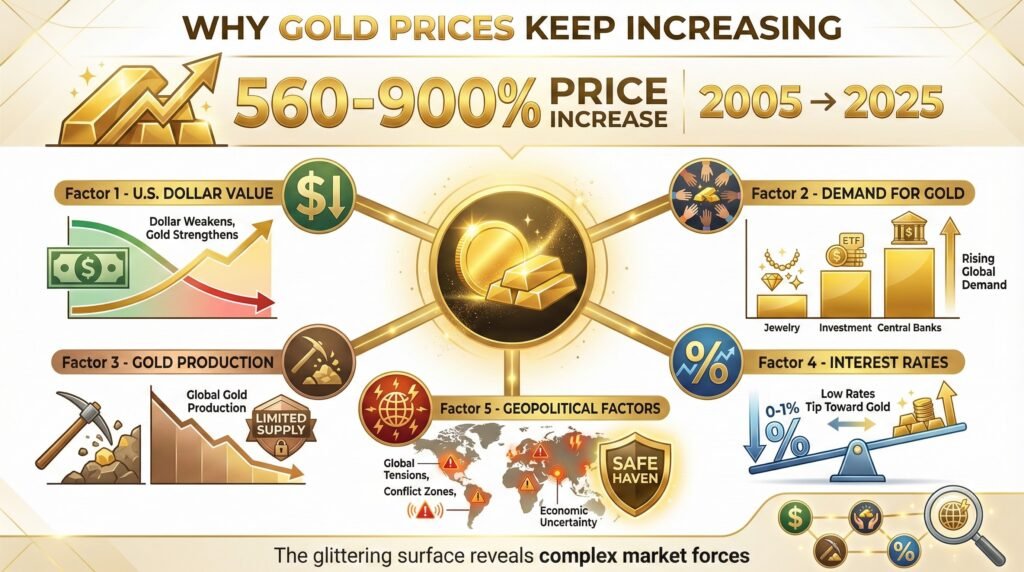

Why Gold Prices Keep Increasing

Did you know that gold prices have soared from roughly 560% to over 900% total increase in the last 20 years? You might be wondering why this precious metal keeps getting pricier. It’s not as simple as you might think.

The fluctuating value of the U.S. dollar, shifting demand for gold, changes in gold production, interest rates, and even geopolitical factors all play a role in this complex equation. To gain a full understanding of why gold prices keep increasing, we discuss:

- Value of the U.S. dollar

- Demand for gold

- Gold production

- Interest rates

- Geopolitical factors

Ready to dig a little deeper? There’s a fascinating world behind the glittering surface of gold prices, and you’re just a step away from unraveling it.

Value of the U.S. dollar

While you might not immediately connect the two, the value of the U.S. dollar plays a crucial role in determining gold prices, as they often move inversely to each other, meaning when the dollar strengthens, gold prices typically drop, and vice versa. This inverse relationship between the dollar and gold is primarily due to global economic dynamics.

When the dollar is strong, it means the economy is doing well, making riskier assets more attractive. Consequently, gold, often viewed as a safe haven during economic turbulence, tends to lose its appeal, causing its price to decrease.

However, when the economy is turbulent and the dollar weakens, you’ll find that investors flock to gold. This is because gold is a tangible asset that has held its value throughout history, providing a sense of security when fiat currencies like the dollar falter. Therefore, during economic downturns, gold prices usually rise as demand for this safe haven asset increases.

Predicting future gold prices involves carefully monitoring the dollar’s performance. If you anticipate that the dollar will weaken due to economic or geopolitical factors, gold prices will likely rise. Conversely, if you foresee a strong economy with a robust dollar, you might expect a dip in gold prices.

Gold is a valuable commodity and needs to be authenticated and sourced transparently. A long-established and trusted gold investment company can guide in navigating the present markets and assist in investment timing.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download Birch Gold Group’s free gold IRA guide to make sure you are aware of all aspects of the gold IRA process:

Demand for Gold

You’ll find that the demand for gold is multifaceted. Jewelry-driven demand is a significant factor, accounting for a large portion of the physical gold demand globally. But don’t overlook the impact of gold exchange-traded funds (ETFs) and industrial applications, both of which contribute to the rising demand and, subsequently, the increasing prices.

Jewelry-driven demand

When you think of purchasing gold, jewelry often comes to mind first; it’s a popular form, but its impact on gold prices may surprise you. Jewelry, despite its visibility, is often a weaker driver of gold prices. Here’s why: many people buy jewelry and keep it for years, even decades.

This long-term holding pattern means less gold re-enters the market, thus not significantly affecting supply-demand dynamics. However, a surge in jewelry purchases – especially in large gold-consuming nations like India and China – can push up gold prices.

Predicting these buying trends is tricky, but it’s crucial for understanding gold price movements. So, while you’re admiring that gold necklace, remember that it’s part of a complex, global market.

Demand from gold exchange-traded funds (ETFs)

Beyond the jewelry market’s influence on gold prices, another crucial factor comes into play: the demand from gold exchange-traded funds (ETFs). You might already understand the concept of ETFs if you’re familiar with stock buying. Gold ETFs invest in gold bullion or gold-mining companies, combining the broad industry exposure and stability of gold.

When more people invest in gold ETFs, demand rises, driving up the price of this precious metal. It’s a direct correlation – as the interest in these ETFs grows, you’ll likely see a parallel rise in gold prices. This trend doesn’t show signs of slowing down. So, keep a keen eye on the gold ETF market. It’s a key player in the ongoing tale of increasing gold prices.

Demand for industrial applications

Let’s shift our focus to the industrial realm, where the demand for gold is significantly influenced by its diverse applications in sectors such as electronics, healthcare, and space exploration.

-

- Electronics: Your favorite gadgets wouldn’t work without gold. It’s used in connectors, switches, and wires due to its excellent conductivity.

- Healthcare: Gold is utilized in diagnostic procedures and therapeutic treatments. An increase in medical innovations boosts gold demand.

- Space Exploration: Gold’s reflective properties protect spacecraft from radiation, pushing the need for gold even higher.

- Production Applications: As industries expand, more gold is needed to produce goods and complete services.

If these sectors surge, you can expect gold prices to follow suit. The correlation between industrial growth and gold value is something you should watch out for.

Benefits of Working with a Reputable Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key. Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and financial setbacks.

Working with a trusted company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Gold IRAs provide advantages over merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a tax-deferred gold IRA or owning the physical gold in your place of residence, make the choice that best suits your needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Gold Production

Often, you’ll find that gold production, a finite resource, is becoming increasingly challenging and costly due to the varying difficulty of prospecting and mining efforts.

The accessibility of this precious metal is dwindling, making the task of extracting it an uphill battle. This is reflected in the plateauing of gold production over the last seven years, a trend that experts suggest could persist.

Furthermore, some predict that gold mining may become unsustainable by 2050, an alarming forecast that amplifies the inherent value of this limited resource. This progressive scarcity is a significant contributor to the rising cost of gold, as decreased supply naturally leads to increased prices.

The dollar value of gold is also connected to the cost of production. When the expense of mining increases, it directly impacts the price of gold. This is because gold miners need to maintain their profitability, and when costs rise, they pass these expenses on to the consumer.

Beyond the immediate economic implications, the environmental footprint of gold mining is also a factor to consider. As the process becomes more challenging, it often also becomes more damaging to the environment, which could lead to stricter regulations and subsequently, higher costs.

Interest Rates

Have you ever considered how interest rates impact the price of gold? Interest rates play a significant role in determining the value of the precious metal. When rates are high, gold’s appeal as a non-interest-bearing asset diminishes, leading to a drop in its price. Conversely, when rates are low, gold becomes a more attractive investment option and its price tends to rise.

Here are four key ways in which interest rates affect gold prices:

-

- Expectations of Central Bank Rate Cuts: If investors anticipate a rate cut, they often flock to gold as a safe-haven asset, pushing up its price.

- Lower Bond Yields: When bond yields are low, gold’s allure increases due to its potential for higher returns, causing its price to spike.

- Negative Interest Rates: In countries where interest rates are negative, gold becomes a more desirable asset, which can result in a surge in its price.

- Inflation Concerns: Gold is often seen as a hedge against inflation. Thus, when interest rates are low and inflation is anticipated, gold’s price can escalate.

Having a means of tracking the price of gold is crucial in order to track the short and long-term progress of your investment.

Calculate the current market value of your gold based on weight, purity, and live market prices. Get instant estimates for selling or buying gold jewelry, coins, or bars.

Access the gold price calculator by clicking the button below and bookmark it for future use:

Gold Price Calculator

Geopolitical Factors

While it’s true that interest rates significantly impact gold prices, another crucial variable to consider is the role of geopolitical factors. Often, when tensions rise and uncertainty prevails, you’ll see an upward movement in gold prices.

This is because gold is perceived as a safe-haven asset, a protective shield for your money in times of conflict. A case in point is the Russia-Ukraine conflict in early 2022, which saw gold prices gain a steady 6%.

Yet, it’s important not to overstate the influence of geopolitical events. Gold is intrinsically linked to the U.S. economy, meaning that overseas conflicts might not exert as much influence on gold prices as domestic turbulence or changes in monetary policy.

You must also be aware of the market adage, “Buy the rumor, sell the news.” It’s not unusual for investors to pile into gold at the first whiff of conflict, only to unload their holdings when the crisis actually unfolds. So, you might see gold prices surge on rumors of war, only to flatline or drop when the conflict becomes a reality.

Conclusion

So, you’re seeing gold prices consistently rise due to a variety of factors. A weaker U.S. dollar boosts gold’s appeal. Growing demand, particularly from investors during uncertain times, sends prices higher.

Limited gold production can’t keep up, further lifting prices. Low interest rates make gold a more attractive investment. Lastly, geopolitical tensions often drive investors to gold as a safe haven. Keep an eye on these factors-they’re key in predicting future gold prices.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect and want to take advantage of the best prices, attend a gold educational webinar hosted by Augusta Precious Metals. Click the button below:

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com