Updated January 8th, 2026

GoldenCrest Metals Review 2026: A New Standard in Precious Metals IRAs

Best Gold IRA Company for Low Investment Minimums, Education, and Promotions

Minimums, Fees, Storage Options, BBB Ratings, Pros and Cons

preciousmetalsinvestmentportfolio.com

Disclaimer: Precious Metals Investment Portfolio may receive compensation from many or all of the companies listed, including Birch Gold. This is how we maintain our free service for consumers.

GoldenCrest Metals may be a relative newcomer to the precious metals industry, but it’s already turning heads with a blend of experience, transparency, and customer-first values that’s rare in the sector.

Founded in 2023 and headquartered in Calabasas, California, the company was built by industry veterans who wanted to “do things better” – no high-pressure sales pitches, no confusing fee structures, and no overpriced “exclusive” coins. 🪙

GoldenCrest focuses on widely recognized bullion products, competitive pricing, and an educational approach that empowers customers to make informed decisions.

In this review, we’ll look at GoldenCrest’s leadership, pricing philosophy, promotional offers, and what sets them apart from competitors, so you can decide whether they’re the right fit for your precious metals or Gold IRA needs.

Background & Company Overview

GoldenCrest Metals was founded in 2023 by a leadership team with decades of combined experience in the precious metals and Gold IRA industry.

After years of seeing customers get pushed into overpriced products and confusing contracts, CEO Rich Jacoby decided to launch a company built on a simple principle: treat customers the way you’d want to be treated if you were making a major financial decision.

Headquartered in Calabasas, California, GoldenCrest operates nationwide, helping retirement savers protect and diversify their portfolios with physical gold and silver.

From day one, the company’s mission has been clear: provide premier customer service, transparent pricing, and only the most trusted bullion products from recognized government and private mints.

Unlike some older, legacy firms that have grown complacent or rely heavily on aggressive sales tactics, GoldenCrest has positioned itself as a “next-generation” precious metals dealer-large enough to handle significant order volume, yet small enough to deliver a personalized, boutique-level customer experience.

Leadership & Private Equity Backing

GoldenCrest Metals’ leadership team brings together decades of experience in the gold, silver, and retirement planning sectors. CEO Rich Jacoby, along with his executive team, has worked across every part of the precious metals supply chain – from sourcing bullion to structuring self-directed IRAs. This deep industry knowledge gives the company an insider’s perspective on what works, what doesn’t, and how to protect customers from the costly pitfalls that still plague the industry.

CEO Rich Jacoby explains the vision behind GoldenCrest Metals:

“For years, I kept hearing the same stories – people being talked into overpriced products, left in the dark on fees, or pressured into making quick decisions. Even from the outside, it was clear the industry could do better. GoldenCrest was built to be that better option – a place where customers get fair pricing, clear answers, and respect at every step.”

One of GoldenCrest’s key advantages is its private equity backing. While many metals dealers operate as lean small businesses, GoldenCrest is well-capitalized and financially stable – a factor that gives customers confidence their buyback guarantees will always be honored.

Whether you’re selling back a handful of coins or a large portfolio of gold and silver, the company’s financial strength means it can process transactions quickly without liquidity concerns.

This combination of seasoned leadership and strong funding makes GoldenCrest stand out in a competitive market, offering both the personal touch of a boutique firm and the security of a financially robust operation.

Bullion Pricing & Product Strategy

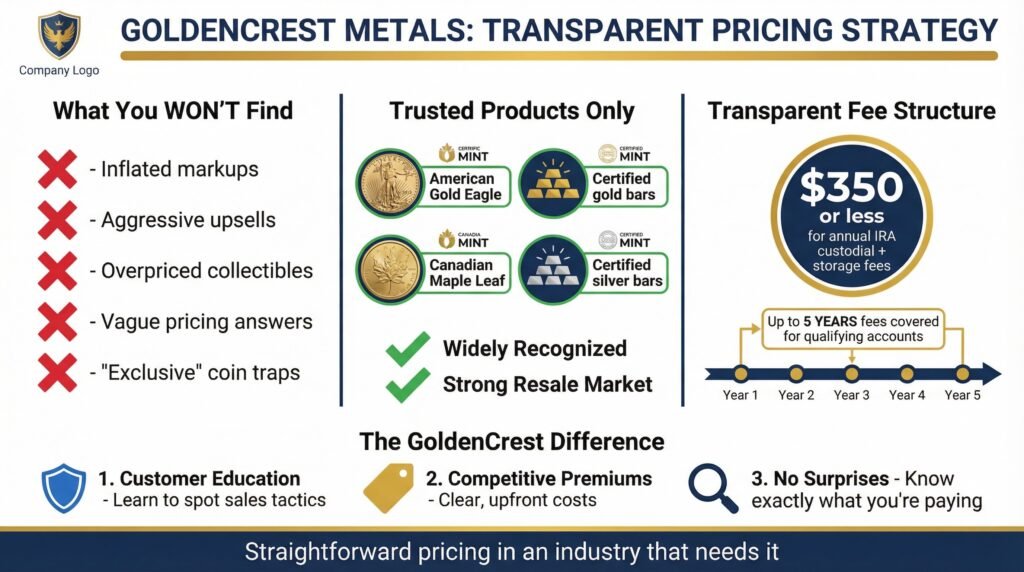

GoldenCrest Metals takes a straightforward approach to pricing-something that’s often missing in the precious metals industry. You won’t find inflated markups, aggressive upsells into overpriced collectibles, or vague answers to specific product pricing questions.

Instead, the company focuses exclusively on widely recognized products from trusted mints, such as American Gold Eagles, Canadian Maple Leafs, and gold or silver bars from reputable refiners.

This strategy means customers avoid the common trap of paying steep premiums for so-called “exclusive” coins that have little to no resale market outside the dealer’s own network. GoldenCrest actively educates its customers on these sales tactics so they can spot and avoid them, even if they choose to work with another company.

The pricing structure is equally transparent. Annual IRA custodial and storage fees are low-typically under $350 total-and for qualifying accounts, GoldenCrest will cover those costs for up to five years.

By focusing on competitive premiums and clear, upfront costs, the company ensures customers know exactly what they’re paying and why, with no surprises down the road.

Education-First, Customer-First Philosophy

GoldenCrest Metals was built on the belief that informed customers make better, more confident decisions – and that a company’s job is to educate, not pressure.

Instead of relying on fear-based sales tactics, GoldenCrest’s team takes the time to explain how the precious metals market works, the role bullion can play in a diversified portfolio, and what fees and markups really mean over time.

They offer free resources, including a detailed Gold IRA guide and a wealth protection guide, along with one-on-one consultations where customers can get their questions answered without being pushed toward a purchase.

Whether you’re new to precious metals or looking to roll over an existing retirement account, the goal is the same: to give you the facts so you can decide if gold or silver is right for you.

This low-pressure, education-first approach not only sets them apart from high-volume call centers but also helps build long-term relationships. Many customers cite this patient, respectful service as the reason they chose GoldenCrest-and why they continue to recommend the company to friends and family.

Pros and Cons

Pros

✓ Transparent, Fair Pricing – No hidden markups, clear fees, and competitive premiums on bullion products.

✓ Focus on Widely Valued Products – Avoids overpriced “exclusive” coins with limited resale value.

✓ Experienced Leadership – Decades of combined industry experience, led by a hands-on CEO.

✓ Private Equity Backing – Strong financial foundation to honor buybacks without liquidity concerns.

✓ Attractive Promotions – 10% silver rebate (up to $25,000), free shipping, and up to five years of zero fees for qualifying accounts.

✓ Boutique Service at Scale – Large enough to handle volume, small enough for personal attention.

✓ Strong Reputation – High customer ratings across BBB, Google, and Trustpilot.

Cons

✓ Newer Company – Founded in 2023, so it lacks the decades-long history of some competitors.

✓ Focus on IRA Eligible Products – Not ideal for collectors seeking rare or numismatic coins.

Promotions & Customer Incentives

GoldenCrest Metals offers several incentives to attract and reward new customers-perks that add meaningful value without inflating the cost of the metals themselves.

One of their most popular offers is a 10% silver rebate on qualified purchases, up to $25,000 in free silver. For retirement savers rolling over a sizable IRA, this can translate into a significant bonus right out of the gate.

In addition, GoldenCrest provides free shipping on all orders and will cover annual account fees for up to five years on qualifying IRA accounts.

Considering that custodial and storage fees can add up quickly in this industry, these promotions can save customers thousands of dollars over the life of their account.

These offers are designed to be straightforward and transparent, with no hidden catches or requirements buried in fine print. It’s a reflection of GoldenCrest’s broader philosophy: give customers real value up front, and build trust for the long term.

If you really want to get started today to take advantage of GoldenCrest’s latest promotional offers, click the banner below to visit the company’s official site to receive their free gold IRA guide.

Operational Capacity Meets Boutique Service

GoldenCrest Metals strikes a rare balance in the precious metals industry-large enough to handle substantial order volumes, yet small enough to deliver a personal, boutique-style experience.

While the company has the infrastructure and funding to process large transactions efficiently, it still treats every customer like a top priority.

A standout example of this commitment is the hands-on involvement of CEO Rich Jacoby. It’s not unusual for him to personally call new customers to ensure their experience has been nothing short of exceptional. In some cases, he even gives out his personal cell phone number, underscoring the company’s dedication to accessibility and trust.

This kind of direct leadership involvement is virtually unheard of in an industry where most executives remain far removed from day-to-day customer interactions. For many buyers, it’s this personalized care, combined with GoldenCrest’s operational strength, that makes the company feel like the best of both worlds.

Storage, Buy-Back & Infrastructure

When it comes to safeguarding precious metals, GoldenCrest Metals partners with some of the most trusted names in the industry. For IRA accounts, they work with Entrust Group as their preferred custodian, ensuring compliance with IRS rules for self-directed retirement accounts.

Metals are stored at the Delaware Depository, a highly secure, fully insured facility with segregated storage, meaning your holdings are kept separate from other customers’ assets.

GoldenCrest also offers a straightforward buyback program, allowing customers to sell their metals back at fair market rates when the time is right.

Thanks to the company’s private equity backing and strong liquidity, there’s no concern about whether funds will be available to complete the transaction.

This combination of secure storage, reputable custodial services, and reliable buyback options gives customers confidence that their metals are safe-and that they’ll be able to easily access their value in the future.

Gold IRA Company Comparisons

Goldencrest Metals vs. Other Gold IRA Companies

- Annual Fee: Fees vary

- Minimum Investment: $10,000

- Promotion: 1st year fees waived (over $50k accounts)

- Annual Fee: $180

- Minimum Investment: $10,000

- Promotion: Free Storage and custodian fees for the first year

- Annual Fee: $225 – 250

- Minimum Investment: $10,000 for direct transfers, $20,000 for IRA/401k rollovers

- Promotion: 1st-year fees waived for qualifying IRAs

Real Customer Feedback & Reputation

GoldenCrest Metals has quickly built a strong reputation in the short time since its launch. The company holds consistently high ratings across major review platforms, including 5-star reviews on the Better Business Bureau and Google, along with excellent feedback on Trustpilot.

Customers frequently praise GoldenCrest for its transparency, patience, and professionalism. Many reviews highlight the absence of high-pressure sales tactics, with buyers noting that their questions were answered thoroughly and without any push to make a quick decision.

One Trustpilot reviewer summed it up: “No pressure, just information-by far the most transparent company I’ve dealt with.”

Others point to the educational value of their interactions, saying they felt more confident about their purchase after speaking with the GoldenCrest team. This pattern of consistent, positive feedback reinforces the company’s image as a trustworthy, customer-first precious metals dealer.

Join the many satisfied customers and investors by accessing GoldenCrest Metal’s free gold investment guide and start protecting your wealth today. Click the banner below to be taken the company’s official site:

GoldenCrest vs. Competitors

The precious metals industry is crowded with dealers vying for retirement savers’ attention, but GoldenCrest Metals stands out in several key ways:

Bullion-Only Approach: Many competitors push “exclusive” or limited-mintage coins with inflated premiums and questionable resale markets. GoldenCrest avoids these products entirely, focusing instead on widely recognized bullion coins and bars that retain value and liquidity.

Transparent Pricing: Some firms bury fees in the fine print or only disclose pricing after a sales call. GoldenCrest is upfront about costs, offering competitive premiums and clear, simple fee structures.

Lower Minimums: While certain companies require $25,000-$50,000 to open a Gold IRA, GoldenCrest’s minimum is closer to $10,000, making them more accessible for both seasoned investors and first-time buyers.

Customer Experience: Instead of high-pressure call center sales, GoldenCrest offers boutique-style service where the CEO often speaks directly with customers.

Financial Stability: Private equity backing ensures buyback capability and operational strength – a layer of security not all competitors can match.

For buyers who want the reassurance of a large, well-funded company but the personal touch of a boutique firm, GoldenCrest Metals offers a unique blend that’s hard to find elsewhere.

Is GoldenCrest Metals Worth It?

GoldenCrest Metals may be a relatively new name in the precious metals industry, but it’s already carving out a reputation as a transparent, customer-first alternative to the high-pressure, high-markup status quo.

With a leadership team that brings decades of combined experience, private equity backing for long-term stability, and a clear focus on widely recognized bullion products, GoldenCrest offers both peace of mind and value for retirement savers.

Their approach is refreshingly straightforward: no overpriced collectibles, no scare tactics-just competitive pricing, industry education, and exceptional service. Add in the attractive promotions, like a 10% silver rebate and up to five years of zero account fees, and GoldenCrest makes a compelling case for being on any shortlist of top Gold IRA providers.

If you’re considering adding physical gold or silver to your retirement plan, GoldenCrest Metals is worth a closer look. You can request their free Gold IRA guide or schedule a no-pressure consultation to see if their approach aligns with your long-term goals.

If you’re considering adding physical gold or silver to your retirement plan, GoldenCrest Metals is worth a closer look. You can request their free Gold IRA guide or schedule a no-pressure consultation to see if their approach aligns with your long-term goals. Click the banner to receive their free gold IRA and investment guide now.

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com.