Precious Metals Investment Portfolio

About Precious Metals Investment Portfolio

The Precious Metals Investment Portfolio offers investors and retirees educational resources on gold IRA rollovers, gold and silver investing, portfolio diversification, and calculating retirement savings in relation to inflation.

Benefits of a Gold IRA and Precious Metals Investing

Discover the key benefits of a Gold IRA, including portfolio diversification, powerful inflation hedging, tax-deferred growth, and protection during economic uncertainty. Explore the pros and cons of precious metals IRAs, from tangible asset ownership to potential costs and volatility, to make informed retirement decisions.

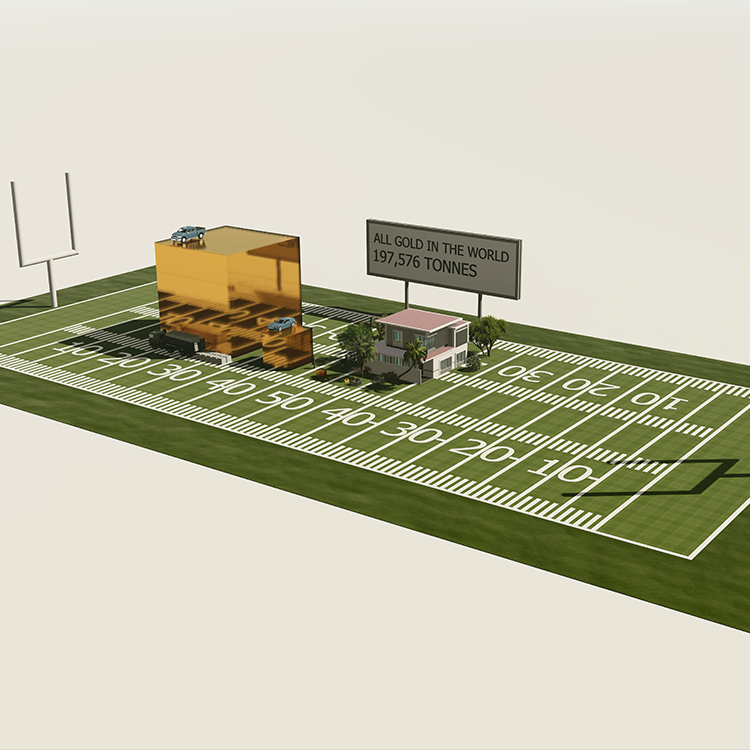

Investing in gold and silver offers numerous advantages for building a resilient portfolio. These precious metals have served as stores of value for thousands of years, providing a hedge against inflation as their prices often rise when fiat currencies lose purchasing power due to economic pressures.

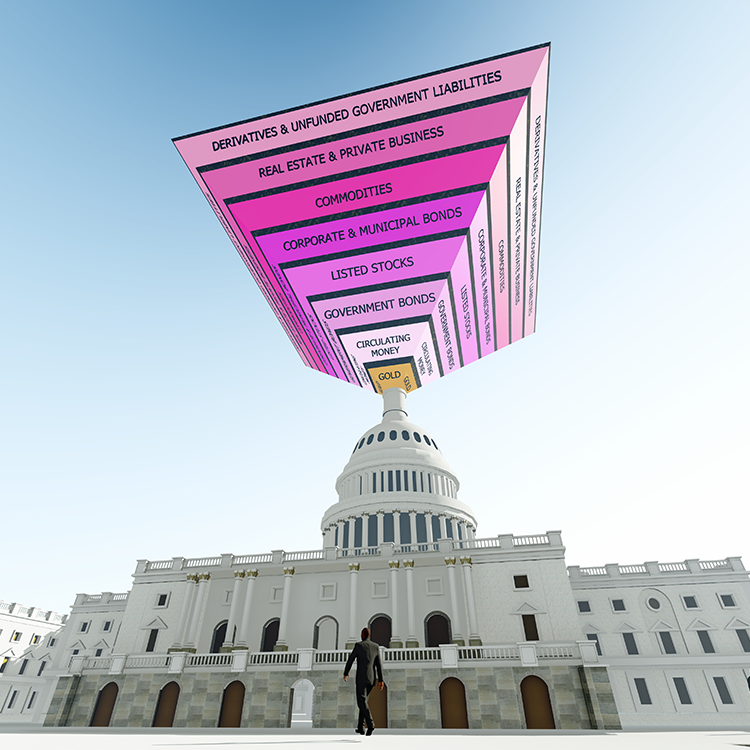

Gold, in particular, acts as a reliable safe-haven asset during periods of geopolitical uncertainty, market downturns, or crises, often performing inversely to stocks and bonds. This low correlation enhances diversification, reducing overall portfolio risk while preserving wealth over the long term.

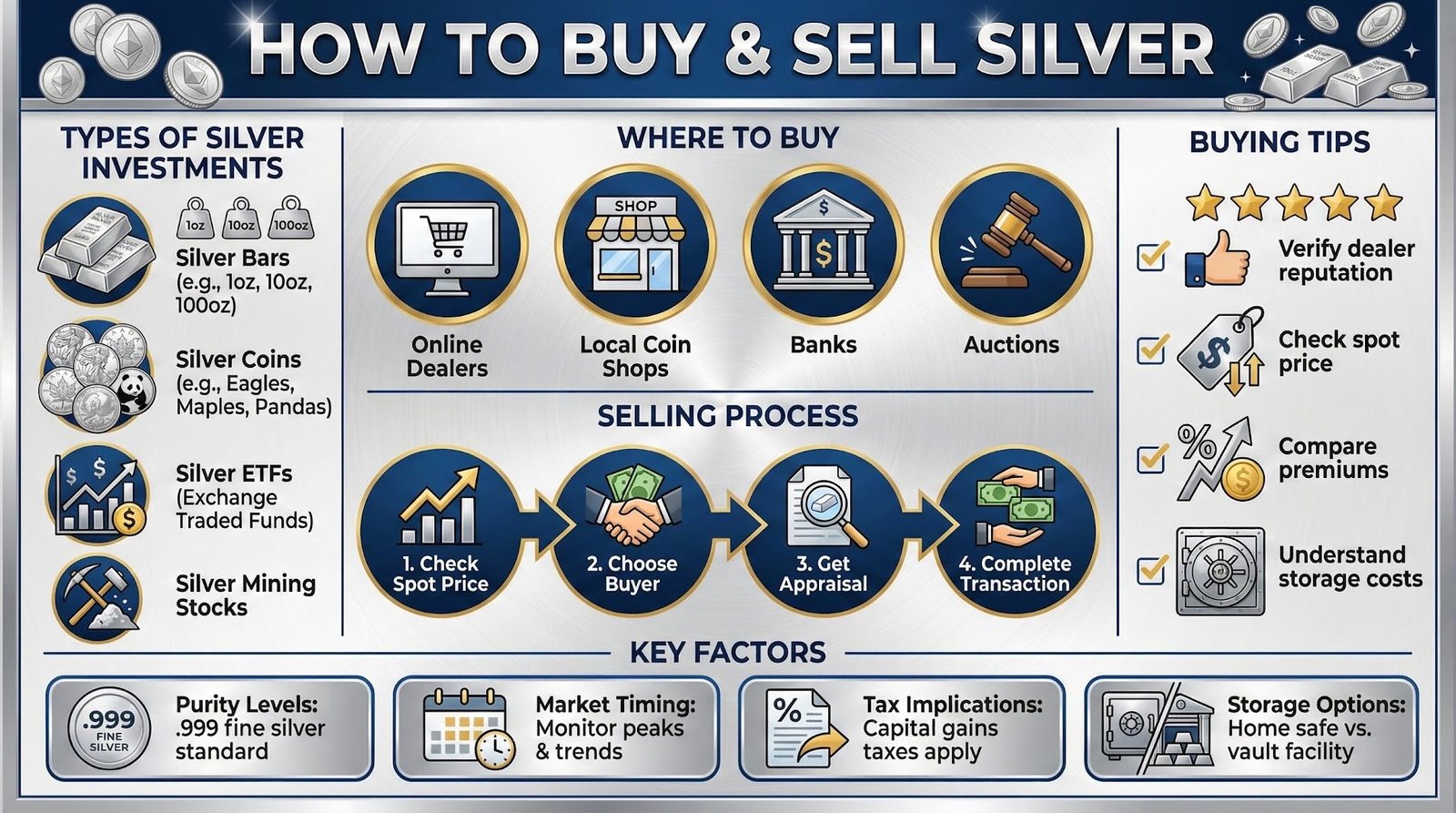

Silver complements gold by offering similar monetary benefits but with added upside from industrial demand in sectors like electronics, solar energy, and electric vehicles. This dual role can lead to stronger price gains in bull markets, and its lower price per ounce makes it more accessible for smaller investors.

Both metals are tangible assets with no counterparty risk, high liquidity, and potential for capital appreciation, making them effective tools for wealth protection and intergenerational transfer in an era of rising global debt and volatility.

Explore the Precious Metals Investment Portfolio site and our educational resources, reviews, and financial calculators below.

Best Gold IRA Companies

Benefits of a Gold IRA

Gold IRA Investing FAQ

Gold IRA Tax Rules

How to Buy and Sell Gold

How to Buy and Sell Silver

Gold IRA Calculator

Inflation-Retirement Calculator

Gold Investing Videos