Gold’s IRA-Eligible Coins & Bars

• Gold Investments

• Silver Investments

• Platinum Investments

• Palladium Investments - What are Noble Gold’s IRA Minimums & Fees?

- Gold IRA Company Comparisons

- Pros and Cons of Noble Gold Investments

- Final Verdict

- Frequently Asked Questions

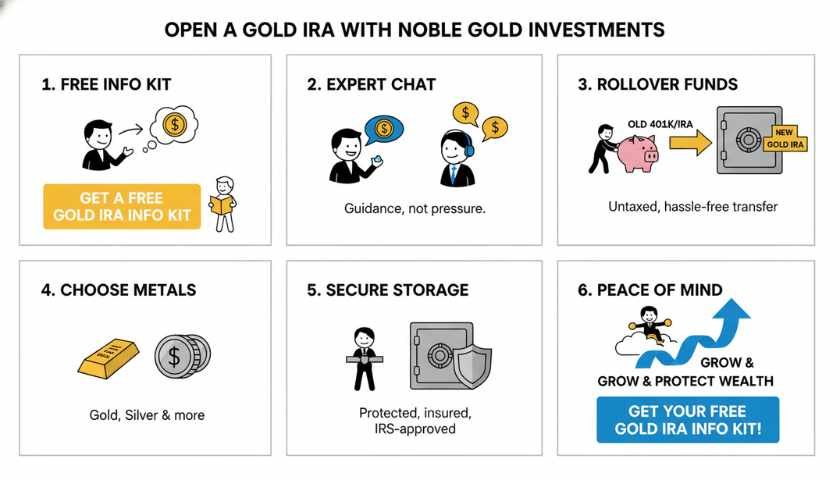

How to Open a Gold IRA with Noble Gold Investments?

Who Owns Noble Gold Investments?

Launched in 2016 by Charles Thorngren and Colin Plume, Noble Gold Investments is one of the newer gold IRA companies in the industry. Their executive staff, however, has over 20 years of combined experience in the precious metals industry. Originally founded as an offshoot of Regal Assets, Noble Gold has grown at a rapid pace in this highly competitive market.

Noble Gold provides beginning investors greater access to entry into the gold investment market, as well as appeals to independent-minded investors who seek greater control over their gold investments.

Noble Gold Investments is touted for their exceptional user-friendly online interface, fiercely independent and unique product offerings, and overwhelmingly positive customer service feedback.

Noble Gold is an accredited business with an A+ rating from the BBB, and boasts a high rating from the Consumer Affairs Alliance, TrustLink, and Business-Consumer Alliance.

Noble Gold Investments Minimum Investment

Noble Gold provides a low barrier to entry into the gold IRA and precious metals investment space. Noble Gold’s investment minimum varies based on the product. Investment amounts start at $2,000 in order to open an account. It is $10,000 for direct transfers and $20,000 for IRA/401k rollovers.

For a company of this quality and collective expertise, this is a huge advantage to beginner and experienced investors.

If you are ready to get started right now, click the banner below to visit Noble Gold Group’s official site and access their gold IRA investment guide.

How Does Noble Gold Investments Work?

Noble Gold Investments Services

Gold and Silver IRAs

Noble Gold Investments provides investors with both gold and silver IRA options that can be either a Roth or Traditional IRA. This allows investors to invest in either physical gold or silver for their retirement on a tax-advantaged basis. Gold and silver each have their unique properties and valuable industrial uses.

Both IRA options have their specific tax advantages depending on your specific situation. Traditional IRAs allow you to invest with pre-tax dollars and only pay taxes when you withdraw from the account. By contrast, in a Roth IRA, you pay with post-tax dollars but distributions from this specific IRA are tax-free.

Noble’s precious metal options include platinum and palladium. This gives Noble Gold an edge over many of its competitors that only provide gold and silver investment options.

Noble Gold provides in-depth educational resources and their expert customer support team can steer you in the right direction for your specific goals.

Easy Website Navigation and Account Setup

For investors eager to get started, Noble Gold Investments provides a simple online IRA setup form that can be filled out in a matter of minutes. Once submitted, a Noble Gold agent will reach out to assist in completing the process by assigning you a custodian.

The heavy lifting of processing the transfer of your funds is done by Noble by working directly with your precious metals custodian. Your 401(k) or IRA rollover is processed to your Noble Gold account quickly so you are freed up to make your precious metals selections.

Noble Gold Investments Survival Pack

For the more independent-minded investors looking for more control, Noble Gold provides Royal Survival pacts for quick access to gold and silver. Particularly, in the event of catastrophic economic collapse and national emergency.

Precious metals can be exchanged for goods and services. They are real money with real worth. Not fiat. The world has never looked more volatile than now. Noble allows you to be prepared for the unknown.

Noble Gold offers a range of Royal Survival Packs priced from $10,000 to $500,000 plus. Delivered to your door and stored in your home, you have ultimate control over your gold investments. Peace of mind.

Storage and Security Options

Best Texas State-Secured Storage Facility

Noble Gold Investments has secured a partnership with IDS (International Depository Services) in Dallas. This provides the first and only private secure depository facility in the south for gold and precious metals storage needs. Before this, the only depositories available with Noble Gold in the U.S. were in Delaware. Delaware and New York no longer have the monopoly on precious metals storage.

Rest easy knowing your gold and silver investments are guarded well. Visit the storage facility to see your gold and physical precious metal investments at your convenience.

What is a Noble Gold IRA?

IRA Rollovers

If you have an existing IRA and 401(k) plan, you can roll it into a Gold IRA. Noble Gold helps protect your retirement savings by investing in a self-directed gold IRA that you control through the ownership of tangible, physical precious metals.

Noble makes opening a gold IRA account a painless process. The company’s expert staff will assist you in the account creation and funding process, assist with the IRA rollover, and educate you on how to buy gold for your specific IRA.

Gold IRAs serve as a good hedge against inflation since gold prices generally move in the opposite direction of paper assets.

Why Invest in A Noble Gold IRA?

The answer is simple…Diversification, stability, tax efficiency, and global acceptance. A Noble Gold IRA is a great way to diversify your retirement portfolio in the event of market downturns and paper assets begin losing value.

Gold investments will typically increase in value when markets go south. And when markets are up, gold still tends to increase in value. In fact, gold is up more than 440% over the last 20 years. Unlike stocks and bonds, gold is a physical asset that you can own.

Gold IRAs are one of the most tax-efficient investment options available. You can also defer your tax payments or often skip paying tax on capital gains. Noble Gold’s experts can advise on how to get additional tax breaks.

As stated many times before, gold has historically been a stable and reliable asset that increases in value over time despite market fluctuations. Whether it is a bull or a bear market, precious metals are an asset that educated investors have held throughout history.

Gold is the only currency that’s accepted around the world. While local and foreign fiat is always prone to volatility and a skeptical eye, gold is king and remains so.

Noble Gold’s selection of IRA eligible coins includes but is not limited to:

Gold Investments

-American Gold Eagle Coins

-American Gold Eagle Proof Coins

-Four-Piece Set Proof Gold American Eagle Coins

-Canadian Gold Maple Leaf Coins

-Pamp Suisse 100 Gram Gold Bar

-Perth Mint 1-Ounce Gold Bar

-Johnson Matthey 1-Kilograph Gold Bar

-Pamp Suisse Lady Fortuna Gold Bars

-Australian Gold Kangaroo Coins

-Austrian Gold Philharmonic Coin

Silver Investments

-5-Ounce America the Beautiful Silver Coins

-1-Ounce American Silver Eagle Coins

Platinum Investments

-1-Ounce Canadian Platinum Maple Leaf Coin

-Baird & Co 1- and 10-Ounce Platinum Bars

Palladium Investments

What are Noble Gold’s IRA Minimums & Fees?

Service

Precious Metals IRA

Investment Minimum

$20,000

Annual Fees and Storage

$225 / $250 (if stored in a depository)

$0 (if stored by you)

Financial Calculators

Find out whether Noble Gold Group’s Gold IRAs are a good choice for your retirement needs. Access our Gold IRA and Inflation-Retirement Calculators. Perform real-time calculations as you read our reviews. See the buttons below to access these calculators and start protecting your wealth today.

Gold IRA Calculator

Inflation-Retirement Calculator

Gold IRA Company Comparisons

Noble Gold Investments vs. Other Gold IRA Companies

- Annual Fee: Fees vary

- Minimum Investment: $10,000

- Promotion: 1st year fees waived (over $50k accounts)

- Annual Fee: $180

- Minimum Investment: $10,000

- Promotion: Free Storage and custodian fees for the first year

- Annual Fee: $180

- Minimum Investment: $50,000

- Promotion: See official site

Pros and Cons of Gold Investing with Noble Gold

Pros

✓Gold and Silver IRAs available in the form of a Roth or Traditional IRA

✓Perfect for beginning and independent-minded investors who want more control of their investments.

√First-year fees are also waived for qualifying IRAs.

✓

✓Platinum and Palladium investments available

✓Secure Texas state-segregated storage

✓User-friendly online navigation to easily start investing

Cons

✓Fees are not very transparent on company website

Final Verdict

Noble Gold’s proven track record of customer service, seamless online setup process, an expansive selection of precious metals, well-vetted storage services, and alternative investments outside the standard gold IRA sphere makes up the bedrock of the company’s trusted reputation and unique approach to the precious metals investment market. First-year fees are also waived for qualifying IRAs.

Weathering a bear market or cycles of inflation and recession is about preparation and managing risk. Noble Gold Investments has proven to be a safe and trusted choice for your retirement planning and wealth-building needs.

Frequently Asked Questions

1. What is Noble Gold Investments?

Noble Gold Investments, founded in 2016 by Charles Thorngren and Colin Plume, is a precious metals company that helps individuals diversify their retirement savings through self-directed IRAs backed by gold, silver, platinum, and palladium.

2. Is Noble Gold Investments legitimate?

Yes. Noble Gold holds an A+ rating with the BBB, strong ratings with Consumer Affairs, TrustLink, and the Business Consumer Alliance, and is known for transparency and customer service.

3. What makes Noble Gold different from other Gold IRA companies?

Noble Gold is recognized for:

-Low entry requirements compared to competitors

-Wide range of metals and unique offerings like “Royal Survival Packs.”

-Secure, IRS-approved depository storage in Texas and Delaware

-Strong educational resources and customer support

4. What is the minimum investment required with Noble Gold?

-Cash Account Setup: ~$2,000

-Direct Transfer: ~$10,000

-IRA/401(k) Rollovers: ~$20,000

5. What are the fees for a Noble Gold IRA?

-Account setup: ~$80

-Annual custodian & storage fees: ~$225-$250

-Some first-year fees may be waived depending on investment size.

6. What are Noble Gold’s storage options?

Noble Gold works with IRS-approved facilities, including Texas Depository and Delaware Depository, offering high-security storage and insurance coverage for metals.

7. What metals can I invest in with Noble Gold?

You can invest in gold, silver, platinum, and palladium coins and bars that meet IRS eligibility requirements.

8. What are Noble Gold “Survival Packs”?

These are pre-selected bundles of physical gold and silver designed for quick access and personal possession in case of emergencies, separate from IRA accounts.

9. Can I take physical delivery of my metals?

Yes. Clients can choose to either store metals in an approved depository or take direct delivery of certain products, including Survival Packs.

10. Who is Noble Gold best suited for?

Noble Gold is ideal for:

-New investors who want educational support

-Independent-minded investors seeking control over physical metals

-Those wanting secure U.S.-based storage

-Investors looking for a lower minimum entry compared to some competitors

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com.