How Does Inflation Affect Gold and Silver Prices?

It seems we're constantly on a financial rollercoaster, despite our best efforts to stay put in the kiddie rides. Inflation, the invisible thief of your buying power, is often the uninvited guest on this wild ride. But let's turn the spotlight onto something that glitters - gold, and its less glamorous cousin, silver.

Gold and silver, both monetary metals, often become the safe haven investors turn to in the stormy seas of economic uncertainty. Gold, more specifically, has an inverse relationship with debased fiat currencies and increases in value as inflation increases. To gain a better grasp of how inflation affects gold and silver prices, we will discuss the following points:

- Understanding Inflation's Impact on Precious Metals

- Gold as an Inflation-Proof Investment

- Factors Driving Gold Price During Inflation

- Investing Options in Gold and Silver

Understanding Inflation's Impact on Precious Metals

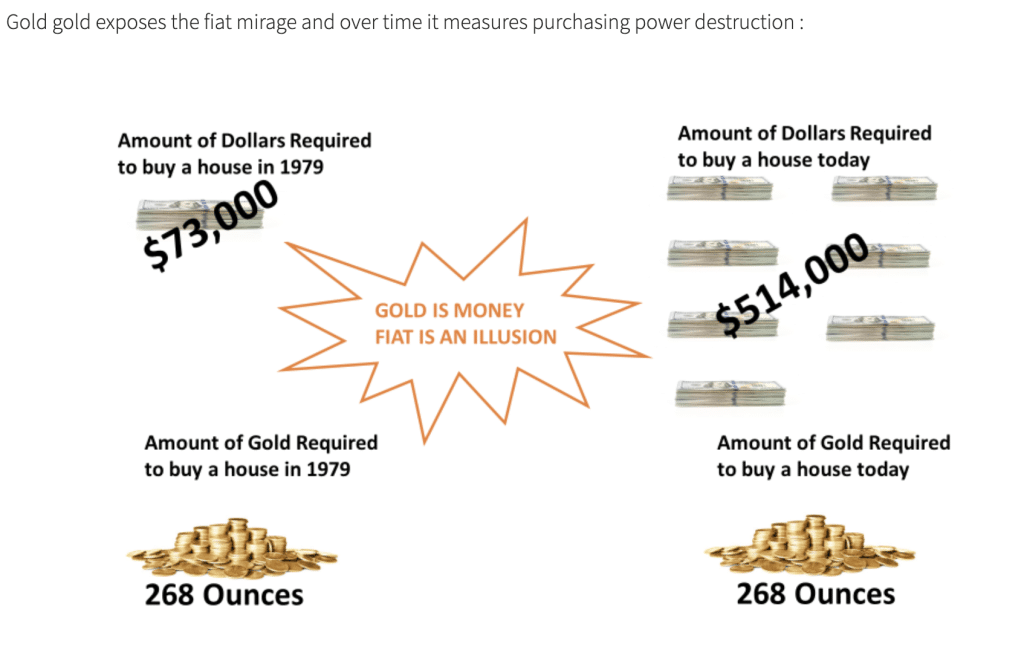

To understand the impact of inflation on precious metals like gold and silver, it's crucial to examine the historical data and market trends that highlight their performance during periods of high inflation. Inflation, essentially, is the continuous rise of prices for goods and services over time, which diminishes the purchasing power of money. When inflation is high, the value of currency drops, and people tend to gravitate towards tangible assets like gold and silver that hold their value.

Historically, during inflationary periods, gold and silver have seen significant price increases. For instance, during the inflationary years of the late 1970s, gold prices skyrocketed. Similarly, when inflation surged in the early 1980s, silver prices followed suit. This pattern is not coincidental. These precious metals are known as 'inflation hedges' for a reason. They have an intrinsic value that doesn't erode in the face of inflation.

Numerous studies have also shown a positive correlation between inflation and gold prices. For example, a study by the World Gold Council found that gold's value tends to rise as the cost of living increases. The same holds true for silver.

Investing in gold and silver during high inflation periods can be a strategic move. It's not just about riding the wave of rising prices. It's about protecting your wealth from the erosive effects of inflation. However, it's important to note that while history offers valuable insights, it can't predict future performance. Always make informed decisions based on careful research and analysis.

Gold as an Inflation-Proof Investment

When considering strategies to safeguard your assets against inflation, you'll find that gold often emerges as a compelling option due to its historical performance and intrinsic value. But why is that the case?

Firstly, gold has consistently demonstrated a strong correlation with inflation. When inflation rises, the price of gold also tends to increase. This is because gold is seen as a store of value, and in times of economic instability, investors often flock to gold as a safe haven. Furthermore, a study conducted by the World Gold Council revealed that gold has not only kept pace with inflation but has often outperformed it.

Secondly, the supply and demand dynamics of gold also play a crucial role. The annual increase in gold supply roughly matches the global economic output's long-term growth. This balance helps maintain gold's value during inflationary periods.

Factors Driving Gold Price During Inflation

Understanding the factors that drive gold prices during inflation requires a deep dive into the dynamics of supply and demand, currency values, and investor behavior. You see, during periods of inflation, the value of money decreases, while the cost of goods and services increases. This scenario can influence gold prices in several ways.

One of the main drivers is the shift in investor's behavior. As inflation rises, you might see investors seeking safety in gold, driving up its demand and, consequently, its price. Gold is often viewed as a store of value, a hedge against inflation, and a safe haven asset.

Another factor is the impact of inflation on currency values. When inflation is high, the value of currency diminishes, leading investors to seek assets that hold their value, like gold.

Moreover, inflation can affect the supply side of gold. High inflation can lead to increased mining costs, which can, in turn, decrease the supply of gold, pushing prices up.

Here are the key factors that influence gold prices during inflation:

- Investor behavior: The shift towards gold as a safe haven asset.

- Currency devaluation: The decrease in currency value prompts investors to seek solid assets.

- High mining costs: Inflation can increase the cost of gold mining, reducing its supply.

- Central bank policies: The actions of central banks can impact gold prices.

- Economic uncertainty: Inflation often comes with economic uncertainty, which can drive up gold prices.

Understanding these factors can help you make informed decisions about investing in gold during times of inflation.

Investing Options in Gold and Silver

Given the factors that influence gold prices during inflation, you might be considering investing in gold and silver as a hedge against economic uncertainty; let's explore the various options available for such investments.

Firstly, you can buy physical gold and silver in the form of coins or bullion. This method offers you direct ownership and control over your investment, and it's not subject to the risks of digital or paper-based assets. However, it also requires secure storage and insurance, which can add to the cost.

Another option is to invest in gold or silver Exchange Traded Funds (ETFs). ETFs track the price of gold or silver and trade on the stock market, providing a convenient way to gain exposure to these metals without having to store them physically. It's crucial, though, to remember that with ETFs, you don't directly own the physical gold or silver.

Gold and silver mining stocks are another investment avenue. These stocks tend to be more volatile than the metals themselves, but they can provide significant returns if the companies perform well.

However, it is worth noting that forms of digital gold, or what could be termed as ‘paper gold’ assets, do open every investor to counterparty risk. Investing in physical gold and precious metals provides more control and less downside risk.

Working with a Suitable and Trusted Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle. Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital

Gold IRAs provide additional advantages to merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Gold IRAs provide additional advantages to merely buying gold from a local dealer. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a gold IRA or owning the physical gold in your place of residence.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist:

Conclusion

So, you've seen how inflation can silently erode your wealth and why gold and silver can act as a hedge against this. The dynamics of their prices during inflation, driven by factors such as real interest rates and supply and demand, offer opportunities for preserving wealth. With various investing options available, from bullion to ETFs, it's clear that understanding these precious metals can be a valuable tool in your financial toolkit.

Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com