Is Gold a Good Investment in 2024? Top 5 Gold Price Drivers

Gold is expected to benefit from several drivers in 2024. In this article, we will cover the top 5 reasons to invest in gold in 2024.

To better understand whether gold is a good investment in 2024, we need to examine the following possible factors at play:

- US Fiscal Uncertainty,

- Quantitative Easing,

- De-Dollarization and Rising Geopolitical Tensions,

- Beginnings of a Global Financial Crisis in 2024

Gold Price Driver #5: US Fiscal Uncertainty

What will the US debt be in 2024?

The US treasury plans to borrow $816 billion in Q1 of 2024, the most ever borrowed in any first quarter.

The US government has crossed the line of $34 trillion of debt. In the past 2 years, we have seen the US government-run wartime budget deficits in a peacetime economy. At the present rate, the US is adding $2 trillion to its debt every year in what could be described as ‘good times’.

To quote Marc Goldwein, senior vice president at the Committee for a Responsible Federal Budget “if we keep adding this much to the debt in good times, things could get really awful in bad times, and we can’t grow our debt faster than our economy forever”

At $1.7 trillion, the fiscal year 2023’s annual budget deficit was the third-highest ever. This amount is staggering, considering the lack of any actual crisis.

Within the first three months of fiscal year 2024, the deficit already has surpassed the half-trillion-dollar mark, putting it on pace to finish the year at more than $2 trillion.

The interest expense alone on the debt is projected to be 1 trillion and above at the present interest rates. Creating what is known as Fiscal Dominance. Remember that word, you will be hearing more of it as the year goes on.

The REAL question is how will the government pay for it… A balanced budget? Given the culture in DC, not likely. Will either political party raise taxes to bring the spending and budget into balance? Not if they want to get re-elected.

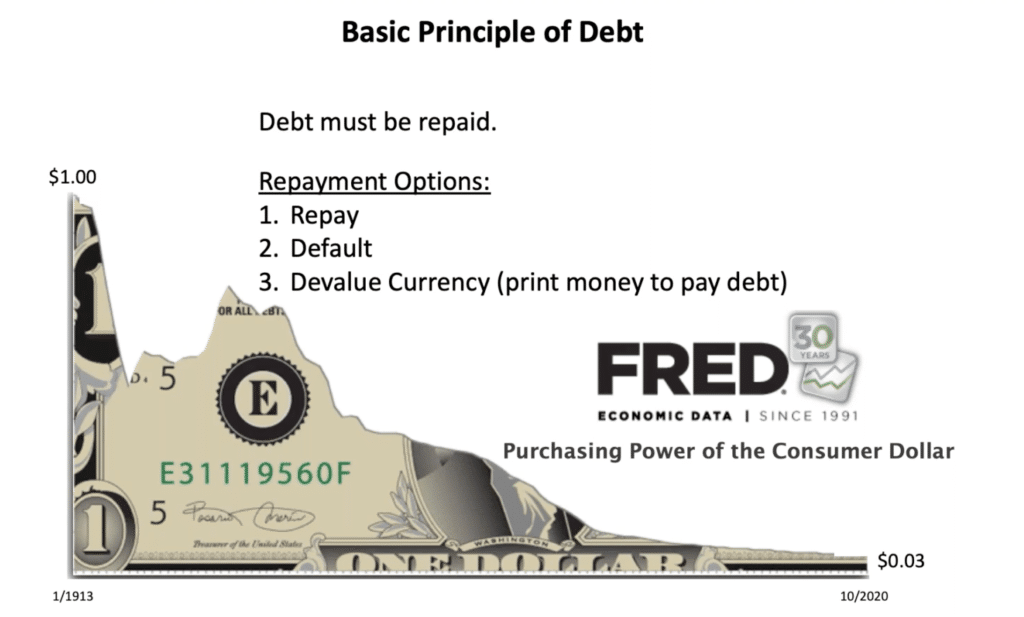

Who will ‘pay the piper’? This expense, as always, will be passed onto present and future generations through inflation, the visible tax.

According to the data provided to us by the same ’spendy’ government, inflation is going down from its 9% peak in 2022. Many are still recovering from the losses experienced during this period and the Federal Reserve’s aggressive hiking cycle to counteract the inflation that they initially thought was transitory, has only increased the debt and lending burden. Adding insult to injury.

It is worth pointing out the obvious, that prices are still rising, but at a slower pace. The Fed’s 2% target inflation ‘sweet spot’ as measured by the fairly dubious government data still equals a 2% erosion of your wealth and retirement savings year over year. This 2% target concept has its origin that will be explained in a future article. Suffice it to say, 2% is just enough purchasing power loss and currency depreciation to go relatively unnoticed.

Whether you earn a paycheck, dividends through stocks, interest through bonds, or another such income stream, once you get past tax payments, capital gains, and other administrative costs, you are still experiencing, at best, a 2% loss in wealth erosion due to inflation.

Gold investing essentially plugs that hole by providing portfolio diversification. Precious metals act as a hedge against your losses in other earnings channels caused by this uncontrollable economic burden. It also appreciates the longer you hold it.

The reported measurements of inflation are one thing, the average ‘lived’ experience by the regular everyday American is another. Please leave a comment on your personal experience with the cost of living and its effects on your day-to-day behaviors and retirement savings.

Gold Price Driver #4: Quantitative Easing

Gold Prices and Interest Rate Cuts

Unfortunately, as a standard remedy to a highly indebted system. The next driver of gold’s price in 2024 is accommodative monetary policy and associated dollar weakness. As stated in the previous video. The servicing costs of the US National debt will be in the range of 1 trillion dollars this year at the present Fed rate.

It is largely believed that the Federal Reserve has ended its aggressive interest rate hiking campaign and that interest rate cuts will begin sometime in the first half of 2024. This projection is subject to change, of course, barring unforeseen economic ‘black swans’ or the early onset of a recession.

Simply put, interest rate cuts usually push the strength of the dollar down and send the price of monetary metals like gold and silver up.

It is worth noting, that if the Federal Reserve pivots their monetary policy too early, there could lead to a resurgence of inflation. If this renewed inflation cross current meets a recessionary front, this could lead to a stagflation environment, which pushes gold higher as seen in the turbulent stagflation period of the 1970’s.

Considering the large amounts of fiscal spending that is continuing to pour into 2024, the prospect of this resurgence could be more of a possibility. The Federal Reserve can push down the ‘demand’ side of inflation, but they have little influence over the supply side driven by uncontrolled government spending.

This prospect is also accelerated by a historic Debt to GDP ratio of 123%. This ratio is predicted to grow even more if the US continues down this path of fiscal dominance. It is worth repeating Marc Goldwein, the senior vice president at the Committee for a Responsible Federal Budget “We can’t grow our debt faster than our economy forever”

Essentially, the Federal Reserve has been slamming on the economic brakes, as the US federal government has been pushing on the fiscal accelerator. As the US central bank begins to lift its foot off the brakes of the American economy by cutting interest rates on the demand side of inflation, the money supply side of inflation is ready to ‘peel out of parking stance’ with greater speed.

The end result being a weaker and inflated dollar and a dramatic surge in gold as seen during the volatile period of the 1970s that witnessed violent waves of inflation, each wave larger than the last.

Finding a reputable gold investment company that studies and actively monitors the present economic cycles, central bank policy changes, the movements of the markets as well as the providing fundamental and technical analysis can eliminate a great deal of the guesswork and risk.

Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one's unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist

Gold Price Driver #3 - Central Banks Buying Gold

Why Are Central Banks Buying Gold Now?

The U.S. Federal Reserve's approach to increasing the money supply and monetizing the ever-growing national debt has weakened the dollars being held by national banks around the world.

Given this fact, countries with sizeable dollar reserves are increasingly converting their reserves into tangible assets like gold. Nations like India, Russia, China, and Brazil are leading this trend by buying gold at an unprecedented pace, disrupting the balance of power between East and West.

In the years 2022 and 2023, central banks around the world have purchased more gold than any time in recorded history according to the World Gold Council. In 2022 alone, central banks collectively increased their purchases by 152% to more than 1,100 tons. This was an all-time high. The council expects this strong buying demand to continue into 2024.

This mass increase in gold holdings and exodus from the US dollar as a central bank reserve asset is not just isolated to the emerging and expanding BRICS nations. Polish and Dutch central banks within European nations are increasing their gold purchases as well. In 2023, the Polish Central Bank stated that they wanted to double their gold reserves up to 600 tons.

By amassing gold, these institutions are tactically positioning themselves to counteract potential losses that are perceived with the dollar in the medium and long term.

This trend isn't just about hedging against inflation or economic instability. It's a calculated move to diversify reserves and reduce reliance on the dollar. Central banks are essentially turning back to the historical money status of gold, both as a form of diversification, a hedge against potential crises, and its scarcity of supply. Stated simply, central banks can’t print more of it.

The trend is clear: central banks are no longer selling gold, they're buying it. They're reducing the supply on the markets, effectively driving up the demand and price of gold.

As the collective acquisition of gold increases and the reserve holdings of US dollars decrease among these central banks, this will gradually create increased inflation of the US dollar due to the existing supply being exported from foreign nations back to the US.

Other international currencies don't offer a compelling alternative as they're all based on unconvertible paper. The lack of a strong alternative to the dollar accelerates the process of 'de-dollarization', leading to increased demand for gold, and thereby weakening the dollar’s position as the global reserve currency. Gold is the only true global currency and is accepted due to its time-tested trust and store of value.

Gold Price Driver #2: De-Dollarization and Rising Geopolitical Tensions

What is the Reason for the Trend Towards De-Dollarization

This leads up to our next world economic driver: De-Dollarization. There has been much talk and no shortage of hype and theories about this particular subject concerning its velocity. Regardless of the differing opinions of the many macroeconomic experts in terms of its forecasting and time horizon, the process has begun and is accelerating.

The BRICS-plus nations have already started trading commodities, such as oil, between member countries in their currencies, not the dollar. The membership of Saudi Arabia further threatens the US dollar’s global reserve currency status and its reputation as the petro-dollar.

Furthermore, the original BRICS coalition share of global GDP is now overtaking the previously dominant Western G7 nations. With the 2024 entry of the additional six nations, Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates, this will increasingly lead to a more bi-fricated global economy and trading system.

As stated before, building on the trend of de-dollarization, central banks around the globe are stepping up their gold holdings. This shift is largely a response to the diminishing purchasing power of their dollar reserves and what could be termed as a response to the ‘weaponization’ of the dollar.

Irrespective of one’s feelings and views of Russia’s invasion of Ukraine in the spring of 2022, the resulting economic sanctions, seizure of foreign assets, freezing of Russia’s currency reserves, and the punitive restrictions placed on Russia with the use of the SWIFT banking system, created an atmosphere of uncertainty among eastern bloc nations.

Moreover, this collective action by the G7 nations, more specifically, the United States, has caused many foreign governments to further contemplate their participation in the ‘dollar system’ and has created impetus for these non-G7 nations to further distance themselves from the dollar reserve system

As with the case of the Russian invasion, the prospect of being considered and dealt with as a ‘pariah state’ in the eyes of Western nations has the potential to transform a country’s dollar reserves from a highly liquid asset to essentially ‘useless’ pieces of paper. Hence, we see the continued accumulation of gold and the reduction of dollars and dollar derivatives of these foreign central banks.

Gold is a time-tested, and universal form of money that every country trusts. It cannot be inflated, or be confiscated if held domestically within a given country's central bank. This provides security. Therefore, the mass purchases of gold are likely to continue and grow in this increasingly bi-fricated world. By extension, these massive gold purchases will continue to give support and push up the price of gold.

Best Gold IRA for Security and Private Ownership Options

Gold Price Driver #1: Beginnings of a Global Financial Crisis in 2024

What is the global economy trend in 2024?

The number 1 driver of the gold price for 2024 can best be summarized as a cumulative of the effects of the previous drivers: the beginnings of a global financial crisis.

In the past two years, the cracks in the global economy have started to show in various sectors. The UK pension crisis, the ‘No Bid’ Bank of Japan market, and the US bank failures of Silicon Valley Bank, Signature Bank, and others are a handful of examples. Though, having the appearance of being isolated incidents, these various crises present as symptoms of a larger and deeper illness which is an overly levered system. Central banks around the world can only ‘paper over’ these problems for so long. Eventually the government and institutional ‘bandaids’ will no longer hold back the blood flow of what is really a systematic, gaping wound.

Arguably, this may be one of many reasons why central banks around the world are increasing their collective holdings of hard assets such as gold onto their balance sheets as opposed to US dollar reserves. One word: preparation.

Gold is a Tier 1 asset that has no counterparty risk, is no one’s liability, and has only increased in value during a time that can best be described as a 40-year-plus debt cycle. Not coincidentally, this period aligns with the rise of widespread, non-asset-backed fiat that accelerated with the United States abandoning the gold standard in 1971.

During this cycle, the ability to increase global debt without the need to increase gold supply reserves made way for an extremely leveraged system.

The aforementioned recent banking and bond market crises serve as mere coughs and sniffles to the underlying disease of debt and leverage that is surfacing despite the mass amounts of ‘fiscal medication’ that central banks are injecting into the sick patient, this being the banking system and bond market. At some point, the disease becomes too strong to mask.

Gold has served as the universal safe haven asset and store of value for thousands of years. The US dollar, the cleanest shirt in the fiat laundry basket, will likely serve as an initial ‘safe-haven’ due to the perception formed by mass conditioning that has occurred for the last 50 or so years. Eventually, the strongest ‘fiat lifeboat’ will reveal its numerous holes.

One could surmise from viewing these recent economic trends, that we are seeing an end of a failing 50-year faith-based fiat experiment. This period is the exception, not the rule, of human history of commerce, although many living do not know of a different reality. With the further revelation of these ' economic faultlines’, we may be seeing a reversion back to the historical ‘mean’ of the necessity for sound money backed by actual tangible hard assets, not faith and trust.

Gold Price Driver BONUS: Buy Low – Take Advantage of Headwinds

Correlation Between Gold Prices and Interest Rates

Ironically, anyone who is interested in buying gold should quietly hope for a stronger dollar in the near term, and the Federal Reserve’s pivot from hiking to cutting interest rates to be delayed. Why? Buy low.

As described by the previous points, the dollar is due to become increasingly inflated due to various reasons, but mainly the Federal Reserve’s return to quantitative easing. This has the effect of keeping gold’s price down, or given recent activity, keeps this asset temporarily ‘range bound’.

It is worth noting, that in the year 2023, practically every possible ‘headwind’ to gold existed: high-interest rates, a ‘stronger dollar’, savings yields returning to bond investments, and a momentum-fueled equity market. Despite all these forces that typically push down the price of gold, the yellow metal made all-time highs and has remained above its new support level of $2,000. This should tell you something.

What Happens to Gold Prices in a Recession?

Another short-term driver that creates a great buying opportunity for gold is the initial onset of a recession coinciding a steep equity market correction or crash.

The prospect of a recession in 2023 seemed imminent but did not surface within the government-reported data. Opinions may vary on this subject depending on one’s ‘lived experience’ during 2023.

Many macroeconomists have pointed to the ‘lag effects’ of the Federal Reserve’s tightening policy being delayed so significantly due to the immense amount of fiscal stimulus that has been injected into the US economy within the past 3 years. This has essentially delayed the ‘felt pain’ of the aggressive rate hikes. Again, many economists differ on this subject.

If a recession is to take place in 2024, accompanied by a large equity market crash, gold is the first commodity to ‘suffer’, but the first to recover. Why is this?

As seen in prior market crashes, panic selling ensues among traders. To cover margin losses within this market's steep downward correction, a general liquidation of anything of value follows. Hence, the mass selling of gold creates liquidity. This drives down the price of gold temporarily.

Then, typically, the flight into a safe haven asset such as the dollar takes place. Nearly simultaneously with this crash, the Federal Reserve will begin cutting interest rates at a rapid pace and as a result, creating inflation, thereby negating ‘real interest rates’ and the beneficial yields that would come from owning bonds.

This, in turn, gives rise to a flight to another safe haven and defensive asset that is not eroding, which is gold. At this stage, gold has already decoupled from the S&P and quickly recovers with the price shooting up as the market further corrects downward with the dollar’s strength weakening as a result of accelerated monetary easing from the US central bank.

This pattern has been observed to various degrees in past market crashes and recessions, more recently the ‘Great Financial Crisis’ of 2008 and the tech market crash of the late 1990s and early 2000s. A new gold bull market emerges as a result. If past is prologue, this is one more price-driver dynamic to pay attention to.

Whether you are in the ‘soft landing’ or ‘hard landing’ camp in terms of economic forecasting for 2024, the best present option for gold investing is to dollar-cost-average into gold while it is at its maximum ‘headwind low’ and range bound to it’s new $2000 support level. The classic investing advice still stands: buy low.

With this in mind, two quotes from the famous Canadian hockey player, Wayne Gretsky, come to mind: ‘I skate to where the puck is going to be, not where it has been’ and ‘You miss 100% of the shots you don't take.’

If you are interested in learning more about gold and its role as a portfolio diversifier, hedge against inflation, protection from counterparty risk, and building generational wealth, see the links provided below.

If you are a serious investor with at least 100K in investment savings looking to take advantage of the most competitive gold prices, see the link below to attend a free gold and silver education web conference held by Augusta Precious Metals.

Find the right company for you. Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com