Gold Investing During Stagflation

Gold performs exceptionally well in periods of economic stagflation due to investors exiting the standard, publicly traded investments like stocks, bonds, and other paper assets. To truly understand why, we need to consider the following:

- What are the dangers of stagflation?

- What is a good portfolio for stagflation?

- Why is gold a good investment during stagflation?

- What happens to the price of gold in stagflation?

- What was the stagflation crisis 1970s?

- Fiscal dominance vs monetary dominance

1. What are the Dangers of Stagflation?

What Causes Stagflation

During periods of stagflation, you have three things occur: economic stagnation, high inflation, and rising unemployment. It is the worst of many worlds. Economic stagflation historically leads to lower returns on investments and lower demand for goods and services.

Inflation creates higher prices due to currency devaluation. In the present context, the contributing factors could be:

- Supply shocks due to de-globalization lead to shortages of products and commodities along the supply chain.

- Poor fiscal discipline and monetary policy of banking and government institutions. This dynamic would overpower the typical recessionary effects of falling prices.

The Federal Reserve is presently trying to bring down inflation by raising interest rates as its primary tool. This is creating stress on banking institutions. Part of the Fed’s mandate is financial stability within the banking system. As a result, the Federal Reserve may have to back off on tightening and hence their fight against inflation.

Hence, much like during the 1970s Arthur Burn’s era of the Federal Reserve, inflation will jump back up but for different reasons.

Again, the banking system has been accustomed to a low to zero percent interest rate environment for over 10 years, so this is a massive shock to their systems as well as the bonds they presently hold. Collectively, the banks will be less profitable.

The higher cost of capital will result in less borrowing and reduced bank lending. This will have a knock-on effect on less business expansion and economic activity. Low growth. This will result in unemployment rising. This is already being felt in the technology section of the economy.

The Federal Reserve’s mandate also extends to sustaining maximum employment. If the unemployment rate starts reaching the 5 percent range, a Fed pivot could be possible here as well.

2. What is a Good Portfolio for Stagflation?

The 60/40 portfolio has been in trouble lately. This classic and basic risk parity portfolio of 60% investments in stocks and 40% bonds was a relatively safe and passive way to invest for the last 15 to 20 years. Particularly, when the Federal Reserve was injecting liquidity into the market and keeping a zero to low-interest rate environment.

However, the flaws of this model are revealed during times of economic turbulence, particularly during times of recession with sticky inflation stacked on top. The 60/40 model is not true diversification since this specific portfolio is merely limited to two asset classes. Some would argue at this point in marketplace history, stocks and bonds are highly correlative in a financial ‘headwind’ environment. The year 2022, was delivered the worst nominal returns year since 1871 for the bond and equity market.

You can see from this historical chart above, the clusters of drawdowns from these two asset classes in periods of economic volatility. Mainly, during the 1930s and 1970s. We could be entering another period of drawdowns presently. The S&P 500 fell by 40 percent during the stagflation event of 1974. US treasuries and government bonds gave negative returns when adjusted for inflation.

Bear in mind, the present equity investment market is far more overvalued and overleveraged than it was in the 1970s. This is largely due to over a decade of the artificially low cost of capital maintained by the Federal Reserve with historically low-interest rates since after the financial crisis of 2008. Lower rates, more borrowing, more risk, and greater artificial growth.

In times of stagflation, “real assets’, sometimes known as hard assets such as commodities and property, are the best-performing assets. However, property investing is presently in a place of adjustment due to value corrections, higher rates, and uncertainty within the private and commercial real estate investment and construction space.

3. Is Gold a Good Investment During Stagflation?

During times of economic contraction or the fear thereof, tangible commodities such as precious metals, base metals, and energy are a more reliant place to park investment capital. Historically, precious metals such as gold and silver have been a safe haven asset because they maintain and appreciate in value compared to other asset classes during periods of economic and market uncertainty.

In periods of bull markets and economic booms, precious metals are typically considered a ‘boring asset’ to hold. But in times of stagflation, that being recessionary unemployment, low growth, high inflation, and panicked markets, this ‘boring investment’ begins to look quite appealing. Also, gold surges in times of stagflation. Gold provides safety as well as wealth building.

Precious metals are essentially wealth insurance against losses that are felt elsewhere. Gold and other precious metals won’t go bankrupt on you and they cannot be printed or manipulated by central banks.

It’s worth noting, central banks in 2022, bought 1136 metric tons of gold, which was the highest rate of gold purchases by government bodies since 1971. 1971 is, not coincidently, the same year US President Richard Nixon ‘temporarily’ removed the United States from the gold standard. As any cynical conservative will agree, nothing is more permanent than a ‘temporary’ government solution.

The year 2023 closely matched 2022 in terms of gold purchases made by global central banks. The first quarter of 2024 set an all-new record as well. If the 'smart money' that typically run the fiat printing presses are stocking up on gold, it stands to reason that the ordinary, retail investor may want to pay attention. These mass purchases by central banks, coupled with ever increasing scarcity of supply will continue to push up gold prices.

Choosing a Suitable and Trusted Gold Investment Company to Work With

Finding the right gold investment company can be daunting and requires time and resources. A gold IRA is a means of owning physical gold and ensuring your precious metals are safely secured.

Choosing the right gold IRA company will depend on one's unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. We have provided links to these companies at the bottom of this article for your convenience.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist:

4. What Happens to the Price of Gold in Stagflation?

Gold Price History

When stagflation sets in with a worldwide recession and sticky inflation, and as the central banks continue to or pause monetary tightening, gold's prices rise as investors exit investments like stocks, bonds, and other paper assets.

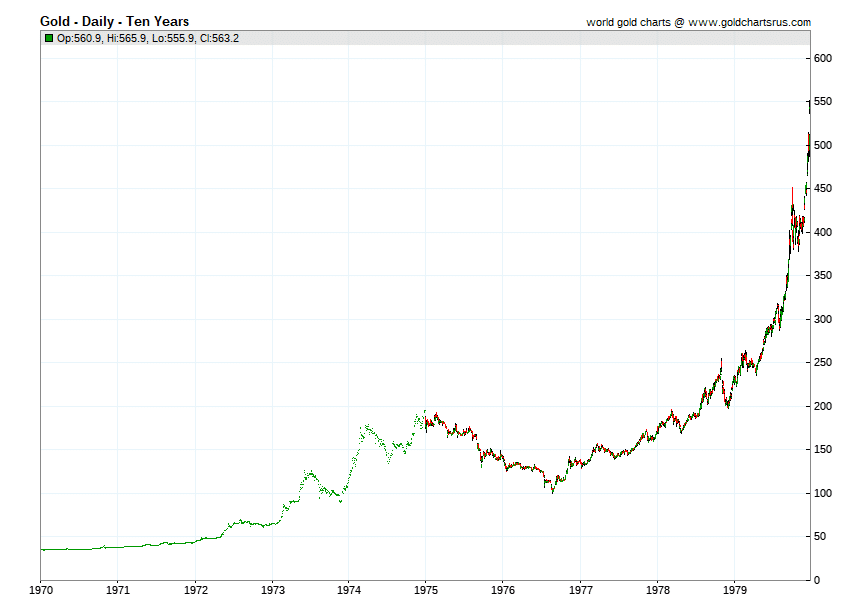

Precious metals, more specifically gold, hit their highest value in the stagflation of the 1970s and early 1980s. Between 1971 to 1982, gold increased by 2,200%. Technically, the stagflation pockets in this period were from 1974 to 1975 and 1978 to 1982.

Gold had another bull run in the economic downturn between 1999 to 2011 with an increase of 700%. The price of gold began to re-value once massive quantitative easing and near-bottom interest rates was implemented by the Federal Reserve. Don’t expect this to return any time soon.

From a more conservative view, gold in a stagflation environment will typically generate an average nominal return of 38 – 39% and an average real return of 25%. Silver came in close behind with an average nominal return of 27% and an average real gain of 13.1%.

5. What was the Stagflation Crisis of the 1970s?

Past is Prologue

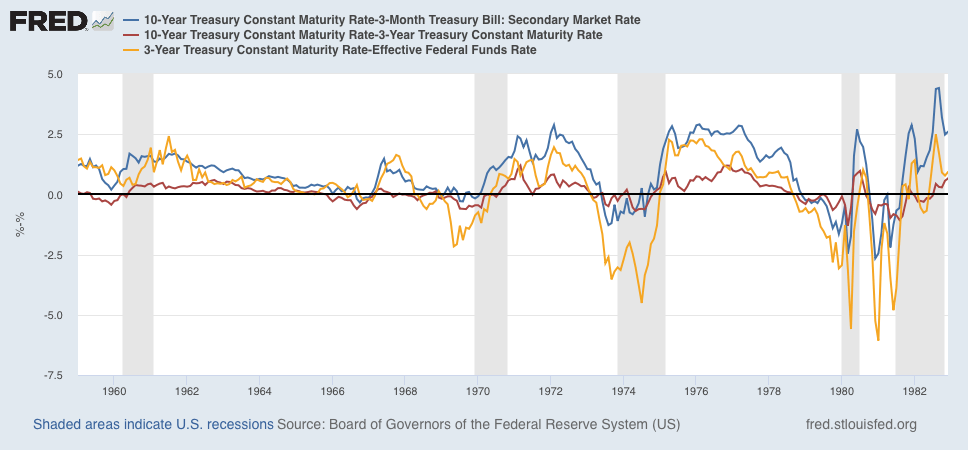

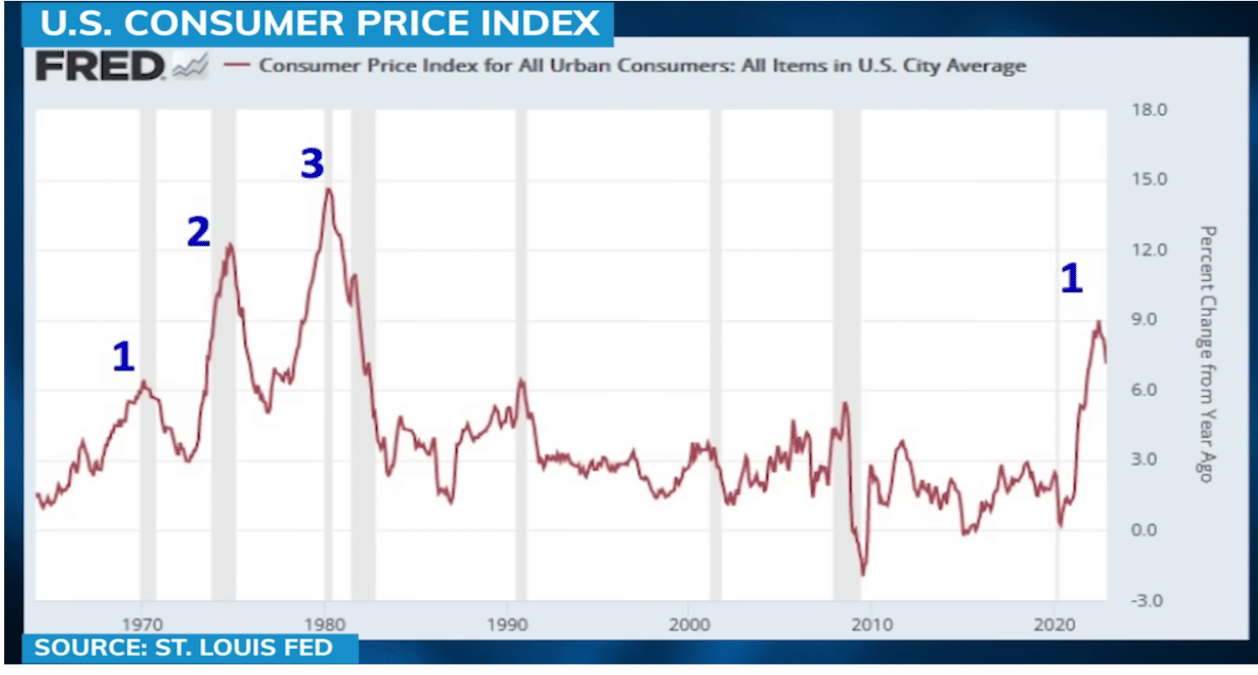

Our last analog for stagflation is the 1970’s for which we experienced multiple waves of inflation as seen in the chart above. If we are using these as models, the first wave of inflation was far milder than the two subsequent peaks. This was due in large to the Federal Reserve easing off tightening too soon and was followed by a more violent spike afterward and eventually the highest spike in 1980 of 18 to 20%. This required the Federal Reserve to apply its quantitative tightening ‘tools’ in a more aggressive way, resulting in double digital interest rate hikes. This was a painful period for the average American and investor.

Would the same measures work now? There is a great difference between the 1970s economic environment and our present one. The main one is the nation’s debt-to-GDP ratio. In the 1970s, the United States debt to GDP ratio was 32-35%. At present, that same ratio is now 130% and rising. Clearly, the ability of the US government to service the national debt during massive interest rate hikes in the 1970s and 80s was far easier than our present economic milieu.

If the past is prologue, the Fed interest rate would have at the minimum meet and possibly exceed the inflation rate to bring down the Federal Reserve’s target level, which is 2%. This could prove difficult since economic stress is already being felt at the 5% Fed rate.

Americans may need to get accustomed to a minimum 4% inflation for possibly the next decade if inflation proves to be as sticky as many economists are predicting.

6. Fiscal Dominance vs Monetary Dominance.

1940’s vs 1970’s Inflation

It is worth noting that although the stagflation era of the 1970s and early 1980s is our most recent reference point for excessively stubborn inflation, the character and source of our present inflation is more kin to the inflation of the 1940s.

Whereas the source of 1970s inflation was generated by excessive bank lending, oil and commodity price spikes, decoupling of the USD from the gold standard, and other demand-driven elements of the economy, the inflation of the 1940s was mainly generated on the supply side with massive government and fiscal deficits.

There is a tipping point where monetary dominance shifts to fiscal dominance. The Federal Reserve can, to a certain degree, quash the demand side of inflation, but the supply side that is presently being driven by massive government spending and deficits is largely out of their reach.

Essentially, the US central bank, along with the smaller private banking sector, is slamming on the economic brake pedal and the federal government is jamming on the accelerator pedal. When the Federal Reserve is forced to pivot and stop its monetary tightening and resume quantitative easing, that is where inflation has the potential to resurge at a more extreme, possibly violent, rate.

We will be covering the subject of fiscal dominance in future articles. See the video below where investor and economist Lyn Alden provides further detail on this subject.

Stagflation Investing - Summary

Gold is an excellent hedge in good times, but a crucial hedge in stagflationary times. The forces facing the US, as well as the world, are far more intense than they were in the last stagflation cycle of the 1970s to 1980’s. The United States debt to GDP ratios are nearly four times higher, the M2 money supply are magnitudes in proportion, equities are highly overvalued, and the ‘salad days’ of cheap Federal Reserve money are likely not to return.

Historically, gold and other precious metals stand strong against such challenging economic headwinds. Investing in silver during stagflation can have its own unique advantages. To learn more about silver and gold investing, see the links below to access the many investment guides from the best gold IRA and precious metals investment companies that we have personally researched and vetted.

You, as an investor, will be building a long-term relationship with whatever gold IRA company you choose. For this reason, we have also detailed each company's culture and core values.

Choosing the right gold IRA company will depend on one's unique investing needs. Depending on whether you are a high-net investor looking for the most competitive prices or require a lower investment minimum and affordable entry to the gold market, we have researched and reviewed our best 4 gold IRA and precious metal investment companies that meet those individual needs. In addition to a gold IRA, owning the physical gold in your place of residence is also an option. Click the button below to access the free gold investment guides to protect your retirement savings today.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

More Featured Articles

Precious Metals and Gold IRA Company Reviews

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com