Will Gold Prices Keep Increasing

"All that glitters is not gold," they say, but when it comes to the dynamic world of economics, gold often shines brighter than the rest. You might be wondering whether the value of gold will continue its steady climb. It's an intriguing question, especially given the recent volatility in the global market.

Factors such as inflation trends, geopolitical tensions, and supply-demand dynamics all play crucial roles in the consistent increase of the gold price. To better understand the forces that will keep gold prices increasing over the short and long term, we will explore the following:

- Will gold prices rise in 2024

- the gold price forecast for 2024

- What Drives the Price of Gold?

- What Makes Gold so Valuable?

- What Drives Fluctuations in Gold Prices?

But will these forces conspire to push the value of this precious metal even higher? Let's explore this golden opportunity to understand the underpinnings of the gold market and make our speculative forecast.

Will gold prices rise in 2024?

Looking ahead to 2024, it's crucial to analyze the various factors that could potentially influence a rise in gold prices, bearing in mind the historical trends and current economic conditions. Historically, gold prices tend to be lowest in January and spike in February, and significant price drops have been observed in months like March, June, and October. Notably, in April 2023, the price of gold peaked at $2,048 per ounce, just shy of the $2,067 record set in August 2020. Since then, however, it's dropped to $1,857 per ounce, a roughly 9% decrease.

This historical pattern suggests that investing strategically in gold now, while prices are relatively low, could be a wise move. However, remember that gold isn't an income-producing investment; it's a protector against more volatile assets. As such, experts generally recommend keeping gold investments to 10% or less of your portfolio. There are multiple ways to invest in gold, including gold bars, coins, gold IRA, stocks, futures, or ETFs. It's vital to understand your portfolio specifications and explore these different investment types to maximize returns.

Consider, too, the external factors that affect gold prices, such as global economic conditions, interest rates, and geopolitical events. Like any investment, gold prices can be volatile and subject to fluctuations. Therefore, it's essential to carefully assess your risk tolerance and financial goals before allocating a specific percentage of your portfolio to gold. Stay informed and consult with financial advisors to make the most of your gold investments.

The Gold Price Forecast for 2024

Given the myriad of factors shaping the gold market, it's important for you to understand the forecasted trends for 2024. Economic indicators, Federal Reserve policies, geopolitical upheaval, and market demand all come together to paint a complex picture of what we might expect in the coming year.

- Anticipation of Federal Reserve Policy: The anticipation of future Fed decisions, specifically the indication of at least three rate cuts in 2024, is expected to be the main driver behind gold prices. As inflation eases, these cuts should result in falling U.S. real yields, which traditionally boost gold prices.

- Geopolitical Uncertainty: Gold is often seen as a safe-haven asset, meaning that geopolitical uncertainty can drive its price up. With global conflicts and economic instability, there's a good chance this uncertainty could persist into 2024, further augmenting gold's appeal.

- The U.S. Dollar and Interest Rates: As the U.S. dollar weakens and interest rates fall, gold's attractiveness increases. It's worth noting that gold prices surged in late 2023 due to these factors, setting a precedent that may continue in the following year.

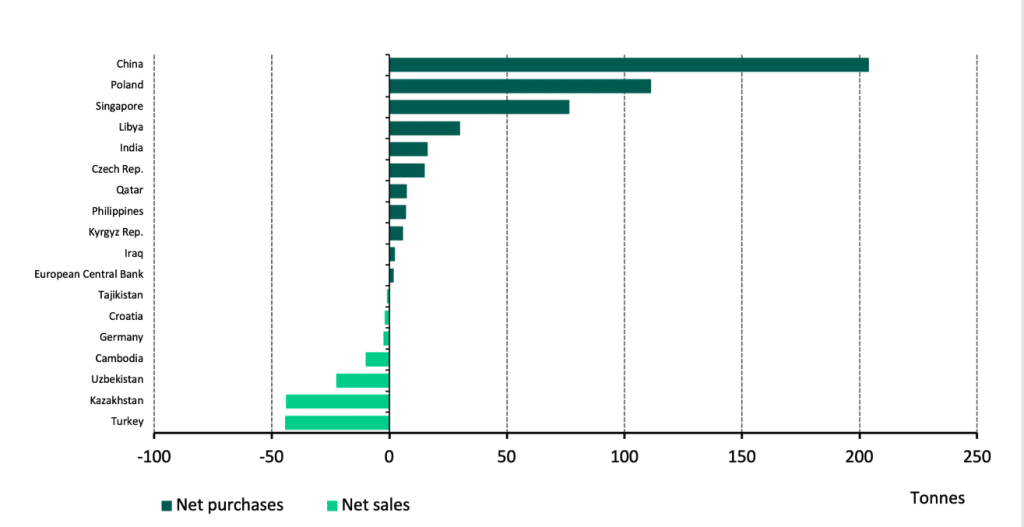

- Market Demand: Central banks and investors are expected to support gold demand in 2024. Banks, led by China, purchased over 800 tonnes of gold in the first three quarters of 2023 and this trend is predicted to continue into 2024.

What Drives the Price of Gold?

You may wonder what factors drive the price of gold. It's not a simple answer; central bank reserves, the value of the U.S. dollar, worldwide jewelry and industrial demand, along with investment as a form of wealth protection all play significant roles. Let's examine how these elements come together to influence gold prices.

Central Bank Reserves

Central banks around the globe play a significant role in driving the price of gold, as they diversify their reserves away from traditional paper currencies and towards the precious metal. When they shift their reserves from paper to gold, the demand for gold rises, pushing up its price. This trend has been observed since the United States abandoned the gold standard in 1971.

Here's a noteworthy pattern:

- Global central banks have been purchasing the most gold in over 50 years.

- There was a slight decline in gold purchases in 2020.

- In 2021, the pace of purchases picked up again and broke the 50-year record in 2022.

- The top gold buyer in 2022 was the central bank of Türkiye, followed by Uzbekistan, India, and Qatar.

Value of the U.S. Dollar

While the central banks' actions significantly impact gold prices, it's also essential to understand the influence of the U.S. dollar's value on gold's market price. The price of gold is inversely related to the U.S. dollar's value, simply because gold is dollar-denominated. When the dollar is strong, gold's price is more controlled. Conversely, when the dollar weakens, you'll find gold prices spiking, driven by increased demand.

You see, gold is often viewed as a safeguard against inflation. As prices rise and the dollar's value falls, so does the cost of gold. If inflation escalates, anticipate a surge in gold prices. So, if you're tracking gold's market price, keep a keen eye on the U.S. dollar's value.

Worldwide Jewelry and Industrial Demand

In addition to the U.S. dollar's value, the worldwide demand for gold in jewelry and industry significantly propels its market price. You see, gold isn't just a precious metal–it's a commodity that's heavily consumed, notably by the jewelry and tech industries. Let's break it down:

- Jewelry accounted for about 44% of gold demand in the first half of 2022, with India, China, and the U.S. being the largest consumers.

- The tech industry accounts for another 7.5% of gold's demand, using it for precision electronics and medical devices.

- The basic theory of supply and demand dictates that as the demand for consumer goods increases, so does the price of gold.

- Therefore, trends in these industries can significantly impact gold prices.

Wealth Protection

Gold's reputation as a reliable wealth protector shines especially bright during times of economic turbulence, attracting a surge of investors seeking to safeguard their assets. You may wonder why this is the case. It's due to gold's enduring value, making it a safe haven during uncertain times. When returns on bonds, equities, and real estate fall, you'll find that the interest in gold investing increases, driving up its price. You can use gold as a hedge against economic events like currency devaluation or inflation. Furthermore, gold provides protection during periods of political instability. So, if you're looking for a way to protect your wealth, investing in gold could be a viable strategy.

Investment Demand

As you consider the protective nature of gold, it's also crucial to understand what drives its price, particularly the impact of investment demand. The price of gold isn't solely based on its historical status; modern investment instruments also play an important role.

Specifically:

- Gold sees substantial demand from exchange-traded funds (ETFs).

- ETFs are securities that hold the metal and issue shares that investors can buy and sell just like stocks.

- One of the largest ETFs is the SPDR Gold Trust (GLD), which held more than 915 tons of gold in January 2023.

- The demand for gold from these ETFs adds to the upward pressure on its price.

In essence, it's not just gold's inherent value that matters, but also how it's traded in today's investment landscape.

Benefits of Working with a Reputable Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle. Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Gold IRAs provide additional advantages to merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one's unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical goldin your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist

What Makes Gold So Valuable?

Understanding the value of gold requires a journey back through the annals of human civilization, where this precious metal has consistently symbolized wealth and power. This isn't merely a historical accident, but rather a result of social construction. You see, the value of gold was agreed upon by societies past, and that agreement has been passed down through generations. This shared belief in the value of gold has been the backbone of its worth, forming a sort of social contract that continues to hold true today.

In addition to the social agreement, gold's inherent qualities contribute to its value. Its durability, for instance, makes it a reliable store of value. Unlike other commodities that can deteriorate or perish over time, gold doesn't rust, tarnish, or decay. This means you can hold onto gold for years, even decades, and it'll still maintain its value.

Furthermore, gold's versatility adds to its value. It's not just a shiny metal that people like to wear as jewelry; it's also a critical component in a variety of technological products. From smartphones to spacecraft, gold's unique properties, including its excellent conductivity and resistance to corrosion, make it indispensable in the modern world.

Best Gold IRA for Low Minimum Investment

What Drives Fluctuations in Gold Prices?

When it comes to fluctuations in gold prices, several key factors come into play, including the strength of the U.S. dollar, inflation rates, central bank activities, and demand for gold in industries such as jewelry and technology.

- The Strength of the U.S. Dollar: Gold is typically priced in U.S. dollars. So, when the dollar is strong, you'll need fewer dollars to buy gold, which lowers the gold price. Conversely, when the dollar is weak, you'll need more dollars to buy gold, pushing the price up.

- Inflation Rates: Gold often serves as a hedge against inflation. In times of inflation, the relative purchasing power of currency drops, so you'd turn to gold. As inflation increases, so does the price of gold.

- Central Bank Activities: Central banks hold gold and their activities can influence its price. When a central bank, like the Federal Reserve, increases its gold reserves, the price tends to rise.

- Industrial Demand: Gold isn't just for jewelry and coins; it's also used in industries like technology and dentistry. As demand for these products increases, so does the demand for gold, pushing up its price.

Central Banks are Acquiring more Gold.

Building on the trend of de-dollarization, central banks around the globe are stepping up their gold acquisitions. This shift is largely a response to the diminishing purchasing power of their dollar reserves, a consequence of the Federal Reserve's mass issuance of new dollars. You see, by amassing gold, these institutions are tactically positioning themselves to counteract potential losses.

Take a closer look at Asia, the Middle East, and Russia. These regions are experiencing a rapid decline in the purchasing power of their dollar reserves. To mitigate this, they're making strategic moves to amass significant quantities of gold. India, Russia, and China, in particular, are buying gold at an unprecedented pace, disrupting the balance of power between East and West.

This trend isn't just about hedging against inflation or economic instability. It's a calculated move to diversify reserves and reduce reliance on the dollar. Central banks are essentially turning back to the historical money status of gold, both as a form of diversification and a hedge against potential crises.

The trend is clear: central banks are no longer selling gold, they're buying it. They're reducing the supply on the markets, effectively driving up the demand and price of gold. This is an important factor for investors to consider when contemplating gold as an investment.

Conclusion

In conclusion, gold prices may continue to rise in 2024, driven by factors like inflation, demand, and geopolitical turmoil. Remember, gold's inherent value stems from its rarity and universal acceptance. However, fluctuations can occur, influenced by economic conditions, market sentiment, and mine production. It's vital to keep an eye on these factors, analyze them carefully, and make objective decisions about your gold investments.

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Take Advantage of the Best Prices. Attend a Free Gold Investment Webinar for Investors with 100k or More to Protect

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com