Gold Price by 2030. A Gold Price Forecast

Gold price by 2030. A gold price forecast. Gold prices have already pierced $4,500 in 2025, and as we look ahead to 2030, the future of gold prices is a topic of significant interest for investors and analysts alike.

Gold price predictions show a gradual rise to $7,000 per ounce by 2030. Various factors, including economic indicators, geopolitical events, and market dynamics, are poised to influence the trajectory of gold’s value in the coming years.

Gold has long been considered a safe-haven asset, especially during times of economic uncertainty. Its historical role as a store of value and a hedge against inflation makes it a focal point for both institutional and retail investors

Current Gold Market Overview

As of the end of 2025, gold has already surpassed $4,500 per ounce, reflecting a more than 60% increase this year alone. This surge is attributed to strong investor sentiment and macroeconomic uncertainties

Notably, before 2025, UBS strategist Joni Teve raised the year-end gold target to $2,900, while Goldman Sachs analysts, led by Lina Thomas, projected a year-end target of $3,100.

However, upward revisions are now warranted since these price predictions have already been exceeded and further underscore the prevailing bullish outlook on gold.

Factors Influencing Gold Prices Leading Up to 2030

Economic Indicators

Gold’s performance is closely tied to various economic factors:

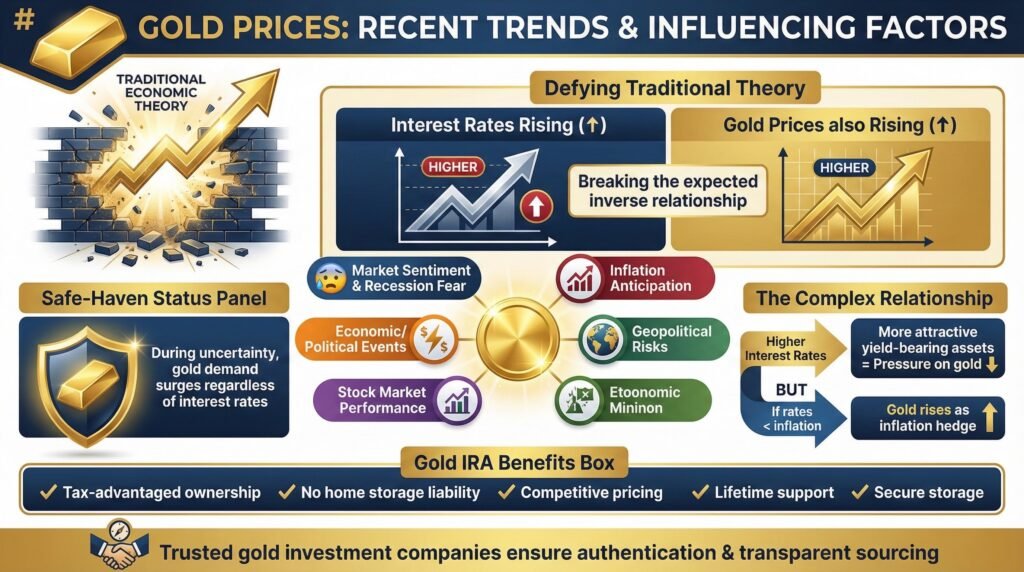

-Inflation Rates: Historically, gold serves as a hedge against inflation. As inflation rises, the purchasing power of fiat currencies diminishes, prompting investors to turn to gold to preserve wealth. Given the rising concerns about global inflation trends, gold is expected to remain an attractive option for wealth preservation.

-Interest Rates: The Federal Reserve’s monetary policy decisions, especially in response to economic conditions, play a pivotal role in this dynamic. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors. Furthermore, Monetary Metals provides the opportunity to earn interest on gold through its gold lease fixed-income products.

-Currency Fluctuations: A weaker U.S. dollar often leads to higher gold prices, as gold becomes more affordable for investors holding other currencies.

Geopolitical Tensions

Global political instability often drives investors toward safe-haven assets like gold:

-Trade Wars and Tariffs: The imposition of tariffs and the potential for global trade wars can create economic uncertainty, boosting demand for gold. For instance, recent U.S. tariffs on steel and aluminum have contributed to gold reaching the $3,000 mark.

-Geopolitical Conflicts: The rise in global tensions can lead to increased gold purchases as investors seek stability amidst uncertainty. The ongoing economic disruptions due to conflicts and global shifts in alliances can significantly affect the valuation of gold.

If you’re concerned about market volatility, securing a portion of your wealth in gold can offer long-term stability. Find out how a tax-advantaged gold IRA can help secure your retirement savings from the aforementioned volatility and uncertainty.

Click the banner below to visit Augusta Precious Metals’ official site to access their free gols IRA checklist and guide.

Central Bank Policies

Central banks significantly influence gold prices through their monetary policies and reserve management:

-Gold Reserves: Many central banks, especially in emerging markets such as the BRICS nations, have been increasing their gold reserves to diversify assets and reduce reliance on the U.S. dollar. This trend supports higher gold prices. If you’re interested in how central banks’ actions affect gold markets, sign up for in-depth research reports from leading financial institutions.

-Monetary Easing: Quantitative easing and other accommodative monetary policies can lead to currency devaluation, making gold a more attractive store of value. Many central banks have increased their gold purchases in response to economic uncertainty, contributing to the sustained demand for gold.

Gold Price Predictions for 2030

Analysts and financial institutions have provided various forecasts for gold prices by 2030:

-IBIS InGold: $7,000 plus

-CoinCodex: $10,000 – 12,300

-BeatMarket: $5,889 – 6,224

-MiningExec (Randy Smallwood): $10,000

If you’re looking to take advantage of these projected price increases, now might be the perfect time to start investing in gold.

Working with a trusted gold investment company that understands the various market forces, inflation, and global economic dynamics can make the gold investing landscape smoother and less stressful.

Gold IRA companies, more specifically, provide a tax-advantaged way of buying and owning gold without the stress of dealing with local or online vendors or the need for security and storage in your own home.

These companies can provide access to competitive prices, price transparency, a reasonable buyback policy, reliable customer service, and security of your precious metals.

Finding the right gold IRA company for your individual needs is critical. For example, if you require a low investment minimum to start a gold IRA, Birch Gold Group or American Hartford Gold would be two choices to consider.

However, if you are a serious high-net-worth investor who can afford a higher minimum to take advantage of the most competitive silver prices and lifetime customer support, then Augusta Precious Metals would be a good fit.

For a highly personalized experience, National Gold Group is a family-owned gold IRA company that offers a low minimum investment, a no-fee buyback policy, and great educational resources for its clients.

Furthermore, Noble Gold Investments provides gold and silver IRAs as well as private investment options for home storage. See the links at the end of this article to find the right gold IRA company that best serves your needs.

To learn more about the advantages of tax-deferred gold IRAs right now, click the banner below to access and download Birch Gold Group’s free gold IRA guide to make sure you are aware of all aspects of the gold IRA process:

Best Gold IRA for Low Minimum Investment

Conclusion

As we approach 2030, the confluence of economic factors, geopolitical tensions, and central bank policies is poised to influence gold prices significantly.

While forecasts vary, the general sentiment leans toward a bullish trend for gold. Investors seeking to hedge against uncertainty and inflation may find value in considering gold as a component of their diversified portfolios.

For those interested in exploring gold investment opportunities, it’s advisable to consult with financial advisors and stay updated with market developments to make informed decisions.

Understanding gold’s historical performance and keeping an eye on global economic shifts will be crucial in navigating the next decade of investment opportunities.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com