How Will Gold Perform with High Inflation Plus A Recession?

Oct 21st 2022: Economic Volitilty Meets Opportunity. The 2023 Gold Buy Up.

No two recessions are alike. Yes, there are common statistical market characteristics that apply in the hypothetical sense.

But to better understand the present 2022 to 2023 recession and it's downstream affect on gold and precious metals, we must recognize these specifics:

- How gold prices have changed due to the present federal reserve's actions on inflation.

- How the inevitable 'Fed Pivot' will affect gold prices and gold investments

- How prepared investors can take advantage of this gold buying opportunity before the Fed Pivot

- Why gold investing in a recession and high inflationary periods is advantageous.

How Gold Prices Have Changed Due to the Present Federal Reserve's Actions on Inflation.

Gold Investing Expectations in a Recession with High Inflation

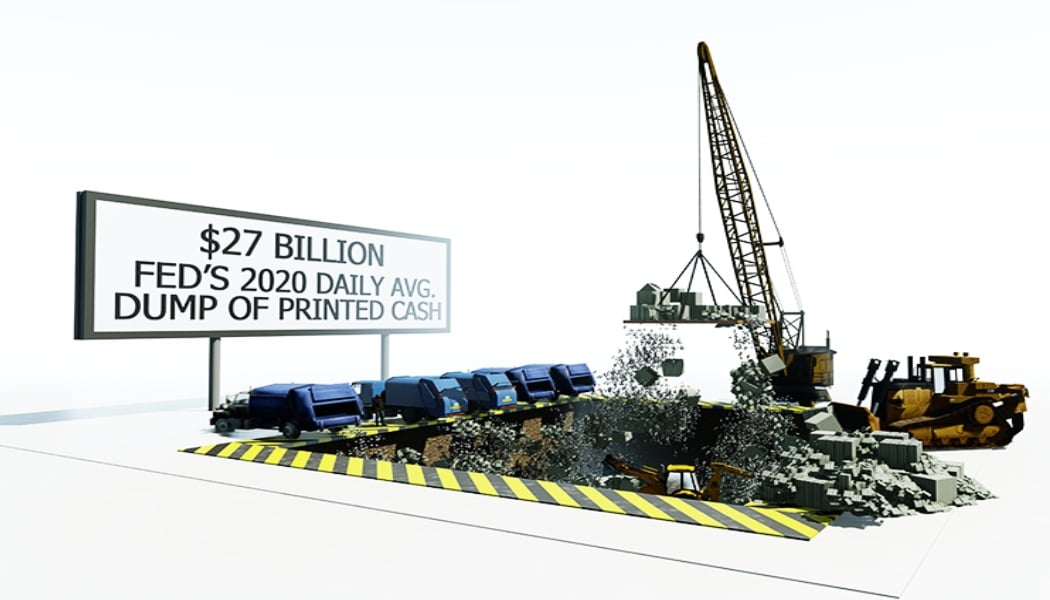

For the remainder of 2022, the Federal Reserve will continue to raise interest rates and quantitative tightening which will have negative implications for the stock market, the debt market, the housing market, the labor market, and overall GDP. This will also have an effect on gold prices. Raising interest rates in order to counteract inflation and strengthen the dollar will push the price of gold and other precious metals downward. According to said David Meger, director of metals trading at High Ridge Futures: The data signals the Fed will be more aggressive in fighting inflation by raising interest rates at a faster pace, pressuring gold.

One question should be asked: When will the Federal Reserve pivot, or essentially reverse course back to looser monetary policy, and, more importantly, how will this affect gold prices? And what can you do to take advantage of this? Any seasoned investor understands this famous quote by the famed hockey player Wayne Gretzky: “I skate to where the puck is going, not where it has been” or the Warren Buffet quote “The best chance to deploy capital is when things are going down.” How have the negative effects caused by the actions of the Federal Reserve created an ideal buying opportunity for precious metals and gold investments?

How the Inevitable 'Fed Pivot' Will Affect Gold Prices and Gold Investments

Gold Investing Expectations in a Recession with High Inflation

In late September, the Bank of England back-peddled its quantitative tightening and pivoted to prevent a bond market crash. The English government is allowing the Bank of England to print an unlimited amount of money to prevent their financial markets from seizing up. They are the first to pivot and, of course, much earlier than expected. As you well know, the Bank of England was performing quantitative tightening, the interest rate got too high, and their financial markets were collapsing. The central bank had two options, a deep recession, possibly a depression, or turning the money printers back on. Are we seeing something of our future here in the U.S.?

The U.K.'s return to quantitative easing and turning the money printers back on is a short-term fix at best. In the long run, this will make inflation worse resulting in currency devaluation, bailouts, and zombie companies. It is only a matter of time and calculated pain before the Federal Reserve, makes its own pivot. It could be in the coming months or as long as 6 months from now, but it is coming.

Like the Bank of England, the Federal Reserve will not be able to raise interest rates in a recession and a debt-fueled economy for very much longer. A Fed pivot is inevitable. And when they do, the money printers will be back on, the dollar will drop, inflation will climb again, and gold and silver prices will rise as they typically do. The 'buy low' window of opportunity for precious metals will start to end until the next cycle of high inflation.

Bear in mind, that an inflation rate of greater than 4% is still unreasonably high. Also, I am sure you have realized by now, that the government's inflation data rarely ever matches the normal everyday citizen's lived experience. The 'real inflation' data should be measured by your day-to-day purchases, not what some media pundit or federal bureaucrat may want you to believe.

All too often we, the public, can have our behaviors and expectations conditioned to resemble that proverbial 'boiling frog'. Do not talk yourselves into a 'new normal' mentality. That would be dangerous for you and your finances.

We may be entering an era much like to 1970's, where inflation may prove sticky and be prone to recurrences resembling stagflation. However, the source and type of inflation may resemble 1940s, when fiscal policy was the main driver of inflation. This type of inflation is not in the Federal Reserve's control. Hence, when the Federal Reserve pivots its policy back to quantitative easing, a 1970s-style inflation resurgence may rear its ugly head.

How Prepared Investors Can Take Advantage of This Gold Buying Opportunity Before the Fed Pivot

Skate to Where the Puck is Going.

It bears repeating: “I skate to where the puck is going, not where it has been”. Another highly appropriate and sage quote by the infamous Wayne Gretzky: “You miss one hundred percent of the shots you don't take.”

As stated before, any educated and seasoned investor knows a buying opportunity when they see one. The golden mantra of ‘buy low, sell high' is a mantra for a reason. It is a matter of observing patterns and cycles and, more importantly, taking action before others do. The unprepared and reactive person collapses into fear and scarcity in times of crisis, whereas the educated, patient, and prepared person sees opportunity whereas the former does not. And prepared group starts skating in the direction of ‘where the puck will be' long before the unprepared is even aware that there is a puck to follow.

2008-2012 Recession S&P Data

Why Gold Investing In a Recession and High Inflationary Periods is Advantageous.

Preppers and Educated Investors Understand Why Gold is so Resilient during the Current U.S. Economic Crises

Central banks control how much fiat paper currency is pumped into the system, not you. With inflation holding steady and eventually rising again with the Federal Reserve pivot on the horizon, now is the ideal time to buy gold and precious metals. Precious metals investments, whether it is a gold IRA or gold investments in the form of private ownership, provide protection from stock market volatility and inevitable cycles of inflation and recession. Ownership of tangible precious metals puts the control back in your hands. If you looking for a Gold IRA Investment company to start your IRA rollover. See our list of the best gold IRA companies here

Preppers, Serious Investors and Retirees Move to Open Gold IRAs

Simply put, money, or fiat currency, is not an investment. Money is an instrument to transfer goods and services from one party to another party. The only thing that matters, day to day, is your actual, real buying power, not how many dollars you have in the bank.

In retirement, when true inflation reaches 15%, your cost of living potentially doubles every 5 years. One of the key benefits of investing in gold is offsetting the weakening dollar and thereby securing your retirement savings. Whether it is a bear or a bull market, precious metals are the ideal asset to hold for portfolio diversification and safeguarding retirement. Simply stated, gold, silver, and other precious metals have stood the test of time and will continue to.

If you are ready to get started with your IRA rollover or want to invest in precious metals as a private investment and need a more in-depth analysis of the best gold investment companies. See our company reviews here.

If you have 100k of retirement savings within a 401k or IRA, click the button below to attend a free web conference where you will learn about how a gold IRA and gold investments can help retirement savers like you protect your wealth from the present recession as well as record high inflation.

U.S. Bureau of Labor Statistics 12-month CPI Inflation Report Data

Gold IRA FAQs

Adam ONeill

Author, lifelong investor, and creator of PreciousMetalsInvestmentPortfolio.com