Semi Numismatic Coins

Imagine owning a 1921 Morgan Silver Dollar, one of the many semi-numismatic coins out there. These aren’t just any coins, but a blend of numismatic and bullion value, making them a treasure for collectors and a solid investment.

The value of semi-numismatic coins comes not only from their physical metal content but also from their historical and aesthetic appeal. To gain a full understanding of semi-numismatic coins, we will discuss the following:

- Understanding Semi-Numismatic Coins

- Valuation of Semi-Numismatic Coins

- Impact of Gold Price Fluctuation

- Market Behavior and Price Attachment

- Premium Dynamics in the Coin Market

Wondering how gold price fluctuations influence these coins or what sets their premiums apart from regular bullion coins? Let’s unravel this intriguing aspect of coin collecting and investing together.

Understanding Semi-Numismatic Coins

Diving into the world of numismatics, it’s essential to understand that semi-numismatic coins are a unique blend of bullion and collectible coins that derive their value from both their metal content and their appeal to collectors.

These coins are a midway point between bullion coins, which are valued primarily for their precious metal content, and numismatic coins, which are valued based on their rarity, condition, and historical significance.

What sets semi-numismatic coins apart is their dual nature. They’re minted with a specific weight in precious metals, typically gold or silver, which provides a baseline value. Yet, unlike standard bullion coins, they also possess attributes that appeal to collectors, such as design, rarity, and historical significance.

This means they can carry a premium above their intrinsic metal worth, though not as high as fully numismatic coins.

Examples of semi-numismatic coins include popular series like the American Gold and Silver Eagles, Canadian Maple Leafs, Australian Kookaburras, and Chinese Pandas. These coins are minted by various countries and are not just treasured for their metal content, but also for their unique designs.

Valuation of Semi-Numismatic Coins

While understanding the distinct nature of semi-numismatic coins is crucial, it’s equally important to grasp how their value is determined. As a collector or investor, you must consider several factors that influence the value of these coins.

Firstly, the intrinsic value of the metal plays a key role. Semi-numismatic coins are typically minted in gold or silver, and their intrinsic value is derived from the weight and purity of the metal.

Secondly, the condition of the coin is pivotal. As with all collectibles, the better the condition, the higher the value. Coins in excellent condition, also known as ‘mint’ or ‘near mint’, will fetch a higher price than those in poor condition.

Thirdly, the rarity of the coin can significantly impact its value. Coins that are rare due to limited mintage or historical circumstances are highly sought after and command higher prices.

- Rarity

- Condition

- Intrinsic Value

- Historical significance

- Demand

In addition to these, historical significance and demand are also important considerations. Coins with historical significance often have a higher value due to their connection to significant events or figures.

Lastly, like any market, the law of supply and demand applies. If a particular coin is in high demand but short supply, its value will increase.

Impact of Gold Price Fluctuation

How does the fluctuation in gold prices impact the value of your semi-numismatic coins? Primarily, it affects the bullion value component of the coin. Yet, it’s important to remember that semi-numismatic coins hold a value that’s split between their intrinsic bullion worth and their numismatic or collector’s value.

When gold prices rise or fall, the bullion part of your coin’s value sees a direct impact. For instance, if gold prices increase by 10%, then the bullion value of your semi-numismatic coin increases by the same percentage. This is because the bullion value is directly linked to the current price of gold.

However, the fluctuation in gold prices doesn’t have the same direct impact on the numismatic value. This part of the coin’s worth is driven by factors such as rarity, condition, and demand among collectors.

While a rising gold price can increase interest in gold coins and potentially boost their numismatic value, it’s not a guaranteed effect.

In essence, the overall value of your semi-numismatic coins is influenced by gold price movements, but it’s also subject to the dynamics of the collector’s market.

As an investor or collector, you must keep a close eye on both these aspects. This will help you better understand the true worth of your semi-numismatic coins and make more informed decisions when buying or selling.

Benefits of Working with a Reputable Gold Investment Company

When starting on the path of gold investing, working with a credible and trustworthy precious metals vendor is key.

Finding an established gold investment company that understands the many vacillations of the gold markets and the numerous variables affecting its price will save much time and hassle.

Working with a reputable company with institutional knowledge can assist you with logical price entry points, positioning, and dollar-cost-averaging so you can maximize your investment capital.

Gold IRAs provide additional advantages over merely buying gold from a local dealer. Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Choosing the right gold IRA company will depend on one’s unique investing needs.

Depending on whether you are a high-net-worth investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a tax-deferred gold IRA or owning the physical gold in your place of residence, make the choice that best suits your needs.

In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Augusta Precious Metals’ free gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Market Behavior and Price Attachment

In the world of numismatic coins, market behavior and your emotional attachment to a coin can significantly influence its premium. Your perception of a coin’s worth, driven by personal sentiment or historical interest, might compel you to pay an extra premium. This emotional price attachment is a key driver behind the coin’s market valuation.

Understanding market behavior in the numismatic world is crucial. Markets can be unpredictable, swaying with global economic trends, public sentiment, and the rarity of the coin. Here’s how these aspects can impact the price:

Global economic trends: In times of economic stability, numismatic coins might see a surge in value. Conversely, during economic downturns, these coins can experience a dip in premium.

Public sentiment: Public perception and interest in a certain coin can drive its price up. This is often shaped by factors such as historical significance, rarity, and aesthetic appeal.

Rarity of the coin: The scarcer the coin, the higher its value. Rarity can be a result of low mintage, historical events, or unique errors during minting.

Condition of the coin: The physical condition of a coin greatly influences its value. Coins in pristine condition are often more sought after, raising their premiums.

Demand and supply: Like any other market, the law of demand and supply applies. High demand coupled with limited supply can lead to an increase in coin premiums.

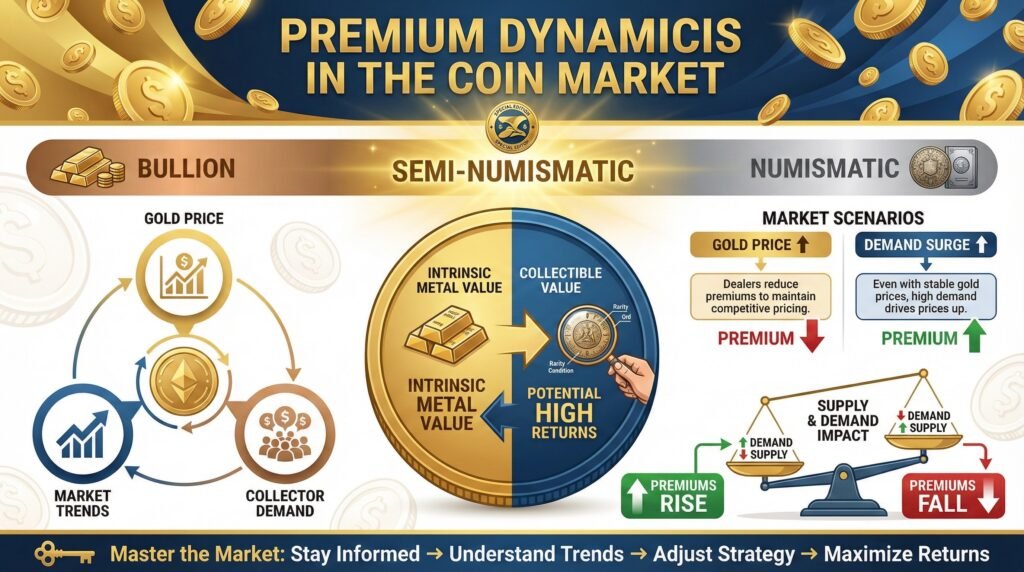

Premium Dynamics in the Coin Market

Understanding the dynamics of premiums in the coin market can significantly impact your investment strategy and potential returns.

The premiums on semi-numismatic coins are an essential component of their value, lying somewhere between bullion and numismatic coins. These premiums fluctuate based on numerous factors, including the gold price, market trends, and collector demand.

When buying a semi-numismatic coin, you’re investing not only in the intrinsic precious metal value but also in the collectible market.

This dual investment offers potential for significant returns, yet it’s crucial to understand the factors influencing the premium. The premium can lag behind changes in the gold price due to market participants’ emotional attachment, affecting its stability.

Moreover, market behavior significantly impacts the response to gold price changes. For instance, when the gold price increases, dealers may reduce premiums to sell their stock, thereby decreasing the overall premium. Conversely, a surge in demand for a particular coin series may inflate premiums, even if the gold price remains stable.

Finally, remember that demand and supply play a pivotal role in determining premium levels.

An increase in demand or a decrease in supply can lead to higher premiums, offering investment opportunities. Conversely, lower demand or increased supply can push premiums down, potentially impacting your investment negatively.

Mastering the dynamics of premiums in the coin market requires informed decisions and a keen understanding of market trends. Keep abreast of changes in the market and adjust your investment strategy accordingly to maximize your returns.

Conclusion

In conclusion, semi-numismatic coins are a unique blend of numismatic and bullion value, making them a worthwhile investment. Factors like gold price fluctuations and market behavior influence their value.

Understanding these dynamics can help you get the most out of your collection. Whether you’re a seasoned collector or new to the game, the world of semi-numismatic coins offers a fascinating and rewarding journey. So, why wait? Dive in and explore the potential of these captivating coins.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

Take Advantage of the Best Prices. Attend a Gold Investment Webinar for Investors with 100k or More to Protect hosted by Augusta Precious Metals

Find the right company for you. Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com