10 Reasons to Invest in Gold

You're about to uncover the top ten reasons why investing in gold is a smart move.

You'll see how this timeless safe have asset can diversify your portfolio, hedge against inflation, and offer stability in uncertain economic times.

You'll also learn about the broader implications of gold investment, from global geopolitics to the state of the dollar.

There is a myriad of reasons to invest in this 5,000-year-old safe haven asset. In these top 10 list of reasons to invest in gold we will discuss the following:

- Gold has demonstrated its undeniable value.

- Gold is reclaiming its traditional role as a form of currency.

- Physical gold can't go bankrupt or default.

- Gold miners are unable to boost their gold output.

- Government budget Imbalances, Fiscal Dominance, and interest rates may cause hyperinflation

- Derivatives

- Gold is currently significantly undervalued

- Some issuers of gold-related financial products may not have the claimed amount of gold.

- The decline of the dollar as the global reserve currency is inevitable.

- Central banks are acquiring more gold.

Let's delve in and discover why gold isn't just a symbol of wealth, but a strategic investment choice.

Gold has Demonstrated its Undeniable Value.

When you decide to gear up for investing, you can't overlook the undeniable value that gold has demonstrated throughout history. This precious metal has served as a form of money for over 5,000 years, outlasting countless currencies and financial crises. It's not just about its glittering appeal; gold's value is deeply rooted in its historical significance and enduring resilience.

Unlike stocks and bonds, gold isn't positively correlated with other assets. This characteristic makes it an excellent diversification tool for your portfolio. When other assets tumble, gold often holds steady or even appreciates, providing a safety net during market downturns.

The value of gold isn't limited to its monetary role. It's a tangible asset, impervious to fire, water, and time. It doesn't require feeding or maintenance, like livestock or property would. This makes gold a hassle-free investment that you can store safely and securely, free from the worries of depreciation due to physical wear and tear.

Furthermore, gold has no counterparty risk. It doesn't rely on someone else's promise or ability to pay. What you see is what you get. Its value doesn't hinge on a company's performance, a government's stability, or the whims of the global economy.

In a world of volatile markets and uncertain economic outlooks, gold stands firm. Its undeniable value has been proven time and again throughout history. So, when you're planning your investment strategy, don't forget to consider the golden opportunity that gold presents for portfolio diversification, risk management, and long-term value preservation.

Gold is Reclaiming its Traditional Role as a Form of Currency.

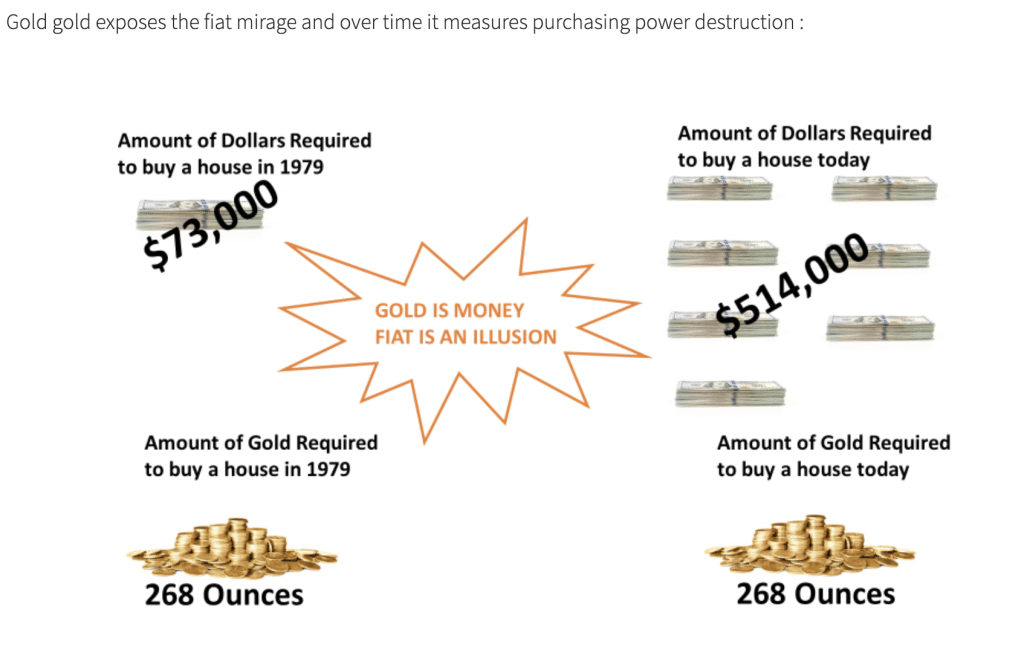

As you navigate the world of investing, it's crucial to understand that gold is steadily reclaiming its traditional role as a form of currency. This unprecedented move is primarily driven by the prolonged experiment of non-convertible paper currencies, which have historically had an average lifespan of 27 years. The U.S. dollar experiment has exceeded this, being 50 years old and showing signs of faltering.

Gold's resurgence as a means of trade isn't surprising. For over 2,000 years, money was made of gold and silver, and it's only since 1971, with the end of the gold standard, that we've deviated from this norm. This deviation has proven to be a failed experiment, with rampant inflation and economic instability being common symptoms.

The government's inability to balance budgets, coupled with fluctuating rates that will need to correct down eventually. These elements may lead to hyperinflation, which devalues currencies and erodes the purchasing power of your savings. Gold, on the other hand, is immune to these issues. It's a tangible asset that doesn't go bankrupt or default on promises.

Another point to consider is the increase in gold demand from countries converting their dollars into tangible assets. Central banks, aware of the dollar's diminishing purchasing power, are buying gold to protect against loss. This surge in demand, combined with limited supply, ensures gold's value in the future.

Therefore, from an investment standpoint, it's wise to consider gold not only as a safeguard for your wealth but also as a viable currency alternative.

Physical Gold Can't Go Bankrupt or Default.

You can always bank on physical gold because, unlike corporations or governments, it can't go bankrupt or default on its obligations. This inherent stability is one of the key reasons why gold has been a preferred store of value for thousands of years. No matter the economic climate, the value of physical gold remains intact because it doesn't rely on a third party's ability to fulfill a promise or obligation.

When you invest in stocks or bonds, you're essentially trusting the issuing company or government to fulfill their financial obligations. If they go bankrupt or default, your investment could be worth little to nothing. Contrast this with physical gold. Its value doesn't depend on the financial health of a company or government. It's an asset that you can hold in your hand and it's universally recognized for its value.

Moreover, physical gold can't be devalued by monetary policies like excessive money printing. In times of economic uncertainty or financial crisis, gold has historically served as a reliable hedge against inflation and currency devaluation. It's a tangible asset that has outlived countless currencies and remained a store of wealth through various economic upheavals.

Lastly, unlike paper money or digital assets, physical gold isn't susceptible to cyber threats. This further enhances its role as a safe-haven asset.

Gold Miners are Unable to Boost their Gold Output.

Despite the increasing demand for gold, gold miners can't simply ramp up their production to meet this need. This might seem counterintuitive given the market forces of supply and demand. However, it's not as simple as flipping a switch. Gold mining is a complex process, requiring significant capital investment, sophisticated equipment, and a skilled workforce.

Furthermore, the locations where gold can be mined are finite. Geological challenges and environmental concerns also limit where and how much gold can be extracted. Securing the necessary permits and approvals for new mining projects is a time-consuming and often unpredictable process.

The 2008 credit crunch severely impacted gold producers' ability to secure financing for new projects. This financial instability hindered their ability to increase production to meet the growing demand. Even as the global economy has recovered, the effects linger, causing a lag in the gold mining industry's capacity to expand.

This inability to boost gold production has implications for you as an investor. The limited supply of gold, coupled with its growing demand, underpins its value. Simply put, the less there's of something everyone wants, the more valuable it becomes.

Government Budget Imbalances, Fiscal Dominance, and Interest Rates May Cause Hyperinflation.

In the midst of these challenges, another significant reason to consider investing in gold lies in the current economic climate where poor government budget balance and interest rates potentially pave the way for hyperinflation. When governments struggle to balance their budgets, they run massive deficits to compensate for the lack of central bank support. The end result will be a rise in fiscal dominance. With the inevitable pivot by the Federal Reserve, there will be a return to low-interest rates, which would set the stage for a destructive economic scenario.

The mechanics are simple yet alarming. Governments, in their quest to stimulate economic growth, often resort to printing more money. This action invariably leads to the devaluation of their currencies and potentially, hyperinflation. This is a scenario you'd want to protect your wealth from, and this is where gold comes into play.

Here are three strategic reasons why gold becomes a solid investment option in such a scenario:

- Hedge against Hyperinflation: Gold has historically proven to be a reliable hedge against inflation. As the value of currency diminishes, the value of gold tends to rise, preserving the purchasing power of your investment.

- Store of Value: In times of economic instability, gold serves as a store of value. Unlike paper money, its worth isn't susceptible to the whims of economic policies and it has outlasted every currency known to man.

- Limited Supply: The supply of gold is finite. No matter how much money governments print, they can't increase the amount of gold. This scarcity underpins its enduring value.

Fiscal Dominance

There is a tipping point where monetary dominance shifts to fiscal dominance. The Federal Reserve can, to a certain degree, squash the demand side of inflation, but the supply side that is presently being driven by massive government spending and deficits is largely out of their control.

Essentially, the US central bank, along with the smaller private banking sector, is slamming on the economic brakes and the federal government is jamming on the accelerator. When the Federal Reserve is forced to pivot and stop its monetary tightening and resume quantitative easing, that is where inflation has the potential to resurge at a more extreme, possibly violent, rate.

We will be covering the subject of fiscal dominance in future articles. See the video below where investor and economist Lyn Alden provides further detail on this subject.

Derivatives

Consider the potential impact of derivatives on the financial system and how investing in gold can provide a measure of security against their instability.

Derivatives, often dubbed as 'financial weapons of mass destruction' by experts like Warren Buffett, are causing significant disruption in the banking sector. They currently represent an alarming one quadrillion dollars, which is 16 times the world's GDP. This massive financial bubble is a ticking time bomb, and its explosion could result in the entire financial system's bankruptcy.

In this volatile scenario, gold offers an investment sanctuary. Gold's inherent value and historical resilience make it a safe asset, offering a hedge against the potential fallout of a derivatives crash. It's a tangible, finite resource that's not subject to the same risks as derivatives, which are essentially contracts based on hypothetical scenarios. When you invest in gold, you're investing in a physical asset with intrinsic value, not a piece of paper that relies on someone else's promise.

The unstable nature of derivatives makes gold an attractive alternative for diversifying your portfolio. Its price isn't directly related to the stock market, which means it can provide balance in times of financial instability. Moreover, it's a globally recognized asset, providing you with liquidity in times of crisis.

While the derivatives market teeter-totters on the brink of instability, gold stands firm. Its historical value, scarcity, and global recognition make it a reliable investment in an otherwise shaky financial landscape. Investing in gold isn't just a strategic move; it's a safety net in a world of financial uncertainty.

Gold is Currently Significantly Undervalued

You mightn't realize it, but gold is currently significantly undervalued, making it a potentially lucrative investment opportunity for you. This undervaluation is due to several factors, which we'll delve into, but the primary reason is its comparison with the colossal amount of printed paper money circulating in the global economy.

- Money Supply Growth: Governments worldwide continue to print money at an unprecedented rate, which devalues currencies and generates inflation. This currency debasement makes gold, a historical form of money that can't be printed on demand, significantly more valuable.

- Gold/Dow Jones Ratio: This ratio helps us evaluate gold's long-term valuation. When this ratio is between 1 and 2, gold is considered properly valued. Currently, it stands at 18, indicating gold is significantly undervalued compared to stocks.

- Historical Investment Levels: Gold doesn't currently reflect its historical investment levels. A mere 1% of global savings is currently invested in gold, whereas historically, the average investment has been around 15%.

As you can see, gold's current undervaluation presents an ideal opportunity for strategic investors like you. If hyperinflation occurs, as some analysts predict, cash and other paper currencies could lose substantial purchasing power. By diversifying your portfolio with gold, you'll be protecting your wealth against excessive asset price inflation and currency debasement.

Furthermore, with stock markets and real estate showing signs of instability, gold offers a safe haven. Now is the time to consider adding this precious metal to your investment portfolio.

Some Issuers of Gold-Related Financial Products May Not Have the Claimed Amount of Gold.

During your exploration of gold investment options, it's crucial to understand that not all issuers of gold-related financial products, such as ETFs and gold certificates, actually possess the amount of gold they claim to have. Many have sold more paper gold than they've physical gold in their vaults. This discrepancy raises the risk of counterparty default, which could lead to significant financial losses.

To navigate this potential pitfall, it's essential to adopt a strategic approach. Rather than investing blindly in gold-based financial products, conduct thorough research into the issuer's gold holdings. Verify whether the issuer's claimed gold reserves align with the amount of paper gold they've issued. This due diligence can help you evaluate the issuer's reliability and the potential risk of counterparty default.

It's also beneficial to consider other investment strategies that can limit your exposure to such risks. Investing directly in physical gold that you own in your name is one such strategy. This approach offers several advantages. First, you'll have the assurance that the gold you've invested in actually exists. Secondly, you'll be free from the risk of counterparty default, which is inherent in paper gold investments.

As the demand for gold continues to rise, the risk associated with paper gold investments could potentially increase. Therefore, it's vital to remain vigilant and strategic in your gold investment decisions. By doing so, you can leverage the benefits of gold as a store of value, while minimizing your exposure to potential risks.

Finding the Best Gold IRA Company for Your Needs

When considering the counterparty risks involving the ownership of highly over-leveraged 'paper gold' products, owning physical gold becomes a far more attractive and secure investment path.

A long-established and trusted gold IRA company can provide competitive prices, transparency, reliable customer service, and security of your precious metals.

Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs whether you prefer a gold IRA or owning the physical gold in your place of residence.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist

The Decline of the Dollar as the Global Reserve Currency is Inevitable.

In light of the inherent risks associated with paper gold investments, it's crucial for you to understand the implications of the impending decline of the dollar as the global reserve currency. The dollar's fall is inevitable due to several factors. Let's delve into the reasons behind this and why gold becomes a strategic investment in this scenario.

- Quantitative Easing Policies: The U.S. Federal Reserve's approach to pump money into the economy, known as Quantitative Easing, has led to an overabundance of dollars. This excess supply inevitably devalues the dollar, weakening its position as the global reserve currency.

- Central Banks' Actions: Countries with sizeable monetary reserves, generally held in dollars, are increasingly converting their reserves into tangible assets like gold. Nations like Russia, China, and Brazil are leading this trend, seeking to preserve the purchasing power of their reserves. This move away from the dollar is accelerating its devaluation.

- Lack of Viable Alternatives: Other international currencies don't offer a compelling alternative as they're all based on unconvertible paper. The lack of a strong alternative to the dollar accelerates the process of 'de-dollarization', leading to increased demand for gold.

As the decline of the dollar seems inevitable, investing in gold becomes a strategic move. Gold, as a tangible asset, stands to gain significantly from the dollar's fall. It offers a reliable store of value and acts as a hedge against currency devaluation. So, not only does gold provide a safeguard against the falling dollar, but it also presents potential capital appreciation opportunities.

Central Banks are Acquiring more Gold.

Building on the trend of de-dollarization, central banks around the globe are stepping up their gold acquisitions. This shift is largely a response to the diminishing purchasing power of their dollar reserves, a consequence of the Federal Reserve's mass issuance of new dollars. You see, by amassing gold, these institutions are tactically positioning themselves to counteract potential losses.

Take a closer look at Asia, the Middle East, and Russia. These regions are experiencing a rapid decline in the purchasing power of their dollar reserves. To mitigate this, they're making strategic moves to amass significant quantities of gold. India, Russia, and China, in particular, are buying gold at an unprecedented pace, disrupting the balance of power between East and West.

This trend isn't just about hedging against inflation or economic instability. It's a calculated move to diversify reserves and reduce reliance on the dollar. Central banks are essentially turning back to the historical money status of gold, both as a form of diversification and a hedge against potential crises.

The trend is clear: central banks are no longer selling gold, they're buying it. They're reducing the supply on the markets, effectively driving up the demand and price of gold. This is an important factor for investors to consider when contemplating gold as an investment.

Conclusion

So, you've seen the golden allure. Investing in gold isn't just about luxury, it's strategic. With its proven value, resilience against bankruptcy, and its rising demand, it's undeniably a wise move.

Factor in hyperinflation risks, the dollar's decline, and shady gold-related products, your decision becomes clearer. So, don't just watch as central banks hoard gold. Be savvy. Capitalize on its current undervaluation.

It's time to consider gold, not just as an asset, but as a shield against financial storms.

Find the right gold IRA conpany for you. Obtain a gold IRA guide and talk to a broker

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com