Is 1 Gram of Gold Worth Buying?

You're here because you're curious if buying 1 gram of gold is worth it.

As an investor, you're always searching for smart moves. In this piece, we'll explore why these small, affordable gold investments could be a golden ticket for you. We'll discuss their value, liquidity, and the options you've got.

Investing in 1 gram of gold is easy and an inexpensive way to make owning gold more accessible to a wide range of investors. To better understand whether gold is worth buying in 1-gram amounts, we must discuss:

- 1 gram gold price

- Is it better to buy gold coins or bars?

- Is buying 1 gram gold coins safe?

- What are the benefits of 1 gram gold coin?

- Gold IRA with 1 gram bullion bars

Whether you're a novice or a pro, you'll find valuable insights here. So, let's dig into the potential of 1 gram of gold together.

1 Gram Gold Price

Again, you'll find that investing in 1 gram of gold is quite affordable, making gold ownership more accessible to beginning as well as seasoned investors. In the world of gold investment, the unit price of gold bars or coins is determined by the weight of gold they contain. Hence, a 1-gram gold bar or coin is significantly cheaper than its 10-gram or 1-ounce counterparts. This affordability opens the door for you to start investing in gold, even if your budget is limited.

The affordability of 1-gram gold bars or coins isn't just appealing to novice investors. Even seasoned investors recognize the value of having these smaller units in their portfolios. They allow for a degree of flexibility in investment strategy, enabling you to buy and sell in smaller increments. This means you can adjust your gold holdings according to market conditions without having to liquidate a larger piece.

Now, let's talk numbers. As of today, the price of gold is approximately $57 per gram. So, a 1 gram gold bar or coin would cost you around the same amount. Of course, this price fluctuates daily with the global gold market, but it's a good starting point for understanding the affordability of 1-gram gold investments.

To put it simply, investing in 1 gram of gold is a cost-effective way to start your gold investment journey. It's a small step, but one that could lead to great financial rewards in the future. With careful planning and a keen eye on the market, you'll find these small gold investments can add up over time.

Is it Better to Buy Gold Coins or Bars?

When it comes to diversifying your investment portfolio, there's a choice to be made between coins and bars. When you're investing in 1 gram of gold, each option offers unique benefits and drawbacks.

Gold coins, often minted by government institutions, come with a certain prestige and collectible value. You might appreciate the intricate designs and the satisfaction of owning a piece of art that's also a valuable asset. However, you should bear in mind that:

* Coins often carry a higher premium due to their collectible nature.

* They might be more challenging to sell due to factors such as collector demand or coin condition.

On the opposite side, gold bars are usually produced by private refineries. They're a more streamlined, no-frills option for the investor focused purely on the intrinsic value of gold. When considering gold bars, remember:

* Bars typically have a lower premium over the spot price of gold, making them a cost-effective choice.

* They're generally more straightforward to sell, thanks to their uniformity and wide acceptance in the gold market.

Buying coins vs. bars should align with your investment goals and personal preferences. Are you drawn to the collectible aspect of coins or do you prefer the straightforward, utilitarian nature of bars?

Is Buying 1 Gram Gold Coins Safe?

You're not taking a massive gamble with your finances by investing in 1-gram gold coins, as their value isn't exorbitant, making it a low-risk investment. The affordability of these coins allows you to gradually build your investment portfolio without draining your savings. Even in the unfortunate event of theft or loss, your financial setback wouldn't be substantial due to the lower cost of these coins.

Consider these aspects:

- Affordability:

- 1 gram gold coins are much cheaper than larger denominations.

- They provide a low-cost entry point into gold investment.

- Risk Management:

- The potential for loss is significantly reduced.

- It's an easy way to diversify your portfolio.

Investing in 1-gram gold coins can be a savvy move, introducing you to the world of gold investment without posing a significant financial risk.

How Can You Tell if a Gold Coin is Real?

The magnet test is a simple and inexpensive way to detect counterfeit gold and should be applied to any physical gold purchase, bars, or coins, that you intend on holding personally. Gold, in fact, is not susceptible to magnetic forces. Therefore, bars or coins containing a high percentage and concentration of gold will not react to a magnet test.

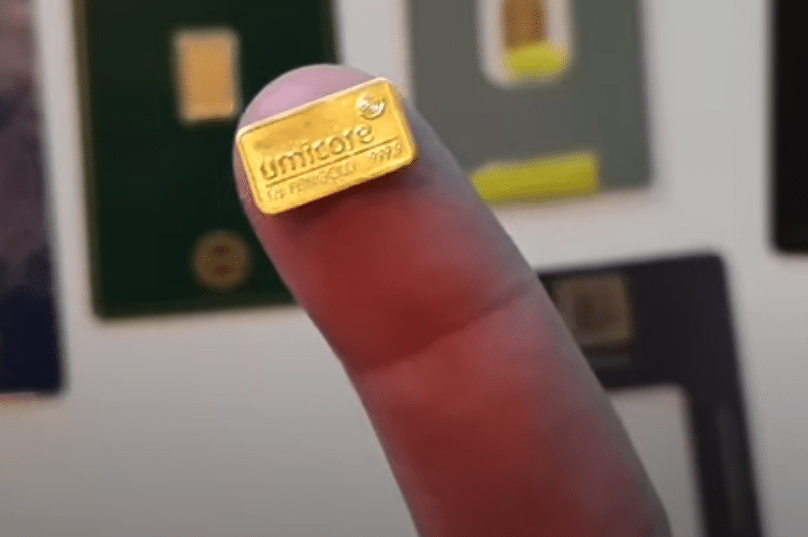

What Does 1 Gram of Gold Look Like?

Whether you choose bars or coins or both, it helps to get an idea of what the actual tangible investment looks like.

1 g Minted Gold Bar

- Bar Size – 8.90mm x 14.70mm

- Bar Thickness – 0.40mm

- Fineness – .9999

- Serial Number – Unique

1 g Gold Coins

- Diameter – 8.00mm

- Fineness – .9999

What are the Benefits of 1 Gram Gold Coin or Bar?

Understanding the monetary value of your tiny treasure is crucial in making informed investment decisions. The value of your 1 gram gold piece is determined by its weight and the current market price of gold. Unlike other commodities, gold prices don't just fluctuate based on supply and demand. Economic conditions, along with various other factors, also play a significant role in determining its price. Yet, despite these fluctuations, gold has a reputation for holding its value over the long term.

So, is 1 gram of gold worth buying? Let's dive into the data. Gold's long-term track record offers security in your investment. It's a tangible asset that isn't tied to the volatility of traditional markets, making it a reliable option for wealth preservation. Even during economic downturns, gold has historically maintained its value, providing a safety net for investors.

Additionally, investing in 1 gram of gold can be a step towards diversifying your portfolio. It's a way to hold a physical asset that doesn't require a significant upfront investment. It's affordable, accessible, and can be an ideal starting point for those new to investing in precious metals.

However, it's important to remember that while gold is a stable asset, it's not immune to risks. Like any investment, the value can decrease. Therefore, it's essential to stay informed about market trends and adjust your investment strategy accordingly.

If you're looking to diversify your investment portfolio without breaking the bank, 1 gram gold investments might be the perfect solution. They're an affordable, low-risk option that adds tangible value to your holdings.

Moreover, this investment strategy helps you curb impulsive buying, promoting healthier financial habits for your future.

No Need to Empty Your Back Account

There's no need to drain your savings account to start investing in precious metals.

Investing in 1 gram of gold presents a cost-effective solution. It's not just affordable, but also a prudent move to diversify your investment portfolio.

The price of gold can fluctuate, but historically, it has maintained its value over the long run. You can purchase 1 gram gold bars or coins without making a significant dent in your savings.

It's a tangible asset that you can hold, unlike stocks or bonds. Buying 1 gram gold bars is also a step towards developing a disciplined saving habit.

Any extra cash you come across can be put towards these small investments, helping you to build a safety net for the future. Buying 1 gram of gold isn't about becoming wealthy overnight. Instead, it's about gradually accumulating wealth over time. It's an affordable and accessible way to start investing in gold.

Consider these two points:

- When you buy 1 gram gold:

- It's a small, manageable investment.

- It's a tangible asset you can hold in your hand.

- It's a step towards diversifying your portfolio.

- When you save your extra cash:

- You're making a conscious effort to prepare for the future.

- You're resisting the impulse to spend unnecessarily.

- You're developing a habit of saving, which can benefit you long-term.

Avoid Impulse Buying

Shifting your focus to the topic of impulse buying, it's critical to understand how making an investment in 1 gram of gold can help curb this habit.

You're likely familiar with the allure of spontaneous purchases, be it clothes, meals, or short trips. These purchases might seem harmless at first, but over time, they can add up and strain your financial health.

By investing in 1 gram of gold, you're putting your extra cash towards an asset that not only holds value but also appreciates over time. Gold's stability and long-term track record make it a reliable wealth preservation tool.

This investment strategy not only safeguards your financial security but also helps you develop disciplined spending habits, effectively shielding you from the financial pitfalls of impulse buying.

Benefits of Investing in Gold

Investing in tangible assets now is an effective strategy for securing your financial future, and you'll find that it promotes healthier spending habits. While 1-gram gold may not seem like a lot, it's a stepping stone that can lead to larger gold investments. Consider this:

- Affordability:

- 1 gram of gold is affordable and accessible, allowing you to start small and build up your investment over time.

- It's a low-risk option that can provide you with attractive returns and diversify your portfolio.

- Future Planning:

- By investing in gold, you're not only saving but also planning for your future.

- This method can help resist impulsive buying and encourage better financial habits.

Gold IRA with 1 Gram Bullion Bars

You'll find that adding 1-gram gold bars to your Gold IRA is a smart move for genuine diversification, especially considering gold's enduring value and the tax advantages associated with such IRAs. These 1-gram bars offer an affordable entry point into the world of gold investment, making it more accessible for a broader range of investors. Their small size also allows for greater flexibility in managing your portfolio, as you can easily adjust your holdings to suit your financial goals and risk tolerance.

Gold bars are highly liquid assets that can be quickly bought and sold, providing you with the agility to seize market opportunities. They offer a tangible safety net against the uncertainties of the stock market, providing a stable store of value in times of economic crisis. Unlike securities, which carry counter-party risk, gold's value is intrinsic and enduring.

Beyond diversification and stability, a Gold IRA allows for tax-deferred growth on your investments. Any profits from selling your gold within the IRA aren't subject to immediate taxation, providing significant long-term savings. This tax efficiency, combined with gold's proven track record as a wealth preserver, makes 1-gram gold bars a strategic addition to your retirement portfolio.

For investors looking for a lower minimum gold IRA, American Hartford Gold, and Birch Gold Group are excellent choices that provide a more accessible entry into the gold investment market.

See our list of the best gold IRA companies that can uniquely suit your investment needs here:

Tap the banner below to visit Birch Gold Group to receive their gold IRA guide

Conclusion

So, is 1 gram of gold worth buying?

Absolutely. It's affordable, accessible, and delivers liquidity benefits. With options like coins and bars, you can easily diversify your portfolio. Remember, the enduring value and stability of gold is unmatched. And with gold IRAs, your investment can grow tax-free.

Always ensure the quality of your purchase.

So, don't wait - seize this golden opportunity and fortify your investment strategy with 1 gram of gold today.

Tap the banner below to visit Augusta Precious Metals to receive their gold IRA checklist and begin your tax-deferred, gold investing journey.

Find the right company for you. Obtain a gold IRA guide and talk to a broker

More Featured Articles

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com