Gold Price Forecast – Near Term

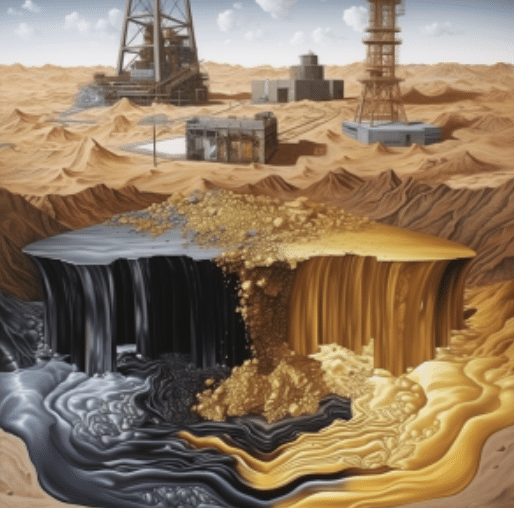

Pondering the potential profits in gold investments? You're not alone. The yellow metal has long lured investors with its reputation as a safe haven in turbulent times, and its price is influenced by a myriad of factors from inflation rates to geopolitical strife.

The near-term price appreciation of gold is quite certain. With the loosening of US central bank policy in the first half of 2024, this will likely begin another cycle of quantitative easing, thereby weakening the US dollar and inversely strengthening the price of gold. Additionally, the possible onset of a delayed recession due to the ‘lags effects’ of the central bank's 2-year tightening policy will also play a role in gold price strength.

To better understand how this near-term gold price forecast would manifest, we will cover the following:

- Factors Influencing Gold Prices 2023-2025

- Gold Prices and Fed Cutting Cycles

- Central Bank Activities and Gold Demand

- Investment Opportunities in Gold

We'll also discuss predictions and trends from leading financial institutions to give you a more comprehensive understanding of where gold might be heading. So, are you ready to unlock the mysteries of the gold market? Let's get started.

Factors Influencing Gold Prices 2023-2025

Diving into the factors influencing gold prices in the period from 2023 to 2025, it's crucial to note that the Federal Reserve's monetary policies, investor sentiment, and geopolitical tensions played significant roles in driving the price movements.

Let's start with the Federal Reserve's monetary policies. When the Fed cut interest rates, it weakened the U.S. dollar, making gold cheaper for investors holding other currencies. This led to increased demand for gold, pushing its price upward. Anticipations of further rate cuts by the Fed in 2024 also contributed to the price rally.

Investor sentiment significantly sways gold prices. During this period, market uncertainties and volatility drove investors to consider gold as a 'safe haven' asset. As a result, the demand for gold surged, leading to a rise in its price. This investor behavior was also fueled by decreasing U.S. real yields, making gold a more attractive investment option.

Geopolitical tensions also played a crucial role in impacting gold prices. Heightened global conflicts sparked fear among investors, leading to an increased demand for gold. This was evident in the late 2023 surge in gold prices, triggered by central bank purchasing and investor concerns over geopolitical conflicts.

Gold Prices and Fed Cutting Cycles

Looking at the performance of gold prices in relation to the Federal Reserve's cutting cycles, it's clear that these monetary policy decisions have a significant impact on the trajectory of gold prices. When the Fed cuts rates, it often signals a weakening economy, which can increase the allure of gold as a safe-haven investment.

Here are some key points to consider:

- The Fed's cutting cycles commonly coincide with periods of economic uncertainty and volatility. This can lead to a rise in the demand for gold, driving up prices.

- Gold has traditionally been viewed as a hedge against inflation. So when the Fed cuts rates to stimulate the economy, this can lead to inflationary pressures, further boosting the appeal of gold.

- The value of the U.S. dollar often weakens when the Fed cuts rates. Since gold is priced in dollars, a weaker dollar can make gold cheaper for investors holding other currencies, thereby increasing demand and pushing up prices.

- Finally, low-interest rates reduce the opportunity cost of holding non-yielding bullion, making gold more attractive to investors.

Predicted Gold Prices for 2024-2025

After examining how the Fed's cutting cycles influence gold prices, let's now shift our focus to the projected gold prices for 2024-2025. As you may know, gold prices fluctuate due to various factors, including the U.S. dollar's strength, inflation rates, and geopolitical uncertainties.

Forecasts suggest that in 2024, gold prices are likely to experience a dip before rising to new highs later in 2025. The peak is projected to reach approximately $2,300/oz. This increase is largely due to expected Federal Reserve rate cuts and a weaker U.S. dollar, both of which traditionally bolster gold's appeal.

As we move into 2025, you might see an upward trend in gold prices. Economic uncertainties and geopolitical tensions are anticipated to escalate, making gold an attractive safe-haven asset. The anticipation of future Fed policy changes could also fuel this rally.

The expectation for 2025 is that gold prices will average higher than in 2024. This is attributed to falling U.S. real yields and the Fed's cutting cycle, both of which historically drive gold prices to new nominal highs.

Making price predictions can be quite challenging. A note, the previous version of this article published in November 2023, estimated the peak gold price in 2025 at $2,300. If you are reading this today, you are quite aware that gold surpassed this mark in early 2024. Given these dynamics, it is best to stay updated on the various macroeconomic trends feeding into this market to find a suitable entry price into gold. This is where a dedicated gold investment advisor becomes all the more critical.

Choosing a Suitable and Trusted Gold Investment Company to Work With

Finding the right gold investment company can be daunting and requires time and resources. A gold IRA is a means of owning physical gold and ensuring your precious metals are safely secured.

Choosing the right gold IRA company will depend on one's unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist

Central Bank Activities and Gold Demand

Central banks play a crucial role in shaping the gold market, with their buying activities significantly impacting gold demand and prices. As arbiters of monetary policy, their decisions often sway the gold market, either through direct purchases or by creating an environment conducive to gold investment.

To understand this interplay, you need to consider the following:

- Central Bank Gold Reserves:Central banks hold gold as part of their reserves, creating a steady demand. When they increase their reserves, they often purchase more gold, pushing prices up.

- Monetary Policy:Central banks' decisions on interest rates can influence gold prices. Lower rates make non-yielding gold more attractive, increasing demand and prices.

- Currency Value:When central banks print more money, it can lead to inflation and a weaker currency. Gold, seen as a safe haven, can then become more appealing, pushing up demand and prices.

- Market Confidence:Central banks' actions can influence market sentiment. If they're seen as managing economic challenges effectively, confidence can increase, reducing gold's appeal. But if confidence drops, gold demand can rise.

In recent years, central banks, particularly those in emerging economies, have been net buyers of gold. This has helped to underpin demand. Additionally, in the face of economic uncertainty and low or negative interest rates, many central banks have turned to gold, further driving up demand and prices.

Investment Opportunities in Gold

As an investor, you have numerous opportunities to delve into the gold market, each offering unique benefits and potential risks. The most direct way to invest is by buying physical gold. This can be in the form of bars or coins. They're tangible, portable, and have no credit risk, making them a popular choice for many.

Alternatively, you can invest in gold-based Exchange Traded Funds (ETFs). These allow you to have indirect ownership of gold, without needing to physically store it. They're highly liquid, easy to buy and sell, and track the price of gold closely. However, they come with management fees and don't offer the same sense of ownership as physical gold.

Gold mining stocks are another option. These are shares in companies that mine gold. They can offer high returns if the company is successful, but they're also more volatile and subject to company-specific risks.

Lastly, gold futures contracts allow you to buy or sell gold at a set price in the future. They're a way to hedge against price fluctuations, but they can be complex and risky.

When deciding which investment opportunity is right for you, consider your financial goals, risk tolerance, and investment timeline. Each option has its pros and cons, and what works well for one investor might not work well for another. It's always a good idea to do your research and, if needed, consult with a financial advisor. Whatever you choose, gold can be a valuable addition to your investment portfolio.

However, forms of digital gold, or what could be termed as ‘paper gold’ assets, do open every investor to counterparty risk. Investing in physical gold and precious metals provides more control and less on the downside liability side. Finding a reputable gold investment company that studies and actively monitors the present economic cycles, central bank policy changes, and the movements of the markets as well as providing fundamental and technical analysis can eliminate a great deal of the guesswork and risk.

Furthermore, these companies can provide serious gold investors access to competitive prices, transparency, a sound buyback policy, reliable customer service, and robust security protection of their precious metal investments.

Conclusion

In conclusion, your gold investments' future hinges on various factors. Fed's monetary policy, inflation, geopolitical stress, and central bank activities all play a part. Predictions suggest a robust market in 2024-2025. It's crucial to stay informed and make calculated decisions. Remember, investing in gold isn't just about immediate returns; it's a long-term strategy. So, keep a close eye on these influencing elements and seize the golden opportunities that come your way.

Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com