Does Inflation Affect Gold Prices?

Is gold truly the safe haven you consider it to be during times of inflation? As an investor, you've likely grappled with the complex relationship between gold prices and inflation. While some argue that gold serves as a reliable hedge against rising prices, others question the validity of this claim.

In an inflationary environment, where the value of money decreases, you'd naturally expect the value of gold, which can't be printed or inflated, to rise. But does this theory hold up to scrutiny? That's what we're here to unravel, so stick around. You're in for an enlightening discussion that might just reshape your investment strategy.

To better understand the concept of inflation and its effect on gold prices, we will discuss the following points:

- Gold and Inflation

- How does inflation affect gold prices?

- Strategic Gold Investment During Inflationary Times

- Economic Mechanics Linking Gold and Inflation

- Does Gold Price Increase with Inflation - Perspective?

Gold and Inflation

Often, you may find that gold stands as a resilient investment during periods of high inflation, providing returns that can outperform the shrinking value of cash. Historically, gold's value has remained relatively stable, with its worth today said to be similar to what it was in the time of the Roman Emperor Augustus. In modern terms, an experienced British Army captain's salary roughly matches the gold payment of a Roman centurion, reflecting gold's long-term buying power.

In comparison to cash investments, gold also often fares better. Consider this: if you'd bought £55 worth of gold every month from 2002 to 2020, you'd have amassed over £28,000, outperforming a 3% cash ISA with £15,703.51, or cash with no interest at £11,880.

However, the relationship between gold and inflation isn't as straightforward as it might seem. The World Gold Council reports that gold's price changes don't always directly correspond with inflation rate fluctuations. Despite this, gold still performs well overall, having appreciated by 15.5% in the last 12 months.

Gold is also a valuable addition to an investment portfolio, serving as both a tactical inflation hedge and a long-term strategic asset. It's a solid portfolio diversifier and a currency hedge, particularly against the US dollar. Even with a conservative annual return estimate of 2-4%, holding between 2% and 10% of your portfolio in gold can significantly improve risk-adjusted returns. So, when considering investments during high inflation periods, remember the historical resilience and potential benefits of gold.

How Does Inflation Affect Gold Prices?

When inflation hits, your attention might shift to gold. Why? It's simple: as inflation erodes the value of money, gold's lure as a safe haven often increases, leading to a surge in demand that, in turn, drives up its price.

Inflation and the Demand for Gold

In response to rising inflation rates, you'll notice that investors, concerned about potential value loss in traditional assets like stocks and bonds, tend to pivot towards gold as a protective measure for their wealth. This fear-driven demand fuels an increase in the price of gold. Just look back to the late 1970s and early 1980s. As per the Federal Reserve Bank of St. Louis, the average federal funds rate leapt from 8.98% to 13.82%. During this inflationary period, NASDAQ data shows the price of gold shot up from $35 per share to a staggering $850 per share. It's clear: inflation has a significant influence on the demand for, and consequently, the price of gold.

Inflation and Gold Supply

Building on the relationship between inflation and gold demand, it's essential to understand how inflation also impacts the supply side of the equation, particularly since gold's finite nature plays a key role in its price fluctuations.

Inflation often devalues currencies, pushing investors towards gold as a hedge. This boosts demand, and with gold's supply capped, prices can surge. Here's how it usually plays out:

- Inflation rises, currency value falls

- Investors flock to gold as a safe haven

- Demand exceeds gold's finite supply

- Gold prices increase

This was evident when gold prices neared record levels in April 2023 and continue to hover around $2,000. So, as you consider gold as an investment, remember inflation's potential impact on its supply and price.

Inflation and Interest Rates

To grasp the full impact of inflation on gold prices, you must carefully consider the crucial role of interest rates. As inflation decreases consumers' purchasing power, demand for goods and services drops, leading to a negative ripple effect on businesses and the stock market. For example, during the inflationary period from October 2007 to March 2009, the S&P 500 plunged by approximately 57%. Investors, seeking stability, shifted their assets into gold, driving its price up by 25.5%. This trend underlines a critical economic interplay: when inflation sparks uncertainty in the market, gold often becomes the safe haven, causing its price to rise. Understanding this relationship allows you to anticipate potential shifts in gold prices during inflationary periods.

Inflation Expectations

Expectations of inflation can also significantly influence gold prices, as you might buy more gold if you believe inflation will rise, driving up the price even before inflation occurs. This expectation-driven demand can create a self-fulfilling prophecy where gold prices increase even if the anticipated inflation doesn't materialize.

Here are a few key points to consider:

- Anticipation of inflation can cause investors to buy more gold as a hedge.

- This increased demand can drive up gold prices, even without actual inflation.

- If inflation doesn't materialize, the prices may not fall back down immediately due to market dynamics.

- Thus, gold prices can be more sensitive to inflation expectations than actual inflation.

Therefore, understanding inflation expectations is crucial when investing in gold.

Strategic Gold Investment During Inflationary Times

As inflation looms, you may be considering gold as part of your investment strategy. Understanding gold allocation, different investment vehicles and the importance of timing can provide a safety net against a depreciating currency. It's also crucial to consider risk management and maintain a long-term perspective to maximize your returns in these uncertain conditions.

Gold Allocation

In periods of rising inflation, strategically allocating 5-10% of your portfolio to gold can provide a critical safeguard, shielding your investments from inflationary pressures without overexposing your portfolio to a single asset. This allocation lends stability and acts as a reliable hedge against inflation.

Consider these factors when strategically investing in gold:

- Historical Performance: Gold has a robust track record of holding its value during inflationary times.

- Diversification: Gold often moves independently of stocks and bonds, reducing overall portfolio risk.

- Liquidity: Gold is a universally accepted form of currency, hence always liquid.

- Potential for Growth: Despite its defensive role, gold has potential for high returns, especially during times of economic uncertainty.

Always base your gold allocation decisions on careful analysis, taking into account your risk tolerance and financial objectives.

Timing

To maximize your gains during inflationary times, it's crucial to invest in gold early in the cycle, as historical data suggests. Spotting inflation trends early and increasing your gold allocations preemptively can significantly boost your investment returns.

Consider these strategic steps:

- Monitor economic indicators for early signs of inflation.

- Adjust your portfolio to increase gold allocation as inflation trends emerge.

- Diversify gold investments across different forms (bars, coins, ETFs, etc.)

- Regularly review and rebalance your portfolio to sustain optimal gold exposure in line with inflation.

Risk Management

Having established the importance of timing and diversification in gold investment during inflationary periods, let's now focus on managing the inherent volatility risk associated with gold prices. Your strategy should incorporate methods like dollar-cost averaging, which mitigates risk by spreading out purchases over time, avoiding the pitfall of investing all at a peak price. Data suggests that this method can temper the inherent volatility associated with gold. Additionally, don't put all your eggs in one basket. Diversification across asset classes is key in risk management. Historical analysis indicates a correlation between inflation and gold prices, but other assets may react differently. Your portfolio should be a balanced mix, mitigating the risk of any one asset's downturn. Inflation can be a golden opportunity, if managed strategically.

Long-term View

In the arena of sustained high inflation, gold often emerges as a champion, underscoring the need for a strategic, long-term perspective in your investment approach. Gold's value doesn't just spike during transitory inflationary periods; it shines most when inflation persists.

This is where a strategic view comes into play. Here are some points to consider:

- Gold's resilience during high inflation is data-backed, it's not a mere speculation.

- Gold can act as a hedge, preserving your wealth when other assets falter.

- A long-term view takes into account potential inflationary trends, not just current inflation rates.

- Regularly reviewing and adjusting your gold holdings can help optimize returns.

In essence, strategic gold investment requires foresight, patience, and an understanding of inflationary dynamics.

Investment Vehicles

While considering your gold allocation strategy, don't overlook the importance of selecting the right investment vehicles to meet your specific financial goals and risk tolerance levels. You've got several options. Physical bars or coins offer tangible assets, while gold ETFs and mutual funds provide liquid exposure to gold prices without the need for storage. Mining stocks offer potential upside from gold price increases and company growth but come with additional risks. Futures and other derivatives can provide leverage and hedging opportunities, but they're complex and may not be suitable for all investors. Your choice should be based on a careful analysis of your investment goals, time horizon, risk tolerance, and other relevant factors. Make your choice wisely to navigate inflationary times successfully.

Gold IRAs

When investing in physical gold, working with a long-established and trusted gold IRA company can provide access to competitive prices, price transparency, a reasonable buyback policy, reliable customer service, and security of your precious metals.

Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. Whether you prefer a gold IRA or owning the physical gold in your place of residence.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist:

Economic Mechanics Linking Gold and Inflation

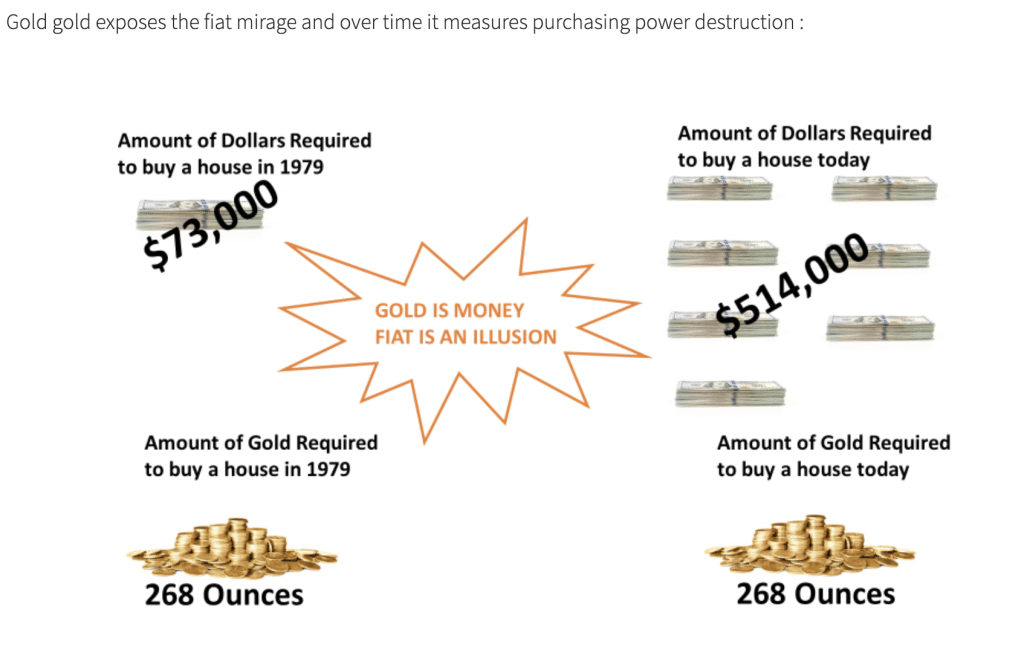

Several economic dynamics reveal why gold often serves as a reliable hedge against inflation. Firstly, inflation erodes the purchasing power of fiat currencies. As your paper money loses value, gold's appeal as a store of value increases due to its finite supply. This drives investment demand for gold as you aim to protect your wealth.

Secondly, inflation typically correlates with decreased real interest rates. This reduces the opportunity cost of holding non-yielding assets like gold. When T-bill rates drop below inflation, gold becomes a more appealing investment compared to bonds.

Furthermore, when inflation rises, gold benefits from currency devaluation effects. You might diversify into gold and other hard assets to avoid depreciating currencies. Central banks also tend to increase their gold reserves to hedge against currency risks.

Interestingly, gold prices often rise when inflation is high simply because investors believe it will. This self-fulfilling prophecy creates a feedback loop – inflation increases, gold is expected to rise, investment demand goes up, and gold prices soar.

In essence, gold's role as a stable long-term store of value underpins its ability to provide inflation protection. Gold has traditionally competed with the US Dollar as a store of wealth and value, particularly during the gold standard era. Consequently, it's no surprise to see gold appreciate when the Dollar's value is undermined by inflationary pressures. Gold is not a perfect hedge, but it has historically rewarded investors during inflationary periods. Understanding these mechanics can help you make informed investment decisions.

Does Gold Price Increase with Inflation - Perspective?

You might be wondering exactly how inflation impacts gold prices, and to understand this, we need to delve into the economic principles and historical data that underpin this relationship. Gold has historically been seen as a hedge against inflation, with its value often rising as inflation increases.

A study by the World Gold Council analyzing 50 years of data found that gold returned an average of 15% per year during periods when the inflation rate exceeded 3%. When inflation was under 3%, the annual return was a mere 6%. This shows gold's potential to outperform in times of heightened inflation.

The connection between inflation and gold prices can be explained through several economic theories:

- Rising inflation typically decreases trust in fiat currencies, leading to increased demand for hard assets such as gold.

- Inflation erodes the purchasing power of currency, hence investors turn to gold as a stable store of value.

- Central banks may raise their gold reserves to diversify from devalued currencies.

- Gold's performance is also influenced by investor behaviors and economic conditions.

These dynamics create a surge in demand for gold, pushing up its price when inflation rises. However, it's important to note that while gold has a historical association with inflation hedging, its performance is complex and dependent on various factors. These include macroeconomic conditions, investor behaviors, and other factors that may be unique to the time period.

Conclusion

In essence, inflation indeed impacts gold prices. As inflation rises, you'll often observe an uptick in gold prices. This correlation is due to gold's reputation as a reliable store of wealth during turbulent economic times. Therefore, strategic gold investments can prove beneficial in inflationary periods. Remember, understanding the economic mechanics linking gold and inflation is crucial for making informed investment decisions. So, keep an eye on inflation trends to navigate your gold investments effectively.

Finding a trusted gold investment company that actively monitors economic trends and policies that directly affect inflation is key. The companies listed below provide this support and guidance.

Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com