Gold IRA Tax Rules – IRS Tax Code Section 408m3

Understanding the complexities of gold IRA tax rules, more specifically, IRS Tax Code Section 408m3, involves knowing the following:

-Understanding IRC 408(m)(3) Permissible Metals

-Compliance and Contributions Under 408(M)(3)

-Additional Financing Options With Solo 401k

-Exploring the IRA LLC Process

-Consequences of Investing in Collectibles

As an investor, you must be aware of how this section influences your retirement savings. But what about the criteria these metals must meet?

Or the coins permissible under this section? Better yet, how do you determine your self-employment status for eligibility? Stay with us as we navigate these waters to provide you with the necessary knowledge to confidently leverage this tax code.

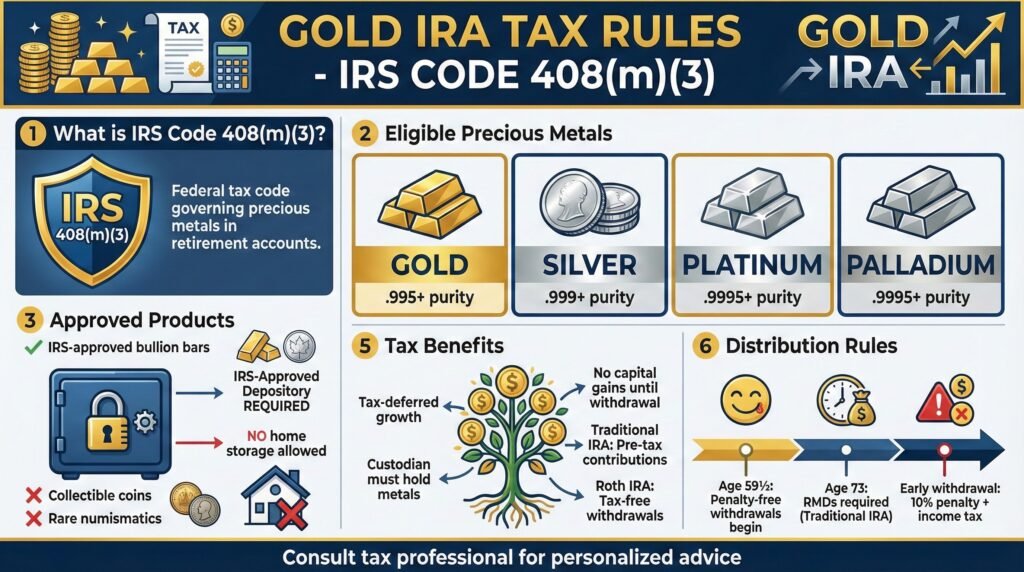

Understanding IRC 408(m)(3) Permissible Metals

When it comes to investing your Solo 401k, it’s crucial to understand that under IRC 408(m)(3), certain metals such as gold, silver, platinum, and palladium bullion are permissible, provided they meet specific quality or fineness standards.

This provision offers you the opportunity to diversify your investment portfolio by including physical precious metals.

However, not all metals are created equal. The IRC 408(m)(3) regulation stipulates that the metals must meet strict fineness standards.

For gold, the minimum fineness required is 0.995, for silver, it’s 0.999, for platinum, it’s 0.9995, and for palladium, it’s 0.9995. It’s important to ensure that any metals you consider for your Solo 401k meet these standards, or they won’t be eligible.

In addition to bullion, certain coins are also allowed under IRC 408(m)(3). These include gold coins described in section 5112(a) of title 31, silver coins in section 5112(e), and platinum coins in section 5112(k). These coins are considered legal tender and are evaluated based on their face value rather than their metal content.

If you have questions or need assistance, reach out at 800-489-7571 or send an email to info@mysolo401k.net.

These resources are available to provide guidance and ensure your investment choices align with the regulations outlined in IRC 408(m)(3).

Compliance and Contributions Under 408(M)(3)

Navigating the compliance and contribution rules under IRC 408(m)(3) can be complex, but understanding them is crucial for managing your Solo 401k investments effectively.

You’ll need to ensure that any metals included in your Solo 401k, such as gold, silver, platinum, and palladium bullion, meet the specific quality or fineness standards set forth by the IRS.

Permissible coins under this section include gold coins described in section 5112(a) of title 31, silver coins in section 5112(e), and platinum coins in section 5112(k). It’s important to be aware of these details to avoid any potential compliance issues.

Next, establishing your self-employment status is key to determining your eligibility for a Solo 401k. You must verify that you are truly self-employed and that your business generates a regular income, as these factors will influence your contribution limits and potential tax benefits under IRC 408(m)(3).

Keep in mind that managing compliance also includes understanding the rules regarding distributions. If you choose to invest in collectibles, be aware that the IRS treats the acquisition of such items as a distribution, with tax implications on the distributed amounts.

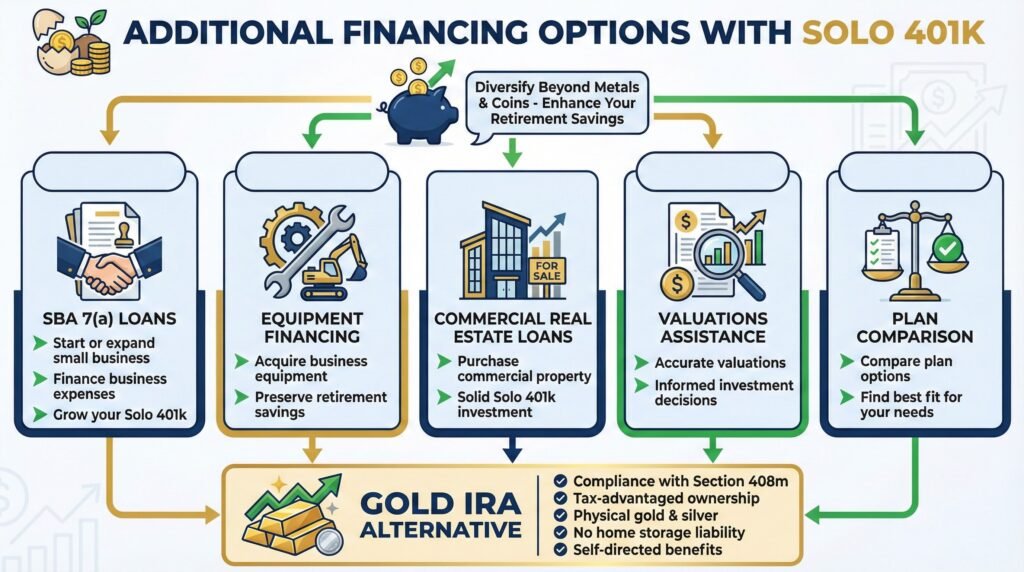

Additional Financing Options With Solo 401k

Diversifying your Solo 401k investments isn’t just about metals and coins; it can also involve exploring additional financing options that can significantly enhance your retirement savings.

You’re not restricted to traditional investment avenues; there are more innovative strategies you can employ to bolster your retirement nest egg.

Here are a few additional financing options you might consider:

-Small Business Administration (SBA) 7(a) Loans: These loans can provide you with significant financial support if you’re looking to start or expand a small business. You can use these funds to finance a range of business expenses, thereby allowing your Solo 401k to grow.

-Equipment Financing: This is an excellent way to acquire necessary business equipment without depleting your retirement savings.

-Commercial Real Estate (CRE) Loans: These loans can be used to purchase commercial property, which can serve as a solid investment for your Solo 401k.

-Valuations Assistance: Accurate valuations can help you make informed investment decisions, ensuring that you get the most out of your retirement savings.

-Plan Comparison: Consider comparing different plan options to determine which is most suitable for your needs.

As an alternative to a Solo 401k, Gold IRAs are a means of buying gold and still remaining in compliance with section 408m. Also, these self-directed Gold IRAs are a tax-advantaged means of owning physical gold and silver without the need or liability of hold the physical precious metal in your residence.

To learn more about the advantages of tax-deferred gold IRAs, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Exploring the IRA LLC Process

Understanding the IRA LLC process can open new avenues for managing and diversifying your retirement investments. This structure, known as a self-directed IRA, permits you to guide your investments in a wider range of assets, not just traditional stocks and bonds.

To start, you’ll need to create a Limited Liability Company (LLC). This is a straightforward process, but it’s crucial to follow all the legal requirements.

You can get help from an attorney, or several online services that provide LLC creation assistance.

Once your LLC is established, you’ll then transfer your existing IRA to a self-directed IRA. It’s important to work with a custodian who handles these types of IRAs and understands the process.

With your self-directed IRA funding your LLC, you’re now able to invest in a broad array of assets. You’ll have the freedom to invest in real estate, private businesses, precious metals, and more. Still, it’s essential to stay within the rules of IRS Tax Code Section 408m3 to avoid penalties.

Now, as you control the LLC, you manage the investments. You can buy, sell, and make investment decisions without needing the custodian’s approval.

However, remember that along with the increased control comes increased responsibility. You must ensure all transactions adhere to IRS rules. Careful record keeping is a must.

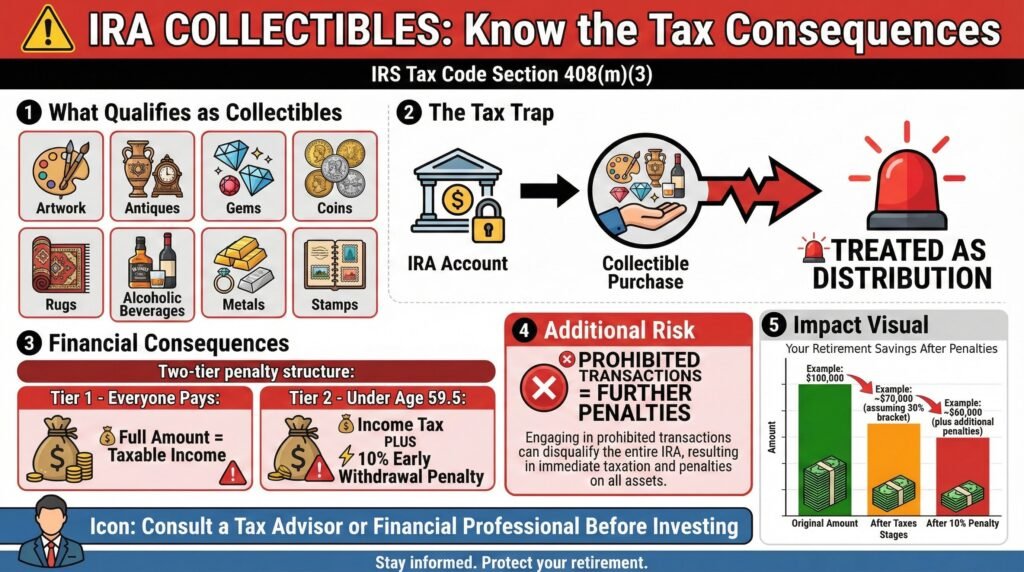

Consequences of Investing in Collectibles

When you invest in collectibles through your retirement account, there are significant tax implications and potential penalties to consider.

IRS Tax Code Section 408m3 refers to the rules and regulations for investing in collectibles using your Individual Retirement Accounts (IRAs).

It is essential to understand that the IRS treats the acquisition of collectibles as a distribution. This means the amount used to purchase the collectible is treated as a distribution and is subject to income tax.

Additionally, if you’re under 59.5 years old, a 10% additional tax for early withdrawals may apply. This can significantly impact your retirement savings and your financial planning. But that’s not all.

The IRS also considers certain transactions as prohibited. If you engage in such transactions, you may face further penalties.

Here are the key factors you should be aware of:

-Collectibles include artwork, rugs, antiques, metals, gems, stamps, coins, and alcoholic beverages.

-If you use your IRA funds to buy these collectibles, the amount used is considered a distribution.

-The distribution is taxable and may attract a 10% additional tax if you’re below 59.5 years old.

-Engaging in prohibited transactions could lead to further penalties.

-It’s crucial to consult with a tax advisor or financial professional before making such investments.

Understanding these consequences is critical when considering investing in collectibles through your retirement account. Make sure you’re well-informed to avoid any unwelcome surprises at tax time.

Conclusion

In conclusion, understanding IRS Tax Code Section 408m3 can significantly boost your retirement savings. You now know the permissible metals and coins for Solo 401k and their quality standards.

You’re also aware of compliance, contributions, and distribution rules. Additionally, you’ve discovered alternative financing options and the benefits of the IRA LLC process.

Avoid investing in collectibles to evade penalties. Use this knowledge to your advantage and fortify your financial future.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com