Stubborn Inflation, the Fed Pivot, and Your Retirement Savings

October 17th, 2022 Report

U.S. Bureau of Labor Statistics 12-month CPI Inflation Report Data

How Gold Prices Have Changed Due to the Federal Reserve’s Actions on Inflation

The Federal Reserve's 'Solution'. Recession.

- Lending Tree reports that 32% of adults have been late on paying a bill in the last 6 months.

- According to a Lending Club Report: 60% of Americans are now living paycheck to paycheck. Up from 55% a year ago.

- CEO of JP Morgan Chase, Jamie Diamond stated: America will be in a recession by the middle of next year. Diamond stated that the stock market could easily fall another 20 percent from current levels and the next 20 percent would be much more painful than the first.

- Billionaire hedge fund manager Paul Tudor Jones stated this about the recession: 'I don't know whether it started now or started two months ago but I'm assuming we are going to get into one. Inflation is a bit like toothpaste. Once you get it out of the tube, it's hard to get it back in.'

- Boston University economics professor Laurence Kotlikoff told Newsmax: Former Secretary Summers would want Powell (Federal Reserve chairman) to raise interest rates like former Federal Reserve Chairman Paul Volcker did in the late 1970s and early 1980s, when rates jumped to as much as 20%.

- Recently featured on Fox Business News, it was reported that 98% of CEOs signaled they were preparing for a U.S. recession over the next year or year and a half according to the survey, The Conference Board Measure of CEO Confidence.

Many ordinary Americans would argue that we are already in a recession and that inflation is still quite present in their everyday lives. The worst of both worlds. The Federal Reserve will continue to raise interest rates and quantitative tightening which will have negative implications for the stock market, the debt market, the housing market, the labor market, and overall GDP. Three questions should be asked: How much pain is too much? And when will the Federal Reserve pivot? And in spite of the 2 previous questions, what can we, as average Americans, do to prepare and protect ourselves?

The Inevitable Fed Pivot, Inflation, and Our Purchasing Power

In late September, The Bank of England back-peddled its quantitative tightening and pivoted to prevent a bond market crash. The English government is allowing the Bank of England to print an unlimited amount of money to prevent their financial markets from seizing up. They are the first to pivot and, of course, much earlier than expected. As you well know, the Bank of England was performing quantitative tightening, the interest rate got too high, and their financial markets were collapsing. The central bank had two options, a deep recession, possibly a depression, or turning the money printers back on. Are we seeing something of our future here?

A return to quantitative easing and turning the money printers back on is a short-term fix at best. In the long run, this will make inflation worse resulting in currency devaluation, bailouts, and zombie companies. For us, a lower standard of living and degraded purchasing power.

Peter Schiff, CEO of Euro Pacific Capital Inc. weighed in on the latest CPI inflation report: "Another hotter than expected #CPI surprised investors. Sept. CPI rose .4%, double expectations. YoY prices rose 8.2%. The 6.6% YoY rise in core CPI is the most since 1982....The Fed is losing its inflation fight. Soon it will surrender."

It is only a matter of time and calculated pain before our central bank, the Federal Reserve, makes its own pivot. It could be in the coming months or as long as 6 months from now, but it is coming. Whether the 'trusted' figures in government want you to believe it or not, the Federal Reserve will be raising interest rates in a recession and a debt-fueled economy, which is simply not sustainable for very long unless the Fed wants to create a near-total collapse within the markets as well. Like the Bank of England, the pivot is inevitable. It is just a matter of when and how much damage is done before they do.

U.S. Bureau of Labor Statistics 10-year Inflation Report Data

The Federal Reserve, the Recession and Sign Posts to Greater Inflation

When doctors seek to diagnose an illness or disease, they look for symptoms. Here in the US, we have a 10-year yield near 4% and a 30-year fixed mortgage year 7%. This has caused a bear market in the stock market, a real estate slowdown, and overall negative GDP. All this so far, and the Federal Reserve has not even applied its full force. Stated quite simply, the Fed is intentionally causing a recession by raising interest rates in order to slow down inflation. What does this mean for us and our living standards? The maximum amount of tolerable pain that the U.S. can bear.

According to the Federal Reserve chairman, Jerome Powell, the Fed will continue to raise interest rates through 2022 into early 2023 and possibly for another year. This is not possible given the present state of the economy. Again, the UK central bank just caved and the US is next. What can we do, as individuals to lessen the pain we feel and sustain and protect our wealth and retirement savings?

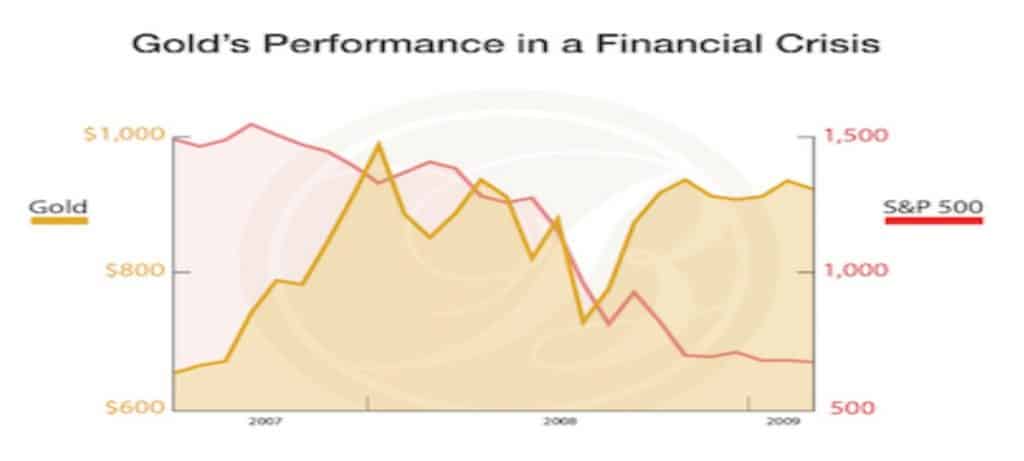

2008-2012 Recession S&P Data

Ordinary American People and Protecting Our Retirement Wealth. Gold IRAs

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com.