Gold Price Forecast 2050

You're eyeing gold as an investment, but not sure what the future holds. Don't worry, we've got you covered.

This article offers a detailed forecast of gold prices up to 2050. You'll learn about key factors that could sway prices and discover various investment strategies.

Forecasting the price of gold, or any commodity, for the next two decades can be a challenge. Gold prices will vary depending on a number of factors, such as the increase in the money supply, rate of inflation, strength of the US dollar, central bank interest rates, global economic conditions, and public and private debt. To gain a better knowledge of gold and it’s future price in the coming decades we need to understand the following:

- Benefits of Investing in Gold

- Gold Price Forecast

- Ways to Invest in Gold

- Gold Price Development

- Gold Price Predictions and Analysis

- Trading With a Regulated Broker

- Risks and Concerns Related to Gold Investment

Whether you're a seasoned investor or just starting out, we'll help you navigate the golden landscape effectively.

So, ready to shine in the world of gold investments? Let's dive in!

Benefits of Investing in Gold

You're probably wondering why investing in gold is beneficial.

Consider it as a shield against inflation risks, a secure means to save for the future, and a stable asset that's easy to buy and sell.

Not to mention, it doesn't require much upkeep, and its price stability is an added advantage.

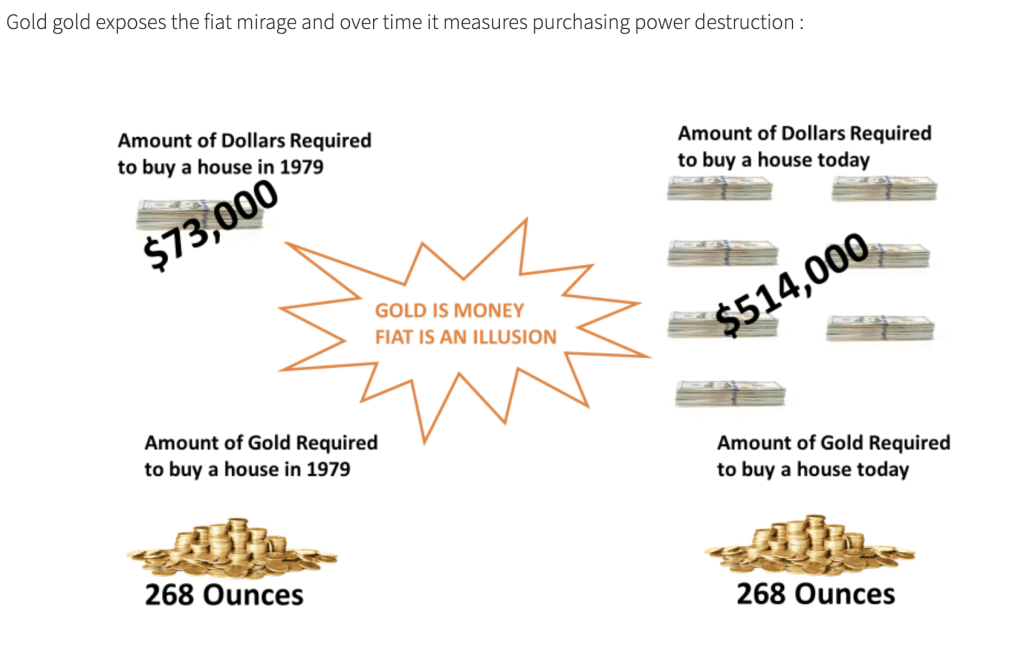

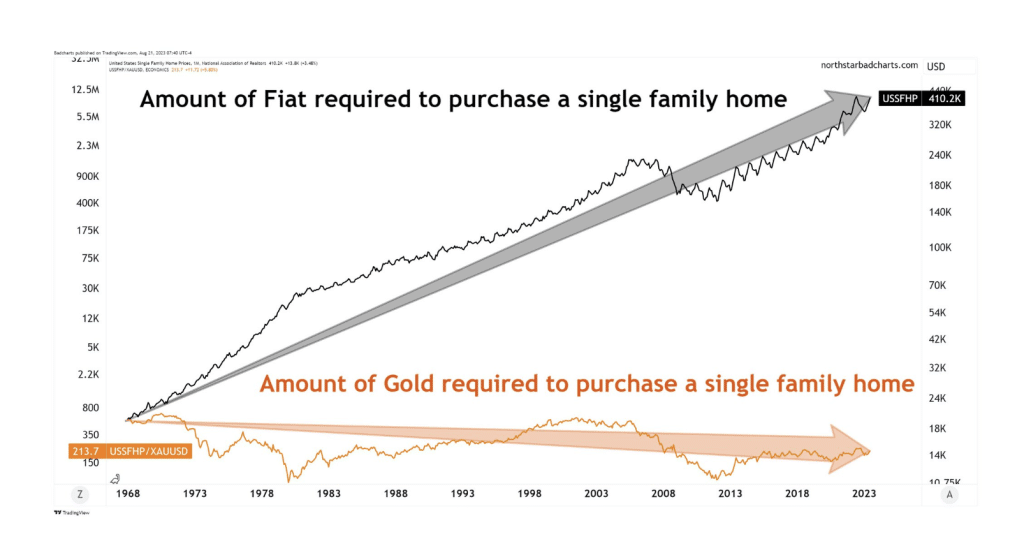

Gold Can Protect Against Inflation Risks

Investing in gold can shield you from the risks of inflation. When you let your money sit idle, it loses value due to the rising prices of goods and services. However, gold's value tends to rise over time, outperforming the inflation rate. This makes gold a safe and smart investment.

You can easily track gold prices online and start investing systematically. This isn't just a strategy for the wealthy; it's a favorite of millions worldwide. You'll never regret putting your money in gold. It's a tangible asset that not only appreciates but also offers quick liquidity and various financing facilities.

A Good Way to Save Money for the Future

When it comes to safeguarding your future financially, investing in gold can be a smart move. Unlike other investments like real estate, gold allows you to invest small amounts.

Buying physical gold, especially gold coins from banks, guarantees quality and secures your money for the future. Sure, you'll pay slightly more than the market rate, but the authenticity certificate you get is worth it. Always check current gold rates in major cities before buying. Don't forget to verify the quality and the seller's buy-back policy.

While banks don't buy back gold, they can offer loans against it. So, investing in gold isn't just a solid way to save for the future, but it can also serve as a financial safety net if needed.

Gold is Highly Liquid

Consider the ease of buying and selling gold in the market, another compelling reason to invest in this precious metal.

You can conveniently purchase gold from trusted jewelers or even banks, assuring you of its quality. They'll provide a guarantee certificate and proper receipts, securing your investment.

Monitoring the gold price from reliable sources allows you to buy at the right time.

Selling gold is just as easy. Local jewelers or traders are always ready to buy, providing immediate liquidity.

If you're not keen on selling, pledging gold for a loan is another option. The constant demand for gold guarantees that your investment is easily convertible to cash when needed.

Truly, gold is a practical and beneficial investment.

Does Not Require Much Maintenance

One of the major advantages you'll find with gold is that it doesn't demand much upkeep. Unlike property investments, which require regular maintenance, gold can be securely stored for an indefinite period without much effort. You don't need to worry about repairs, renovations, or any sort of maintenance.

This ease of storage makes investing in gold particularly appealing if you're time-poor or seeking a fuss-free investment. Moreover, gold's enduring value means it can sit in your locker for years, potentially appreciating without any intervention from you.

However, remember to stay updated with the latest gold rates before making a purchase. So, if you're looking for an investment that doesn't require much maintenance, gold could be just the ticket.

Price Stability is an Added Advantage

Despite the low maintenance advantage of gold that you've learned about, another significant benefit you'll find is its price stability, especially in comparison to other investment options. This stability is a safe haven for investors during financial crises, unlike the equity market where stock prices can plummet to zero.

Gold always holds its value. It's a fact that's been proven over centuries, making it a favored choice for investors. You can track the gold rate today and over many days to understand its minimal price fluctuations. Looking at the historical price of gold, you'll find it has remained stable, even during global financial crises.

Builds Generational Wealth

As a gold investor, you'll find it's an asset that can be effortlessly passed on to your future generations, preserving wealth for years to come. This practice is deeply rooted in tradition, commonly seen when gold ornaments are gifted during pivotal life events like weddings.

Investing in gold allows you to safeguard your money for future needs and can be a significant part of your asset distribution to your children. Its value remains stable, unaffected by the passing of time, and it can be easily exchanged or sold at its current market value. Always stay updated on gold prices in your region to ensure you're aware of its worth.

Investing in gold isn't just about securing your future, it's also about creating a legacy.

Best Supplement to the Stock Market and Real Estate Investment

Investing in gold can be your safety net when stock market and real estate investments take a downturn, providing a stable and reliable asset to balance your portfolio. Unlike these fluctuating markets, gold rates won't plummet drastically, safeguarding your investment in the long run.

This precious metal isn't just an excellent diversification strategy, it's also a tangible asset you can use in various forms, like ornaments. As gold prices are projected to reach $6,000 per troy ounce or more by 2050, your investment could potentially offer substantial returns.

Plus, gold acts as a hedge against inflation and global uncertainties, making it a truly valuable addition to your financial plan. Don't put all your eggs in one basket; let gold be your financial safety net.

Gold Price Forecast

Now, let's turn our attention to the gold price forecast.

You might be wondering, what're the technical analyses predicting for the future of gold prices?

Well, we're about to explore that, offering insights into the potential trends and fluctuations that could shape the gold market by 2050.

Gold Market Technical Analysis

In this section, you'll delve into the technical analysis of the gold market, understanding the factors that could influence the predicted price of gold reaching $6,000 per troy ounce or more by 2050. Currently, the market is experiencing choppy volatility, with a significant resistance point at $2,000.

Breaking above this could indicate bullish pressure. However, a drop below could lead to a decrease to around $1,950.

Keep an eye on interest rates and the US dollar as they can greatly impact gold prices. The market is also influenced by geopolitical issues and news from the Middle East.

Ways to Invest in Gold

You're likely wondering how to start investing in gold. Well, there are several methods, from buying physical gold to purchasing gold mining stocks.

Let's explore these options and find one that works best for you.

Purchasing Physical Gold

When considering ways to invest in gold, you'll find that purchasing physical gold is one of the most straightforward methods. Buying gold bullion, which is investment-grade gold in the form of bars, ingots, or coins, is a common route. Always buy from reputable sellers and remember that physical gold requires safe storage and insurance.

Alternatively, investing in gold jewelry offers exposure to gold but includes costs beyond the gold content, such as craftsmanship and branding. This isn't the same as a pure gold investment. Always verify the authenticity of your gold, as unethical sellers may use deceptive practices.

Lastly, remember that gold prices fluctuate based on market forces, so the value of your investment won't remain constant.

Gold as a Commodity-Linked Structured Investment

Considering gold as a Commodity-Linked Structured Investment offers you a dynamic approach to diversify your portfolio. This method involves agreeing on an investment duration, base currency, and a Target Conversion Rate (TCR) with your bank or broker.

At the investment's end, you'll get your principal and coupon in either gold (XAU) or the base currency. If gold appreciates against the base currency, you're repaid in that currency. But if gold falls below the TCR, your investment converts and you're repaid in gold.

This approach can yield higher interest than holding onto US dollars, for example. It's perfect if you don't mind being paid in gold, which you can then hold, sell, or reinvest.

Investing in gold ETFs or Gold Unit Trusts

After diversifying your portfolio with Commodity-Linked Structured Investments, you can further expand your investment strategies by investing in gold ETFs or gold unit trusts.

Gold ETFs are funds that hold a range of gold-backed assets. They're easy to trade, more affordable for beginners, and offer liquidity.

Gold unit trusts, on the other hand, are more actively managed, with professionals handling the buying and selling of gold-related assets.

Both options incur management fees, with ETFs generally being slightly cheaper. They can be conveniently purchased through a bank or licensed broker.

Before investing, it's crucial to review the companies behind the funds and consult a financial advisor to understand the prospectus and expense ratio.

Investing in Gold Mining Stocks

Your investment portfolio's diversity can be significantly enhanced by adding gold mining stocks, which offer a unique set of benefits and risks. Instead of buying gold directly, you're investing in companies mining it. Their stocks should rise as gold prices increase, boosting the value of the company's gold inventory.

However, miners' efficiency in extracting gold at a lower cost can fluctuate due to management quality, adding an element of risk. Other risk factors include company debt and potential environmental or legal issues.

In a falling gold price scenario, these companies can cut spending to maintain profitability. Unlike most gold ETFs or physical gold, they may also offer dividends

Choosing a Suitable and Trusted Gold Investment Company to Work With

Finding the right gold investment company can be daunting and requires time and resources. A gold IRA is a means of owning physical gold and ensuring your precious metals are safely secured.

Choosing the right gold IRA company will depend on one's unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist:

Gold Price Development

Let's now turn our attention to the development of gold prices.

You might be curious about the gold price forecast for 2023 and beyond, as well as the key factors driving these prices.

We're about to explore these points in the following discussion.

Gold Price Forecast for 2023 and Beyond

In the wake of today's economic landscape, it's your understanding of gold's price development for 2023 and beyond that could secure your financial stability.

ANZ Research predicts gold trading at $2,100 by late 2023, peaking at $2,200 in September 2024. They cite US banking issues, high interest rates, and debt ceiling uncertainty as key drivers behind this surge, along with central banks' gold purchases and India's monsoon season.

TradingEconomics forecasts a slightly lower figure, expecting gold to trade at $2,041 by the end of the current quarter, rising to $2,120.72 in a year's time. These predictions, while not extending to 2030 or 2050, reflect the growing confidence in gold's enduring value in times of financial uncertainty.

What are Gold's Key Price Drivers?

Understanding the key price drivers of gold is crucial for making informed investment decisions. These drivers revolve around supply and demand forces, with a few unique twists. When inflation rises, you'll often see gold's price climb, as investors flock to this 'safe-haven' asset. Central banks' monetary policies aimed at controlling inflation also significantly affect gold's price.

Bear in mind the relationship gold shares with the US dollar. As the greenback strengthens, gold becomes pricier, reducing demand. Conversely, a weaker USD can boost gold's price, making it more affordable for overseas buyers.

Don't overlook gold's cultural significance, especially in China and India where it's used extensively for jewelry during festivals and weddings. Global economic uncertainty also fuels gold's price, making it a key asset during unstable times.

Gold Price Predictions and Analysis

Now, let's delve into the analysis and predictions of gold prices, providing you with a clearer picture of what to expect in the future.

According to PAX Gold long-term price predictions, there's a steady rise on the horizon. By 2023, the price could reach up to $2,439.93, marking a significant increase of 21.51% from today's price.

Fast forward to 2040, you might witness a skyrocketing price of $16,275.31, that's a whopping 769% increase from today.

This steady climb is influenced by various factors, including economic trends, global uncertainty, and public opinion.

Remember, these are mere predictions, and actual prices may vary.

Always do your research and consult with a financial advisor before making investment decisions.

Trading With a Regulated Broker

When you're ready to invest in gold, it's crucial that you do so through a regulated broker to ensure your transactions are secure and transparent.

Regulated brokers are supervised by financial authorities, providing you with a safety net in case things go awry. They're obliged to follow strict regulations and maintain high standards of operation. This directly impacts the security of your investment, reducing the risk of fraud.

Regulated brokers also offer transparent pricing, giving you the real picture of what you're buying and its cost. They're required to uphold client privacy and protect your personal information.

You'll also find that they offer a range of investment options, allowing you to diversify your portfolio.

Risks and Concerns Related to Gold Investment

While gold investment is often seen as a safe haven, it's not without its risks. These include:

- Capital at risk: Like any investment, the value of that asset can fluctuate, and if the price goes down, you may lose money on your investment. Fortunately, if you are studying the long-term price of gold for even small length of time, you will clearly see that it has performed very well over the years.

- Price volatility: Gold prices can be highly volatile, meaning they can experience significant fluctuations in a short period of time. This volatility can make it difficult to predict and time your investments in gold effectively. However, compared to other safe haven assets, like Bitcoin, gold is far more stable. Principally, if you are holding gold, you investing long not short. If you are planning on holding gold as speculative investment, it may not be a good fit.

- Counterparty risk: When investing in digital gold(ETFs, Mutual Funds, Futures Contracts, and Sovereign Gold Bonds), you may have to trust there is physical gold backing the paper asset version of the gold investment. This introduces counterparty risk, as there is a chance that the third party could default or go bankrupt, potentially resulting in the loss of your investment.

Let's take a closer look at these potential pitfalls to better understand the challenges you might face when investing in gold.

Capital At Risk

You should be aware that investing in gold also comes with certain risks, notably the market risk where the price of gold could potentially drop during the period you hold it. While investments like Cash ISAs or bank savings accounts offer 'capital protection', gold doesn't guarantee this. Your capital is at risk if you sell your gold at a lower price than you bought it.

Despite this, physical gold assets like coins or bars have an intrinsic value due to gold's rarity, meaning their value will never fall to zero, unlike shares in companies which can become worthless. Therefore, while there's a risk of capital loss, it's limited in comparison to other types of investments.

Owning the physical metal has its advantages when using a trusted gold IRA and custodian. This lowers the counterparty risk innate to owning digital versions of gold. We have provided links at the end of this article to free investment guides from our top four gold IRA and precious metals investment companies that we have personally researched and vetted.

Price Volatility

Don't let the shiny allure of gold blind you to the inherent risks, especially the price volatility that comes with this type of investment. As with any asset, gold's price can rise and fall sharply, posing a market risk. If the price drops below your purchase price, you'll face a capital loss.

However, unlike certain paper assets, the value of physical gold can never plummet to zero. Remember that while gold offers a hedge against inflation and economic uncertainty, it doesn't provide a passive income like dividends from stocks or interest from bonds.

Therefore, it's crucial to balance your portfolio and not solely depend on gold. Do your research and make informed decisions to prudently manage your gold investments.

Counterparty Risk

It's essential to understand that investing in gold isn't without its risks, notably counterparty risk associated with certain forms of gold investments. Unlike physical gold, investments like gold ETFs or gold mining stocks rely on third parties. If these parties falter due to a market crisis or poor performance, your investment value could erode. In a worst-case scenario, your investment could drop to zero.

However, physical gold is immune to counterparty risks. Over the past 20 years, the market price of gold has remained steady, proving it to be an asset class free from counterparty risks. T

Conclusion

So, you're all set to delve into the world of gold investments. Keep in mind the potential ups and downs and stay updated with economic and geopolitical trends.

Whether you're buying bullion, investing in ETFs, or trading futures, ensure you're dealing with a regulated broker. Remember, managing and securing your wealth is key.

Don't overlook the risks, but don't let them deter you either.

Here's to a golden future!

Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com