Do You Pay Taxes on Gold Inheritance?

Bewildered by bullion? If you’ve recently received a gold inheritance, you may be wondering about your tax obligations. Don’t fret. Understanding your tax responsibilities doesn’t have to be a daunting task.

Determining the payment of taxes on a gold inheritance, whether it’s inheritance tax, capital gains tax, or other potential levies we should consider the following points:

-Rules to Follow When Inheriting Gold or Other Precious Metals

-Is There a Tax on Inherited Gold Bullion and Coins?

-How Is the Inherited Gold Coin Tax Calculated?

-Can You Avoid Paying the Tax?

-Who Is Responsible for Paying the Inherited Gold Coin Taxes?

You’ll discover how these taxes apply to your golden gift, how to calculate what’s owed, and even tips for possibly avoiding these taxes. So, let’s start the journey to answer your burning question: Do you pay taxes on gold inheritance?

Rules to Follow When Inheriting Gold or Other Precious Metals

When you inherit gold or other precious metals, you must adhere to certain tax regulations.

If you choose to keep your inheritance, the rules differ from when you decide to sell these precious metals.

Understanding these guidelines is crucial to avoid potential tax pitfalls and to make the most out of your inheritance.

If You Keep Inherited Gold or Precious Metals

If you’ve inherited gold or other precious metals, it’s important to understand the various rules and tax implications that apply to your newfound assets.

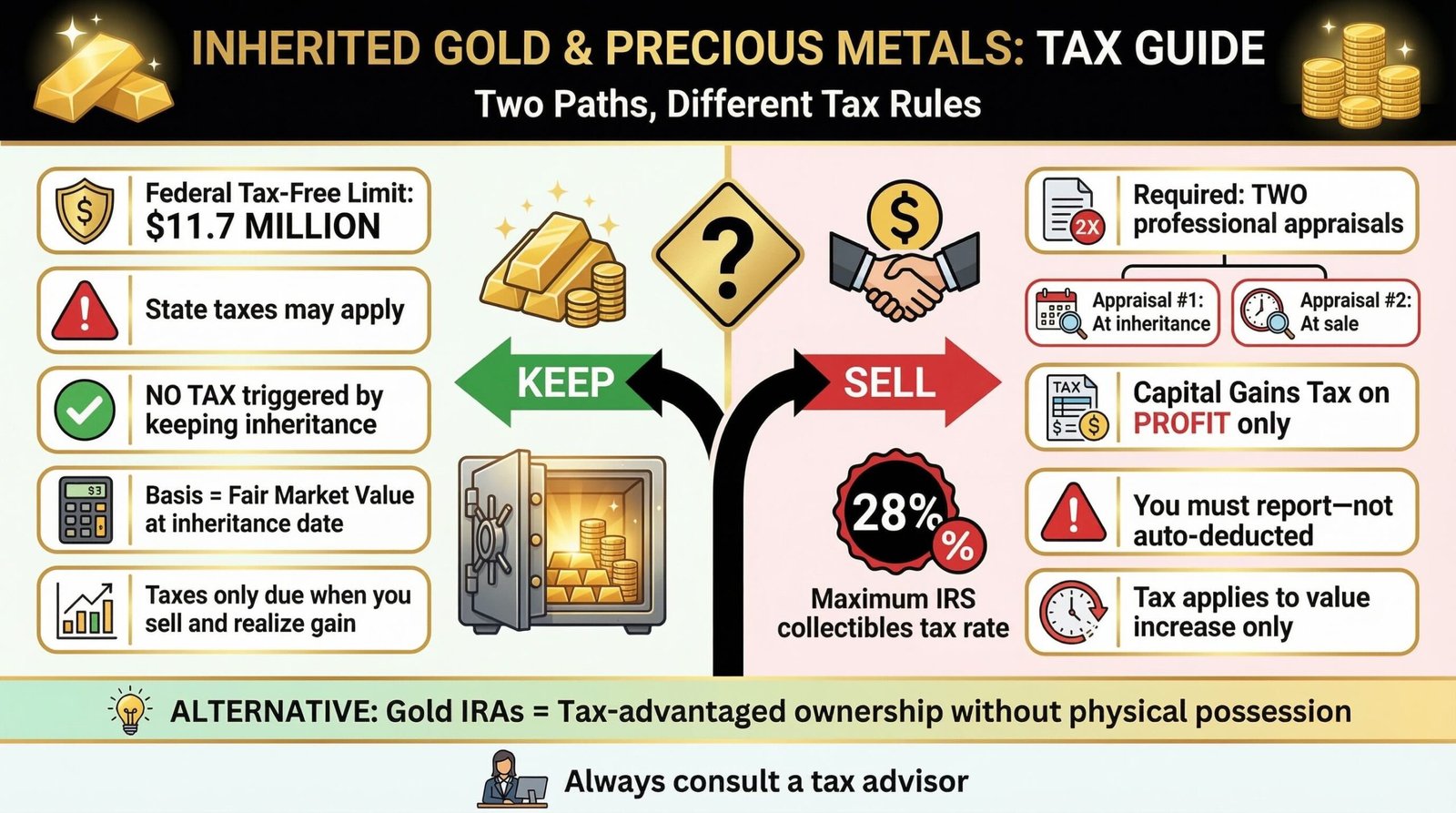

Federally, you’re allowed to inherit up to $11.7 million tax-free, which includes the value of any gold or precious metals. However, state taxes might impact this. If your inherited assets, including precious metals, exceed the federal limit, you’ll pay taxes on the excess.

Keeping your gold inheritance doesn’t trigger tax unless you sell and realize a gain. The basis price for calculating gain is the fair market value of the gold at the time you inherited it.

Always consult a tax advisor to ensure you’re complying with all tax laws.

If You Sell Inherited Gold or Precious Metals

You’ll need to be aware of several key rules and potential tax implications if you decide to sell your inherited gold or other precious metals.

The items must be professionally appraised twice – first, to determine their fair market value at the time of inheritance, and second, at the time of sale.

You won’t be taxed on the initial appraised value. However, if the metals increase in value by the time you sell, you’ll need to pay capital gains tax on the profit.

The IRS considers these metals collectibles and can tax you up to 28% on any gain. It’s your responsibility to report this when you file your taxes, as the tax isn’t automatically deducted at sale.

Gold IRAs are a tax-advantaged means of owning physical gold and silver without the need or liability of hold the physical precious metal in your residence.

To learn more about how gold investing can protect your long-term wealth and the advantages of tax-deferred gold IRAs, click the banner below to access and download Augusta Precious Metals’ gold IRA checklist to make sure you are aware of all aspects of the gold IRA process:

Is There a Tax on Inherited Gold Bullion and Coins?

Even though you might assume that inheriting gold bullion and coins would be tax-free, it’s essential to understand that taxes do apply under certain circumstances.

Inheritance tax for gold bullion and coins is generally fair at the federal level. Provided your inherited precious metals don’t exceed $12.9 million, you won’t owe any federal tax upon receiving your inheritance. This figure includes the entire estate value.

However, your state might impose its own inheritance taxes. For instance, if you’re in Pennsylvania, your tax rate will depend on your relationship to the deceased. Here, surviving spouses don’t have to pay any inheritance tax, but siblings might’ve to pay up to 12% and non-relatives up to 15%.

Let’s delve into some specifics:

-Federal and State Inheritance Taxes

-Federal exemption stands at $12.9 million for inherited precious metals.

-State taxes vary, with Pennsylvania levying rates up to 15% for non-relatives.

Selling Inherited Precious Metals

If you sell your inherited precious metals, you’ll face federal taxes. The IRS calculates your rate based on the fair market value, up to 28%.

How Is the Inherited Gold Coin Tax Calculated?

To calculate the tax on your inherited gold coins, you need to figure out the estate tax and the capital gains tax. If the inheritance exceeds the federal exemption of $12.9 million, estate taxes apply, ranging from 18% to 40% depending on the estate’s value.

However, you’ll only likely face these if you reside in a state that imposes taxes on inherited precious metals.

Next, consider the capital gains tax, relevant only when you sell the gold. It’s calculated on the profit you make from the sale, not the total proceeds.

The cost basis, or the market value of the gold at the time of inheritance, is the starting point. For example, if you inherited gold worth $1,330 per ounce and sold it for $1,800 per ounce, your capital gains would be the difference, $470 per ounce. If you fall into the 39.6% tax bracket, you’d pay the lesser rate of 28% on these gains.

Remember, these calculations pertain to physical gold and precious metals. Different rules apply to precious metal bank accounts and investments, which may have varying requirements for short- and long-term capital gains.

Navigating the complexities of tax on inherited gold coins can be challenging, but understanding these basics gives you a head start. By planning strategically, you can maximize your inheritance and minimize your tax liability.

Can You Avoid Paying the Tax?

While it may seem like taxes on inherited gold are unavoidable, there are actually several strategies you can employ to minimize or even bypass this financial obligation.

One effective strategy is simply holding onto your inherited gold. By doing so, you avoid the tax liability that would arise from selling the precious metals. This option allows your gold or silver to appreciate in value over time, offering potential future financial benefits.

Another strategy involves the use of a trust or a tax-advantaged Individual Retirement Account (IRA). With these options, you can transfer or sell your precious metals in a way that can significantly reduce or even eliminate your tax obligations.

Consider these options:

-Holding onto your precious metals

-Allows gold or silver to appreciate over time

-No tax liability unless you decide to sell

-Using a trust or a tax-advantaged IRA

-Offers a method to transfer your precious metals in a tax-efficient manner

-Provides the option to sell your metals in the future, possibly at a lower tax rate

Who Is Responsible for Paying the Inherited Gold Coin Taxes?

As the recipient of a gold inheritance, you’re the one on the hook for any taxes owed on those inherited assets. This includes coin collections, gold, silver, and other precious metals. But don’t worry, this responsibility typically doesn’t come into play until you decide to sell these assets.

When you do sell, you’ll be liable for capital gains taxes. How much tax you owe will depend on three key factors: the value of the asset at the time of inheritance, the profit you make from the sale (also known as the capital gain), and your personal tax bracket. It’s crucial to note that the ‘cost basis’ for these inherited assets is determined by their market value at the time you inherit them, not the original purchase price.

In less common scenarios, where the total estate exceeds the federal estate tax exemption of $12.9 million, you as the beneficiary will face additional tax requirements. The rate of tax you owe will be determined by the cash value of the entire estate, not just the gold assets.

To ensure you’re accurately reporting these assets and any associated capital gains on your tax return, it’s advisable to have the coins professionally appraised. This will help you determine their current market value and calculate any capital gains accurately. Remember, being detail-oriented and proactive will help you navigate this process more smoothly and avoid any potential tax pitfalls.

Conclusion

In summary, inheriting gold can come with tax implications. It’s essential to understand federal and state tax laws, calculate potential taxes accurately, and know who’s liable for payment.

While it may seem daunting, smart planning and professional guidance can help you navigate this process and possibly avoid some taxes. Being well-informed about your obligations can save you from unnecessary headaches and significant financial loss.

If you have 100k in savings to protect and want to take advantage of the best gold prices and lifetime customer support, attend a free gold and silver educational web conference hosted by Augusta Precious Metals. Secure your place today by clicking the banner below.

If you have 100k in savings to protect, attend a gold investment educational webinar hosted by Augusta Precious Metals. Tap the button below:

Obtain a gold IRA guide and talk to a broker

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com