What Is IRA Approved Gold

You might be thinking that investing in gold is risky or complicated, but it doesn't have to be.

IRA approved gold is a specific type of gold that the IRS allows to be included in an individual retirement account. Essentially, it's a high-quality gold, often in the form of .9999 fine gold bars or coins. To gain the best understanding of gold specifically approved for Gold IRAs, we will discuss:

- What is a Gold IRA?

- Types of IRA-Eligible Gold Products

- Examples of IRA-Acceptable Gold Products

- What to Consider When Purchasing IRA-Eligible Gold

- Choosing the Best Gold IRA Company

By investing in this type of gold, you're not only diversifying your portfolio but also enjoying the tax benefits that come with an IRA.

Let's demystify the concept of IRA-approved gold and show you how it can be a valuable addition to your retirement strategy.

What is a Gold IRA?

In your journey to understanding IRA-approved gold, you'll first need to grasp what a Gold IRA is. This isn't your typical retirement account, but a unique twist on the traditional IRA, specifically designed for holding physical bullion, such as gold coins or bars. This special account, also known as a precious metal IRA, operates much like a regular IRA, with the same contribution limits and distribution rules. The key difference lies in its asset composition.

While your regular IRA might hold paper assets like stocks and bonds, a Gold IRA is specifically earmarked to hold physical precious metals. This isn't limited to gold, but also includes other approved metals like silver, platinum, and palladium. It's an innovative way to diversify your portfolio, combining the reliability of gold with the potential growth of an IRA.

But that's not all. Gold IRAs can also hold gold stocks, which are shares in gold mining or production companies. They can include gold mutual funds that invest in both bullion and stocks. You can even have gold ETFs that track gold indexes. This gives you an array of options to gain exposure to the gold market, without necessarily holding physical gold.

However, to hold physical gold in an IRA, you'll need a self-directed account administered by an IRS-approved custodian. This comes with its own set of rules and fees, which we'll delve into later. For now, just remember that a Gold IRA offers a unique fusion of physical gold and retirement savings.

Types of IRA Eligible Gold Products

When considering gold products for your IRA, it's essential to understand the types that are eligible. This includes gold coins, bars, and rounds, all of which must meet the IRS's minimum fineness requirements.

IRA-Eligible Gold Coins

You may wonder, what types of gold coins are IRA eligible? Gold coins, admired for their collectability and ease of sale, offer an excellent way to diversify your retirement portfolio. Not all gold coins qualify, but those minted by national governments and meeting IRS fineness standards do. This includes a variety of globally recognized coins:

- American Gold Eagles: Highly sought after, these are the only 22-karat coins eligible.

- Canadian Gold Maple Leafs: Known for their purity at 24 karats.

- South African Krugerrands: These were the first gold bullion coins produced for investors.

- British Sovereigns: These historic coins are made with 22-karat gold.

- Chinese Gold Pandas: Unique in offering a new design every year.

Investing in these coins could lead to potential growth in your IRA.

IRA-Eligible Gold Bars and Rounds

Let's delve into gold bars and rounds, another type of IRA-approved gold products that can significantly enhance your retirement portfolio. These items are valued purely on their gold content, making them a cost-effective choice compared to gold coins that may carry collectability premiums.

However, not all gold bars and rounds qualify. They must meet specific IRS requirements, including a purity of .999 or higher, and must be produced by a recognized mint or refiner. This ensures you're investing in high-quality products and minimizes potential risks.

Some popular options include the Credit Suisse, Valcambi, RMC, and PAMP Suisse gold bars. These brands are renowned for their quality and trustworthiness, making them excellent additions to your retirement savings.

Be sure to consult with an experienced precious metals advisor to guide your investment choices.

Examples of IRA-Acceptable Gold Products

You have a wealth of choices when it comes to IRA-acceptable gold products. Options range from American Eagle Bullion and Coins, Austrian Philharmonic Bullion Coins, to British Britannia Coins, and more.

Each of these investments, which meet the minimum fineness requirements, can be a robust addition to your diversified retirement portfolio.

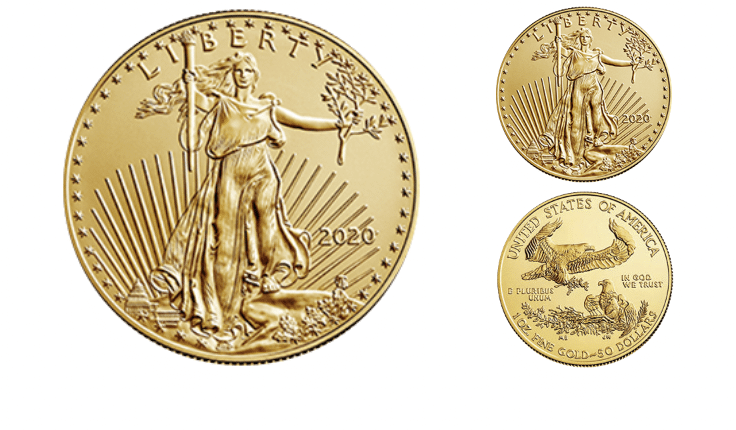

American Eagle Bullion and/or Coins

Among the various options for IRA-approved gold investments, American Eagle Bullion and Coins are a favored choice due to their reliable weight and purity guarantees. As products of the United States Mint, they offer an efficient and economical way to include precious metals in your investment portfolio.

- American Eagle Bullion and Coins are available in gold, silver, and platinum varieties, giving you flexibility in your investment choices.

- These coins feature an iconic design that's recognized worldwide, enhancing their resale value.

- They're produced by the United States Mint, ensuring their authenticity and quality.

- The weight and purity of these coins are guaranteed by the U.S. government.

- They're eligible for inclusion in an IRA, allowing you to diversify your retirement portfolio with precious metals.

Australian Kangaroo/Nugget Bullion Coins

Another excellent IRA-approved gold investment option is the Australian Kangaroo/Nugget Bullion Coins. Issued by the Perth Mint, these coins are renowned for their unique red kangaroo design and the portrait of Queen Elizabeth II on the reverse. Their distinct appearance isn't their only appeal, however.

These coins are prized for their high gold purity, making them a valuable addition to any gold IRA. As an investor, diversification is key to safeguarding your portfolio. With their unique design and high gold content, these Australian coins offer a strong way to diversify.

Not only do they contribute to the strength of your portfolio, but they also bring a touch of the exotic to your holdings. Remember, it's not just about value, but also about the joy of ownership.

Australian Lunar Series Coins

Continuing with the theme of Australian gold products that qualify for inclusion in your gold IRA, let's delve into the Australian Lunar Series Coins. These coins are recognized by the IRS as acceptable gold products for your IRA, and they provide a unique opportunity for diversification.

- Unique Design: Each coin in the series features a different animal from the Chinese zodiac, making for an exciting collection.

- Limited Mintage: The Perth Mint limits the production of these coins, which can increase their value over time.

- Inflation Hedge: Like other gold products, these coins can serve as a hedge against inflation.

- Quality Assurance: The coins are minted by Perth Mint, guaranteeing their quality and authenticity.

- IRA Eligibility: These coins meet IRS requirements for inclusion in a gold IRA.

Austrian Philharmonic Bullion Coins

When you're considering gold products for your IRA, you shouldn't overlook the Austrian Philharmonic Bullion Coins. They're recognized by the IRS and have a unique appeal for collectors and investors alike.

Minted by the Austrian Mint, these coins feature the renowned Vienna Philharmonic Orchestra, making them distinct and highly sought after. They're available in both gold and silver, providing diversity to your investments.

With their investment-grade gold content and high-quality craftsmanship, they offer a solid, tangible asset that can withstand economic fluctuations.

British Britannia Coins

In your journey towards diversifying your retirement portfolio, you'll find that since 1987, British Britannia Coins have been a reliable and IRS-approved gold product option. These coins are minted by the Royal Mint in the United Kingdom and contain one troy ounce of 24-carat 999.9 fine gold.

Here are a few reasons why they're a solid investment choice:

- They're legal tender coins officially supported by the UK government.

- They offer high liquidity, making it easy to buy and sell.

- They're exempt from capital gains tax in the UK.

- They bear a unique design, adding a collectible value.

- The strong backing from the UK government enhances their credibility.

Investing in British Britannia Coins can strengthen your gold IRA and provide a buffer against market volatility.

Canadian Maple Leaf Coins

Often, you'll find that Canadian Maple Leaf Coins are another excellent choice for IRA-approved gold investments. Minted by the Royal Canadian Mint, these coins boast a high purity of 99.99% fine gold, making them a premium gold product. What sets them apart is their iconic maple leaf design, a symbol of Canada's natural beauty and heritage.

Their worldwide recognition enhances their liquidity, a key consideration for any investment. An advantage of these coins is their acceptability in gold IRAs due to their high purity level, thus satisfying IRS' stringent requirements. This makes them a solid choice for diversifying your retirement portfolio with gold.

Chinese Panda Coins

Adding to your Gold IRA, you'll find that Chinese Panda Coins meet the stringent IRS standards required for precious metal investments. These gold coins, issued by the People's Republic of China, feature a unique Panda design, making them a standout choice for your portfolio.

- Purity: Chinese Panda Coins are crafted with 99.9% pure gold, surpassing the IRS's minimum fineness requirement of 99.5%.

- Design: The coins showcase a different panda image each year, adding a collectable appeal.

- Value: Their value is based on their gold content plus a premium for their collector's appeal.

- Availability: They're available in various weights, offering flexibility for investors.

- Storage: Like other IRA-eligible gold products, they must be stored in an IRS-approved depository to maintain their tax-advantaged status.

With careful consideration, Chinese Panda Coins can be a valuable addition to your Gold IRA.

U.S. Buffalo Bullion Coins

Continuing with your exploration of IRA-acceptable gold products, let's turn our attention to U.S. Buffalo Bullion Coins, which are another excellent choice for diversifying your Gold IRA.

Introduced in 2006 by the United States Mint, these coins are made from 24-karat gold, guaranteeing high purity. Each coin is backed by the US Mint for the weight and purity indicated on the reverse side, adding an extra layer of security to your investment.

Their face value is $50, but their intrinsic metal value is typically much higher. Due to their conformity with the IRS's minimum fineness requirements, Buffalo Bullion Coins are IRA eligible.

With their high gold purity and recognition, they serve as a reliable investment, bolstering the strength of your gold IRA.

What to Consider When Purchasing IRA-Eligible Gold

When purchasing IRA-eligible gold, you need to be mindful of several critical factors.

It's essential to understand the contribution limits, be aware of the associated fees, and know the minimum investment requirements.

Also, it's crucial to be clear about the implications of early withdrawal to avoid potential penalties.

Contribution limits

Often, you'll need to consider the annual contribution limits set by the IRS when purchasing IRA-eligible gold. For the tax year 2023, the maximum you can contribute is $6,500, or $7,500 if you're over 50, ensuring your investments grow tax-deferred within your IRA.

Here are some key points to keep in mind:

- These limits apply to all types of IRAs, including traditional, Roth, and self-directed IRAs.

- Exceeding these limits could lead to potential penalties.

- Regularly reviewing these limits is necessary as they may change annually.

- If you're 50 or older, you're allowed an additional $1,000 as a catch-up contribution.

- Adherence to these limits allows for a disciplined investment approach, keeping your retirement planning on track.

Fees

Another crucial factor you need to consider when purchasing IRA-eligible gold is the various fees associated with gold IRAs. These can include a one-time setup fee, ongoing administrative or custodial fees, storage costs, and transaction fees.

Each gold IRA company has its own fee structure, so it's vital to research and compare these fees to ensure you're getting the most from your investment. Minimizing fees can significantly boost your potential returns, helping to secure your financial future.

Minimum Investment Requirements

While you're considering investing in an IRA-approved gold, it's crucial to understand that some custodians may require a minimum investment, which can range anywhere from $5,000 to $25,000. The IRS doesn't enforce this, but individual custodians may have their rules.

Before starting, consider the following:

- Ascertain whether your chosen custodian has a minimum investment requirement.

- Evaluate if you can afford the minimum investment without compromising your financial stability.

- Consider the type of gold investment - bullion coins, bars, or ETFs.

- Explore the potential returns on your investment. Does the minimum investment align with your retirement goals?

- Finally, look into the possibility of penalties or fees if you can't maintain the minimum investment.

Early Withdrawal Penalty

As a critical part of your investment strategy, you should also consider the potential early withdrawal penalty that can come with a gold IRA. If you access your funds before reaching the age of 59½, you could face a 10% penalty. This is designed to deter premature fund access and ensure these assets serve their purpose: providing financial security during retirement.

By keeping your gold investments within your IRA until the proper age, you can sidestep this penalty and enjoy the tax-deferred growth of your assets. It's essential to plan your investment timeline carefully, considering the potential penalties, to maximize your returns.

Choosing the Best Gold IRA Company

Gold and silver are valuable and, most of all, expensive. Working with a long-established and trusted gold IRA company that can provide competitive prices, price transparency, reliable customer service, and security of your precious metals will take away all of the guesswork.

Depending on whether you are a high-net investor looking to take advantage of the best prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our top 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a gold IRA or owning the physical gold in your place of residence, we have done the due diligence.

Tap the banner below to visit Noble Gold Investments to receive their gold IRA guide

Conclusion

So, you're ready to dip your toes into the golden world of IRA-approved gold? Remember, it's not just about buying any gold, but quality, .9999 fine gold bars and coins.

Be savvy, understand the nuances of Gold IRAs, and choose eligible products wisely.

With careful planning and investment, you'll not only diversify your portfolio but also set yourself up for a more secure retirement.

Now that's a golden strategy!

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Attend a Free Gold Investment Webinar for High Net Worth Investors

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com